レポート・報告書

アジ研ポリシー・ブリーフ

No.242 Progress of Cross-border QR Code Payments in ASEAN: Challenges in Japan-ASEAN Interoperability

PDF (415KB)

- Cashless and QR code payment adoption rates are exceptionally high throughout ASEAN countries.

- Payment digitization is accelerating the development of cross-border payment systems and enhancing financial integration across the region.

- To achieve QR code interoperability between Japan and ASEAN, it is essential to recognize the different approaches and objectives of both parties, and to establish appropriate infrastructure within Japan.

Progress of Digital Payment and Financial Integration in ASEAN

The digital payment is progressing in ASEAN (the Association of Southeast Asian Nations). When the ASEAN Economic Community (AEC) was formed in 2015, financial integration, inclusion and stability were identified as important elements to achieve a highly integrated regional economy. Regarding financial digitalization, the promotion of digital payments was recognized as one of the financial inclusion strategies for each country in 2016.

In 2019, the ASEAN Payments Policy Framework for Cross-Border Real-Time Retail Payments within the ASEAN Region was published, which promoted to advance bilateral cross-border alliances within the region. Based on the G20 Roadmap for Enhancing Cross-border Payments by the Financial Stability Board (FSB) in 2020, which made improving cross-border remittances an international priority, the Regional Payment Connectivity (RPC) agreement was reached in 2022 by Indonesia, Malaysia, the Philippines, Singapore and Thailand.1 In 2023, the ASEAN Digital Economy Framework Agreement (DEFA) was launched, and the digitization of the economy is regarded as a common goal for ASEAN.

Development of unified QR code and fast payment systems

Along with the progress of digitization, financial integration at an operational level is being promoted, such as the commencement of interoperability of QR code payments (hereafter QR payments) with other countries. Until QR codes became widespread, financial access was only possible through bank accounts, and the benefits of digitization did not lead to the expansion of financial inclusion. However, from around 2016, QR payments began to be used in ASEAN as a means of payment without the need to link to a bank account, and they expanded rapidly. The expansion of QR payments has increased mobile money accounts and played an important role in financial inclusion in ASEAN countries.

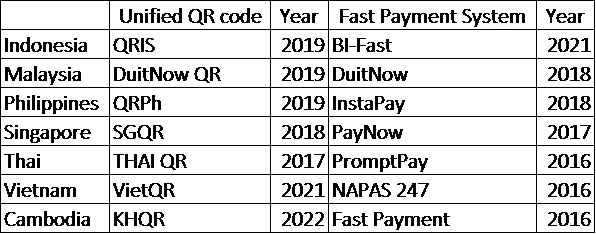

Table: Unified QR code and fast payment system (FPS)

However, as incompatible QR code systems coexisted, governments in each country introduced unified QR codes from around 2017. This has resolved system compatibility issues and enhanced interoperability between domestic digital payment platforms. Domestic unification also brought efficiency to interoperability with other countries and facilitated the introduction of common standards for security and the personal information protection, thereby promoting further expansion of interoperability.

Given this progress in interoperability within the ASEAN region, in December 2022, the Ministry of Economy, Trade and Industry of Japan (METI) signed a memorandum of cooperation with the Bank Indonesia to promote interoperability between JPQR, Japan's unified QR standard, and QRIS of Indonesia. In December 2023, METI also signed a memorandum of cooperation with the National Bank of Cambodia. Furthermore, Japan is aiming to implement interoperability of QR payments with other ASEAN countries in fiscal year 2025.2

Expansion of cashless payments and differences between ASEAN and Japan

Many factors combined boost the demand for cashless payments, including the development of digital technology, the spread of smartphones, the experience of the COVID-19 pandemic, and the expansion of the e-commerce market. According to a VISA survey,3 the cashless payment usage rate in ASEAN is 93%, broken down as follows: Singapore 97%, Malaysia 96%, Indonesia and Vietnam 95%, Thailand 94%, Philippines 92%, and Cambodia 68%. QR payment usage rates are also high: Malaysia 68%, Indonesia 66% and Vietnam 62%4. On the other hand, the cashless payment usage rate in Japan is 39.3% (2023),5 of which QR payments, although growing, are still low at 10.9%.

The difference in the expansion of QR payments between ASEAN and Japan reflects the difference in the number of payment option due to the maturity gap in payment system. In Japan, the Zengin System has provided fast payments since 1973, ahead of the rest of the world, and therefore bank and credit card payments are widely used. Later developments such as electronic money and QR codes are mere alternatives to existing payment methods. On the other hand, in ASEAN, where payment systems were not sufficiently developed and bank account ownership rates were not high, the changes that took decades in developed countries are progressing all at once. The spread of electronic money and QR codes is an important element for building stable financial system, achieving financial inclusion, and enabling financial integration. However, ASEAN is not solely focused on QR payments: construction of Fast Payment Systems (FPS) and system integration in cross-border transactions are conducted simultaneously.

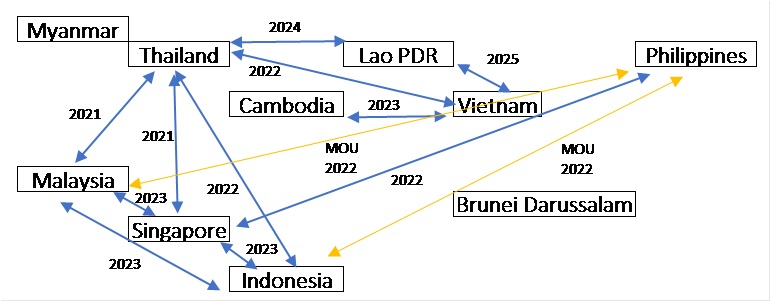

As a result, the entities promoting QR codes unification and the interoperability are also different. In Japan, the promotion of cashless payment is the responsibility of the "Cashless Promotion Council" or Payments Japan, a general incorporated association formed through collaboration between industry, academia and government, including relevant government ministries and agencies and related organizations. In ASEAN, on the other hand, promoting QR codes unification and their interoperability is part of building the financial system, so central banks take the lead, and the difference in the importance of cashless payments in the national policies has resulted in the difference in promoting entities. As seen in the figure below, the momentum of ASEAN can be observed from the fact that bilateral, QR payment interoperability has started in eight countries within a short period of time since 2021.

Figure: Interoperability of bilateral QR payments in Southeast Asia

Challenges for Japan

The promotion of cross-border QR payments in ASEAN is progressing relatively smoothly, as it is led by central banks based on the ASEAN framework. The network of interoperability may cover the entire ASEAN region in the not-too-distant future.

On the other hand, in Japan, cross-border payments are being promoted individually by money transfer service providers, and they are not spreading due to increased costs such as security measures. Furthermore, to realize interoperability, international switchers are needed to build and operate systems that perform message switching and settlement, but Japan has not yet prepared for building them.6 In addition, while ASEAN countries are working to adopt unified QR codes, there is a fundamental problem that JPQR, the unified standard in Japan, hardly widespread.

These issues in the Japanese system need to be resolved urgently. The necessary perspective for achieving interoperability with ASEAN is not so much understanding technical issues as understanding the importance and the situation of cross-border and QR payments in ASEAN and recognizing their differences with Japan. Furthermore, although there is a common framework, the stage of development of each country also varies, so it is important for Japan to understand the system of each country and to create an environment to act flexibly.

(Miki Hamada, Development Studies Center)

- Vietnam joined the RPC in 2023.

- Nikkei Shimbun, Japan, ASEAN to launch joint QR code payment services in FY2025, March 14, 2024

- VISA, “The Future of Commerce on the Cups of Change, Visa Consumer Payment Attitudes Study 2024,”https://www.visa.com.ph/content/dam/VCOM/regional/ap/singapore/global-elements/documents/visa-cpa-2024-report-ipvmc.pdf

- VISA, “Navigating A New ERA in Payments, Consumer Payment Attitudes Study 2022,” https://www.visa.co.th/content/dam/VCOM/regional/ap/documents/visa-cpa-report-smt-2022.pdf

- https://www.meti.go.jp/press/2023/03/20240329006/20240329006.html

- NETSTARS is developing a system.

The views expressed in the document are those of the author(s) and neither the Institute of Developing Economies nor the Japan External Trade Organization bears responsibility for them. ©2025 Miki Hamada