レポート・報告書

アジ研ポリシー・ブリーフ

No.243 Vietnam’s Cross-border QR Code Payment Initiatives: Uniqueness of ASEAN countries highlighted by challenges

PDF (386KB)

- QR code payments are rapidly becoming widespread in Vietnam.

- The country is also actively working on cross-border payment connectivity, but has not yet brought it fully into operation.

- Japan needs to take into account the circumstances of each country when promoting payment connectivity with ASEAN countries.

ASEAN countries are increasingly adopting QR code-based cross-border payments. Vietnam has also started interoperability with several countries in the region, and is aiming to connect with countries outside the region. However, the country is faced with its inadequate domestic institutions being an obstacle, having problems even with neighboring countries with whom the launch of interoperability has already been announced.

This paper discusses the background to the challenges facing Vietnam, while pointing out that the current situations and issues of QR code payments (“QR payments”) reflect the unique circumstances of each country.

An increasing shift to a cashless economy

Vietnam has traditionally been considered a cash-dominant economy. As people still remember the collapse of credit cooperatives in the early days of Doi Moi, their trust in financial institutions has also been low.

However, even in Vietnam, the recent spread of cashless payments has been remarkable. While the use of credit cards is limited, QR payments using mobile devices have become a common form of retail payment.

Against the backdrop of the rapid penetration of smartphones, QR codes are now posted at storefronts not only of shopping malls and convenience stores, but also of small privately-owned shops and food stalls in urban areas.

In terms of service providers, several non-banks are offering QR payment services on electronic wallet (“e-wallet”) apps. Typical examples include MoMo and VNPAY, both of which are run by well-known startups.

In addition, commercial banks are providing QR code money transfer and payment services via mobile apps. In particular, money transfers between individuals are widely used as a means of paying small amounts of money at small shops and street stalls.

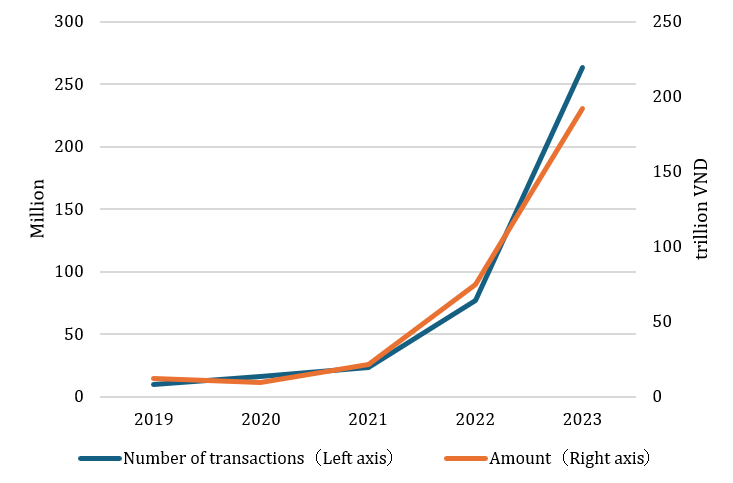

The adoption of QR payments by individuals and businesses in Vietnam reached a milestone in 2021, when the common QR code brand “VietQR” was released and the fast money transfer service was offered free of charge. The huge impact of these moves can be seen in the fact that QR payments showed dramatic growth after this year, both in terms of the number and the amount of transactions (Figure 1).

Figure 1: QR code-based transactions in Vietnam

Vietnam’s national strategy to promote financial inclusion

The advancement of cashless payments is prescribed within a framework of the national strategy to promote financial inclusion.

The Prime Minister's decision approving the National Financial Inclusion Strategy towards 2025 envisions the promotion of the development and popularization of various payment services. The implementation of the strategy is led by the State Bank of Vietnam (SBV), the central bank of the country. The fast money transfer service using the above-mentioned VietQR is provided by the National Payment Corporation of Vietnam (NAPAS), whose shareholders include the SBV and major commercial banks.

The significant role played by banks is a distinctive feature of QR payments in Vietnam. Money transfers between individuals using mobile apps offered by banks are very popular, while an e-wallet needs to be linked to a bank account. According to SBV's announcement in 2023, the percentage of the adult population holding bank accounts exceeded 70%.

Promotion of cross-border QR payments

Within the ASEAN region, Vietnam is accelerating efforts to introduce cross-border QR payments. In 2023, the country joined ASEAN Regional Payment Connectivity (RPC) initiative, originally launched by Singapore, Malaysia, Indonesia, Thailand and the Philippines.

According to SBV, Vietnam aims to encourage the use of the local currency and to promote commerce and tourism in Vietnam by providing convenient and affordable retail payment methods.

Efforts to ensure payment system linkage with neighboring countries have been promoted on a bilateral basis. The start of interoperable payment services with Thailand and Cambodia was announced in 2022 and 2023, respectively, and a ceremony was held early 2025 to announce the framework for connectivity with Laos.

Initiatives are also underway with a view to connectivity with countries outside the ASEAN region. In 2024, an agreement was reached with China on cooperation in enabling cross-border QR code payment connectivity, in line with a memorandum of understanding between the central banks. Vietnam has announced its policy to pursue payment connectivity with countries including China, Japan, and South Korea in 2025.

Outstanding issues

However, the actual operation of cross-border QR payments is not going smoothly. Vietnam has already announced the commencement of cross-border QR Payments with Thailand and Cambodia. While outbound transactions (payments in Thailand and Cambodia by Vietnamese travelers) are reported as of 2024, inbound transactions (payments in Vietnam by travelers from the partner countries) are reported to be extremely limited.

The delay in developing the necessary institutions is the main obstacle. Although VietQR is a common brand for QR codes, its use is not mandatory. There are many different QR codes in use, not just VietQR, but also those of commercial banks and e-wallets. Another problem is that QR codes for payments are easily mistaken with those for money transfers. The regulations for merchants participating in cross-border QR payments are not yet in place. As there are no logos or other signs on storefronts indicating the availability of cross-border QR payments, it is difficult for customers to determine whether or not they can use the service at the store.

Another issue that has emerged is the low level of security. Until recently, the QR code standard in Vietnam was solely “merchant-presented” mode, whereby a purchaser scans the code posted at the store to initiate a transaction. This method offers the advantage of low initial costs, as all the store needs to do is to post a printed code. However, it is prone to fraudulent acts such as substituting a fake code.

Although NAPAS and the Vietnam Banks Association have been working on improving the infrastructure, it is yet to be seen whether their efforts will facilitate the operation of cross-border QR payments.

Uniqueness of ASEAN countries highlighted by challenges

While there are similarities in the way QR payments are implemented and the issues encountered in each country, there are also many differences between countries. Such uniqueness becomes clearer when comparing countries.

The reason the above-mentioned issues arose in Vietnam is because the country introduced a simple QR payment method with low initial costs. As a result, while there were positive outcomes in terms of progress towards financial inclusion through the rapid spread of services, the more arduous tasks of ensuring code unification and managing and supporting merchants were given lower priority.

Some countries are successfully dealing with the problems associated with simple methods. In Indonesia, the use of the unified national standard for QR codes (QRIS) has been made compulsory, and therefore unified QR codes are posted at any store. With the aim of promoting the development of micro-, small and medium-sized enterprises through QR payments, the central bank has also been actively involved in building and assisting QRIS merchant networks.

Governments have different priorities in promoting QR payment and cross-border connectivity. Whether or not the policies are successfully formulated and efficiently implemented also depends on the circumstances of each country.

Implications for Japan

Japan is currently working with the ASEAN countries to enable unified QR code interoperability. However, it is essential to remember that ASEAN is enormously diverse.

In pursuing interoperability with ASEAN, it is crucial for Japan to determine: how QR code payments are used in each country; what the national government's objectives are, what stakeholders the government is cooperating with in promoting cross-border payment connectivity; and what benefits and risks can be expected for Japan by promoting connectivity with each country.

(Mai Fujita, Area Studies Center)

The views expressed in the document are those of the author(s) and neither the Institute of Developing Economies nor the Japan External Trade Organization bears responsibility for them. ©2025 Mai Fujita