レポート・報告書

アジ研ポリシー・ブリーフ

No.226 Towards Bangladesh-India-Japan (BIJ) Trilateral Trade Partnership

Prabir De

PDF (402KB)

- India and Japan are Bangladesh’s major trade and investment partners. A trilateral trade and investment relation between them may pave the way for industrial value chains.

- Trilateral trade between Bangladesh, India and Japan has increased to US$ 37 billion in 2023 and trilateral FDI has increased rapidly due mainly to Japanese investments in Bangladesh and India.

- Trilateral trade relations offer many benefits, while minimizing the trade costs.

Introduction

Bangladesh holds a place of significance in terms of trade and strategic ties in the Bay of Bengal neighborhood. India and Bangladesh not only share geographical border but also deep cultural bondage. India and Bangladesh also share excellent bilateral trade and economic relations. India and Bangladesh are members of the South Asia Free Trade Area (SAFTA). Bilateral trade has witnessed impressive growth in recent years, more particularly after the COVID-19 pandemic. Japan and India are Bangladesh’s major trade and investment partners. A trilateral trade and investment relation between them may pave the way for industrial value chains, thereby fostering regional integration in Bay of Bengal.

Trade relations

In recent years, bilateral trade between India and Bangladesh has registered an impressive growth. Total trade between the two countries increased from US$ 3.38 billion in 2010 to an all-time peak of US$ 15.99 billion in 2022 and then declined to US$ 13.15 in 2023. India is the second largest trading partner of Bangladesh, next to China. India provides duty free and quota free market access to Bangladesh for all products except 25 tariff lines under the SAFTA.

Even though India’s exports to Bangladesh have been growing, substantial part of the growth comes from the export of items such as industrial raw materials and consumer goods. India’s major exports to Bangladesh have been cotton, cereals, mineral fuel and mineral oil products, automobiles, machineries, iron and steel, organic chemicals, electrical machinery, etc. On the other hand, apparel and clothing (not knitted), fish and crustaceans preparations of cereals, etc. are India's major imports from Bangladesh. India and Bangladesh have growing production linkages in garments.

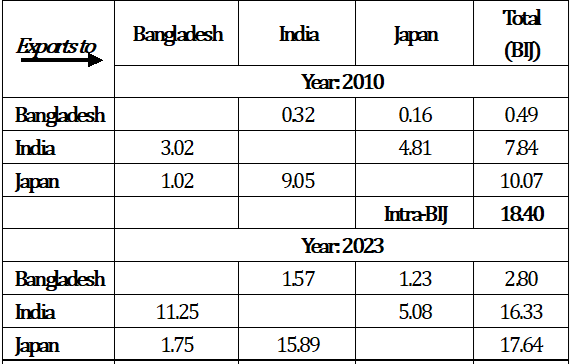

India-Japan trade has grown much faster than Bangladesh-Japan trade (Table 1). Bilateral trade between Japan and Bangladesh has grown from about US$ 1 billion in 2010 to about US$ 3 billion in 2023. Bangladesh primarily exports readymade garments (knitwear and woven shirts) to Japan, which has been the major export to the country. Other notable exports include leather goods and home textiles. Bangladesh primarily imports iron and steel, vehicles, machinery, etc. from Japan, with significant items including cars, hot-rolled iron, and machinery used for manufacturing purposes. On the other hand, India’s trade with Japan has grown from about US$ 14 billion in 2010 to over US$ 20 billion in 2023. India's major exports to Japan include textiles, clothing, organic and inorganic chemicals, leather, footwear, etc., whereas India's major imports from Japan include iron and steel, inorganic chemicals, electrical machinery and equipment, etc.

Table 1: Intra-BIJ Trade (US$ billion)

The intra-trilateral trade between Bangladesh, India and Japan (BIJ) has increased from US$18.40 billion in 2010 to US$ 36.77 billion in 2023 (Table 1), indicating high potential of trilateral trade between them. The resources between them provide a tremendous opportunity to form industrial value chains and may add greater value to the region’s trade and integration.

Easing Trade Barriers

Despite good relations, trade between India and Bangladesh has not increased significantly due to some issues regarding product diversification, product standardization, infrastructure at the land port, rail, road and shipping connectivity, para-tariff and non-tariff barriers, payment system, etc. which need proper attention and intervention. To unlock the potential of bilateral border trade, issues of mutual interests, including removal of non-tariff barriers and port restrictions, harmonisation and mutual recognition of standards and procedures on both sides, removal of the Anti-Dumping Duty (ADD), strengthening connectivity and trade infrastructure, among others, are required to be addressed.

Here are some examples. India’s exports to Bangladesh can be increased through the Agartala integrated check-post (ICP) if trade restrictions are removed from India’s exports. Unlike Petrapole ICP in West Bengal, only 42 items can be traded through Agartala ICP in Tripura. Moreover, Bangladesh imposes 30-36 per cent duty on certain Indian goods. While India provides duty free quota free access to Bangladesh on all tariff lines except tobacco and alcohol under SAFTA since 2011. India has also imposed ADD on jute of Bangladesh origin. Both Japan and India have imposed the ADDs on selected bilateral export items in the past. Therefore, narrowing the trade gaps is the task that requires to be taken up on priority.

Bangladesh has a merchandise trade deficit with India and Japan, and so also India with Japan. Japan’s growing FDI inflows to India and Bangladesh in the capital account may appear to nullify the trade deficit that India and Bangladesh face with Japan in the current account. It goes without saying that streamlining non-tariff measures (NTMs) can increase the trilateral trade and also industrial value chains. Nonetheless, it may facilitate the Japanese FDI and valuable technology, which are essential in order to gain from new trade opportunities and value chains. Further liberalisation of trading arrangements between them may generate new trade amidst growing global uncertainties.

Figure 1: Towards Trilateral Trade Partnership

There is also a need to enhance connectivity between India and Bangladesh by strengthening cooperation in digital, road, rail and inland waterways. Japan has an important role in strengthening the connectivity between them. Japanese assistance in Matarbari Deep-Sea Port (DSP), and India’s assistance in physical and industrial infrastructure in Bangladesh is well-documented. Bangladesh has to improve the business environment in order to gain from the vast private investments that India and Japan offer to the country. Bangladesh aims to become a US$ 1 trillion economy by 2031. To sustain the growth, important catalysts would be development of infrastructure, skilled human resources, stronger maritime linkages, etc., to add a few. India and Japan are such vast opportunities that may help Bangladesh meet the US$ 1 trillion GDP target.

Way forward

Trilateral trade has increased phenomenally in the last one decade. Trilateral cooperation offers many positive spillovers to India’s Northeast and vice versa. India has already completed a decade of signing of the CEPA with Japan (Figure1). Japan and Bangladesh have completed the joint study group (JSG) for a CEPA, whereas the same between India and Bangladesh is ongoing. Bangladesh requires CEPA with both India and Japan in post-2026 by when Bangladesh elevates to the ‘developing country’ group. In such context, India-Bangladesh-Japan trilateral may become a free trade area once three of them have CEPAs in place. A trilateral trade partnership will spread the industrial value chains, thus benefiting Bangladesh and Northeast India.

(Prabir DE/Research and Information System for Developing Countries (RIS), New Delhi, Views are personal.)

The views expressed in the document are those of the author(s) and neither the Institute of Developing Economies nor the Japan External Trade Organization bears responsibility for them.

©2025 Prabir De