IDE Research Columns

Column

How Did the COVID-19 Pandemic Change Trade and Investment?

Kazunobu HAYAKAWA

March 2022

The Institute of Developing Economies, JETRO

The coronavirus disease (COVID-19) has dramatically decreased trade in goods, trade in services, and foreign direct investment in the world, especially in the second quarter of 2020. Against this backdrop, we conduct various empirical analyses using global data. Our findings can be summarized as follows. The negative impacts are magnified when the COVID-19 pandemic becomes serious in exporting, importing, supplier, investing, and investment host countries. However, such impacts of the COVID-19 pandemic are heterogeneous across industries and types of investments. Their magnitude is also different, depending on the necessity of people’s cross-border movement. Furthermore, some factors, such as vaccination, various online tools, or input diversification, play a crucial role in mitigating the negative impacts.

The coronavirus disease (COVID-19) has spread worldwide since 2020. Although the global economy has suffered from various types of negative shocks, such as financial crises or natural disasters, one of the most distinctive features of the COVID-19 pandemic is the forced adoption of infection prevention measures, such as lockdown and social distancing. These measures have raised various types of transaction costs in the global economy.

Economists have responded quickly and investigated the economic impacts of the COVID-19 pandemic. For example, an e-book entitled, Economics in the Time of COVID-19, released by Baldwin and di Mauro (2020), discusses the possible economic effects of infectious diseases. In this column, based on our empirical analyses using global data, we discuss how COVID-19 could affect the global economy. Specifically, we consider its effects on global trade in goods, trade in services, and foreign direct investment (FDI).

Global Trend

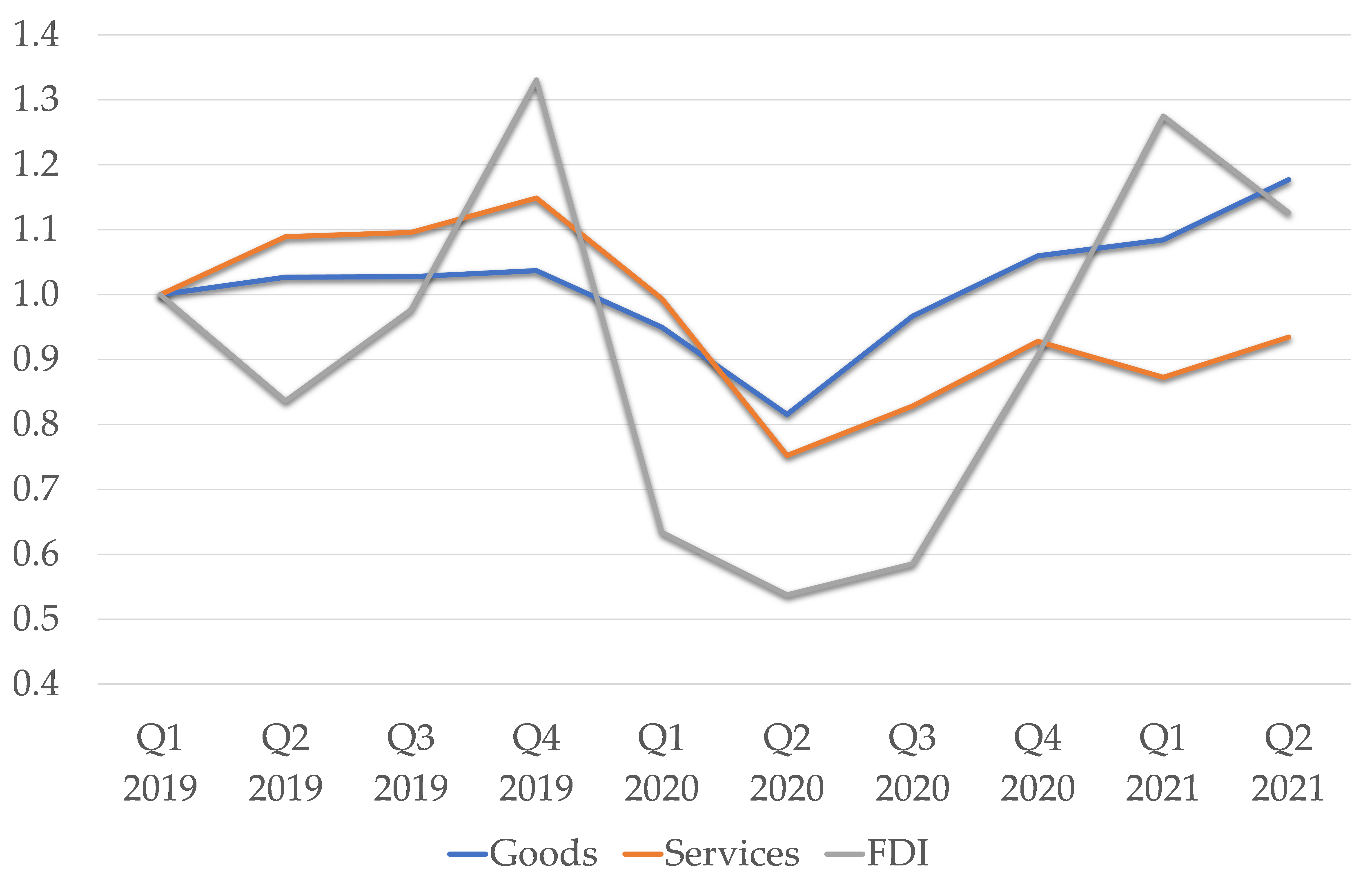

The figure depicts the changes in trade and FDI (flow) in the world. We normalize their values by those in the first quarter of 2019. The three measures began to contract in the first quarter of 2020 and hit the bottom in the second quarter of 2020. Among the three measures, the decrease in FDI was greatest, which was almost a 50% drop. Afterward, they started to rise gradually to the normal level. The recovery of FDI was remarkable, whereas that of trade in services has been slow. In summary, a dramatic decrease in trade and investment was observed in 2020 but not afterward.

Figure. Changes in Goods Trade, Services Trade, and Investment in the World (Q1 2019 = 1)

Sources: Author’s compilation using the data from the WTO Data Portal, the UNCTAD Statistics, and the

OECD Statistics.

Trade in Goods

The COVID-19 pandemic can affect both imports and exports of goods. On the demand side, the stay-at-home order decreases shopping opportunities, thus decreasing demand. The decrease in sales due to workplace closures may have also reduced people’s earnings and incomes, further decreasing the aggregate demand. These decreases result in a decline in the consumption of goods and imports. By contrast, COVID-19 increases the demand for foods, medical products, and personal protective equipment, such as masks and sanitary products. It may also increase the demand for products related to teleworking and stay-at-home activities (e.g., laptop computers). On the export side, the closure of workplaces halts business operations, leading to the suspension of production activities. Furthermore, factory productivity may decline because of the introduction of infection control measures (e.g., social distancing) in factories. These factors result in the shrinkage of production output, thus reducing exports.

The study of Hayakawa and Mukunoki (2021c)—one of the earliest on the trade effects of COVID-19—investigated the trade effects of the first shock (i.e., January to August of 2020). They found negative effects on non-essential or durable products or products in labor-intensive industries but positive effects in industries providing medical products. Hayakawa and Mukunoki (2021b) obtained similar findings when they focused more on lockdown measures. Furthermore, Hayakawa and Imai (2021) found that the COVID-19 pandemic decreased exports of medical products in the early period of the pandemic, but the decrease was smaller for countries with economic and/or political ties to neighboring countries. Hayakawa and Mukunoki (2021a) demonstrated that in exporting and importing countries as well as countries supplying machinery parts to exporting countries, the COVID-19 pandemic caused a substantial reduction in the exports of finished machinery products.

Some studies have explored the factors that help mitigate the negative trade shocks of the COVID-19 pandemic. For example, Hayakawa (2021) found that the negative effects, especially on exports, are mitigated with an increase in vaccination doses. Ando and Hayakawa (2022a) demonstrated that the negative impacts of COVID-19 on finished machinery products become smaller as exporters diversify the sources of the imported inputs. Using province-level data of China, Cai and Hayakawa (2020) demonstrated that the negative impacts of COVID-19 on trade are smaller in provinces with a large number of deaths during the severe acute respiratory syndrome (SARS) outbreak. Hayakawa, Mukunoki, and Urata (2021) revealed that the development of e-commerce (EC) in importing countries contributes to mitigating the negative effects of the COVID-19 pandemic.

Trade in Services

Similar to the case of goods trade, in the case of services trade, labor shortages and income decreases caused by the COVID-19 pandemic are expected to reduce both services exports and imports. However, the more detailed effects differ across various services sectors, especially across the types of the services mode. In particular, modes 2 (consumption abroad) and 4 (the presence of natural persons) tend to require the cross-border movement of consumers and suppliers, respectively. As travelers (mode 2) and skilled professionals (mode 4) hesitate to move to countries in which COVID-19 is spreading, COVID-19 decreases mode 2 services exports and mode 4 services imports.

As services trade in mode 1 (cross-border supply) does not require the movement of suppliers or consumers, this type of service may increase, especially during the pandemic and, perhaps, even thereafter. For example, in addition to the use of online meeting tools such as Teams, Zoom, and Skype (i.e., imports of information and communications technology services), stay-at-home orders may increase the demand for online recreational or educational channels (i.e., imports of personal services). However, some sources could yield negative effects. For example, the COVID-19 pandemic forced various sports games to be canceled (e.g., baseball games in the United States or soccer games in Europe), and film shoots were postponed. The decrease in these contents would lower exports of personal services.

Against this backdrop, Ando and Hayakawa (2022b) empirically examined the impact of the COVID-19 pandemic on services trade in 2019 and 2020, using quarterly data about 146 countries. They found that the COVID-19 pandemic had a significantly negative impact on services trade. Moreover, consistent with the conjectures above, the extent of the impact varied among disaggregated services sectors, reflecting the nature of services. Travel services were the most affected, followed by transport and construction services.

FDI

The COVID-19 pandemic could change FDI flows. The COVID-19 damages in host countries will decrease their demand size and raise the fixed cost of investments (e.g., various search costs of location and workers). The rise of the latter cost may be large in greenfield FDI than cross-border merger and acquisition (M&A) because it would be difficult to hire new workers and build new factories. However, the severe damage in the host country may lower the valuation of acquired firms, enabling investors to acquire local firms with lower prices, which is known as “fire-sale FDI.”

The severity of the COVID-19 pandemic in the home country could have a negative impact through reduced investment capital. It may also induce outward FDI. For example, firms may switch their export base from home to abroad to continue production activities. The mobility restriction induced by the COVID-19 pandemic reduces the handling capacity of freights due to the shortages of truck drivers and port labors, resulting in the rise of both domestic and international transport costs. Thus, firms may switch from exporting from home to producing abroad and selling domestically.

Against this backdrop, Hayakawa, Lee, and Park (2022) empirically examined the effects of the COVID-19 pandemic on FDI, using quarterly data of bilateral FDI flows from 173 countries to 192 countries from the first quarter of 2019 to the second quarter of 2021. In the manufacturing sector, the COVID-19 pandemic in host countries had significant negative impacts on both greenfield FDI and cross-border M&A, whereas in home countries, they do not experience any significant impacts on both types of FDI. In the services sector, the COVID-19 pandemic in both host and home countries has negative impacts on greenfield FDI, whereas the impact of the COVID-19 pandemic on cross-border M&A appears to be mostly insignificant.

Implication

The findings above, which were obtained from our empirical analyses using global data, have various implications for mitigating the negative effects of the COVID-19 pandemic on the global economy. These include raising vaccination rates, ensuring procurement from multiple suppliers, actively using EC, ensuring a well-managed cross-border movement of people, and developing online tools for investors. In some of these areas, international cooperation is possible. In particular, the donation of vaccines to countries with lower vaccination rates is one of the possible urgent measures.

References

Ando, Mitsuyo, and Kazunobu Hayakawa. 2022a. “Does the Import Diversity of Inputs Mitigate the Negative Impact of COVID-19 on Global Value Chains?” The Journal of International Trade & Economic Development 31 (2): 299-320. (The revised version of IDE Discussion Paper, No. 809). https://doi.org/10.1080/09638199.2021.1968473

Ando, Mitsuyo, and Kazunobu Hayakawa. 2022b. “Impact of COVID-19 on Trade in Services.” Forthcoming in Japan and the World Economy. (The revised version of IDE Discussion Paper, No. 824). https://www.ide.go.jp/English/Publish/Reports/Dp/824.html

Baldwin, Richard, and Beatrice Weder di Mauro. 2020. “Economics in the Time of COVID-19. A.” VoxEU.org eBook. London: CEPR Press.

Cai, Dapeng, and Kazunobu Hayakawa. 2020. “Heterogeneous Impacts of COVID-19 on Trade: Evidence from China’s Province-Level Data.” Forthcoming in the Journal of International Trade & Economic Development. (The revised version of IDE Discussion Paper, No. 803).

Hayakawa, Kazunobu. 2021. “Does Vaccination Mitigate the Negative Impacts of Coronavirus on Trade?” IDE Discussion Paper, No. 827. https://www.ide.go.jp/English/Publish/Reports/Dp/827.html

Hayakawa, Kazunobu, and Kohei Imai. 2021. “Who Sends Me Face Masks? Evidence for the Impacts of COVID-19 on International Trade in Medical Goods.” The World Economy 45 (2): 365-85. (The revised version of IDE Discussion Paper, No. 810). https://doi.org/10.1111/twec.13179

Hayakawa, Kazunobu, Hyun-Hoon Lee, and Cyn-Young Park. 2022. “Impacts of COVID-19 on Foreign Direct Investment.” IDE Discussion Paper, No. 831. https://www.ide.go.jp/English/Publish/Reports/Dp/831.html

Hayakawa, Kazunobu, and Hiroshi Mukunoki. 2021a. “Impacts of COVID-19 on Global Value Chains.” The Developing Economies 59(2): 154-77. (The revised version of IDE Discussion Paper, No. 797). https://doi.org/10.1111/deve.12275

Hayakawa, Kazunobu, and Hiroshi Mukunoki. 2021b. “Impacts of Lockdown Policies on International Trade.” Asian Economic Papers 20(2): 73–95. (The revised version of IDE Discussion Paper, No. 798). https://doi.org/10.1162/asep_a_00804

Hayakawa, Kazunobu, and Hiroshi Mukunoki. 2021c. “The Impacts of COVID-19 on International Trade: Evidence from the First Shock.” Journal of the Japanese and International Economies 60: 101135. (The revised version of IDE Discussion Paper, No. 791). https://doi.org/10.1016/j.jjie.2021.101135

Hayakawa, Kazunobu, Hiroshi Mukunoki, and Shujiro Urata. 2021. “Can E-Commerce Mitigate the Negative Impact of COVID-19 on International Trade?” Forthcoming in the Japanese Economic Review. (The revised version of IDE Discussion Paper, No. 808). https://doi.org/10.1007/s42973-021-00099-3

*The views expressed in the columns are those of the author(s) and do not represent the views of IDE or the institutions to which the authors are attached.

Thumbnail image: Foreman worker wearing protective mask to Protect Against Covid (Aflo)