IDE Research Columns

Column

How Do Ports and Airports Shape Industrial Clusters in East Asia?

Satoru KUMAGAI

Institute of Developing Economies, JETRO

December 2024

The location of industries in East Asia is closely associated with access to transportation infrastructure, such as ports and airports. This column presents findings from a novel analysis of industrial location patterns across 1,786 subnational regions in 16 East Asian countries. Using a comprehensive regional GDP dataset, the study examines how factors such as domestic and foreign market access, proximity to ports and airports, and local economic conditions affect the concentration of various industries. The results reveal that the determinants of industrial location vary considerably across sectors. For instance, the automotive industry is strongly associated with domestic market access, while the electronics industry is more dependent on foreign market access and proximity to airports. These insights have important implications for developing industrial and infrastructure policies in Asia.

Uneven Economic Landscape of East Asia

East Asia’s economic landscape is characterized by stark disparities between and within countries. Key economic indicators reveal the extent of this unevenness. For instance, per capita gross domestic product (GDP) ratios range from 1:1000 between the lowest and highest regions, population density varies by a factor of 1:100,000 across regions, and “GDP density” (GDP per square km) has an astounding 1:1,000,000 ratio.

To better understand this economic geography, we utilized a novel dataset called the Geo-Economic Dataset for Asia (GEDA, 2005 version), compiled by IDE-JETRO. This comprehensive dataset provides subnational GDP data for 25 sectors across 1,786 regions in 16 East Asian countries. It allows us to analyze the spatial distribution of economic activities with unprecedented detail. While acknowledging the temporal limitation, we argue that this analysis provides crucial insights into the fundamental patterns of regional economic integration. It captures a pivotal phase in the evolution of cross-border production networks—specifically, the period that witnessed the systematic expansion of East Asian production networks—to incorporate emerging and frontier economies in the region.

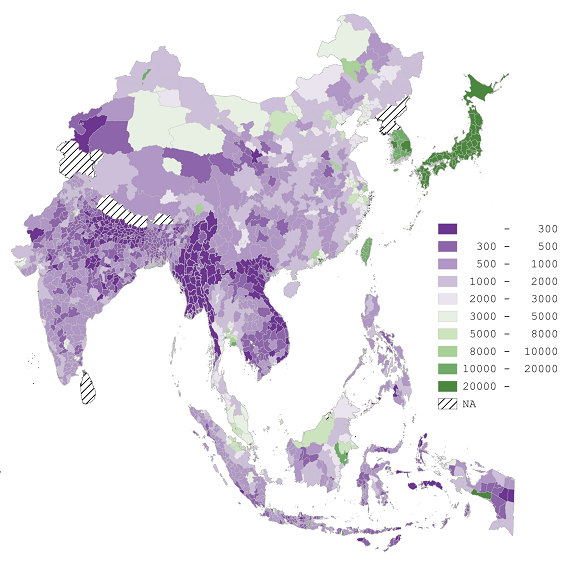

Figure 1. GDP per Capita in East Asia (2005).

Source: Authors’ own compilation based on GEDA (2005).

Figure 1 illustrates the stark income disparities across East Asia. High-income regions are often capital cities or areas rich in mineral resources, while vast swathes are relatively low-income areas.

This uneven distribution is not uniform across industries. Some sectors, including automotive manufacturing, tend to be concentrated in relatively few areas, while others, such as food processing, are more widely dispersed.

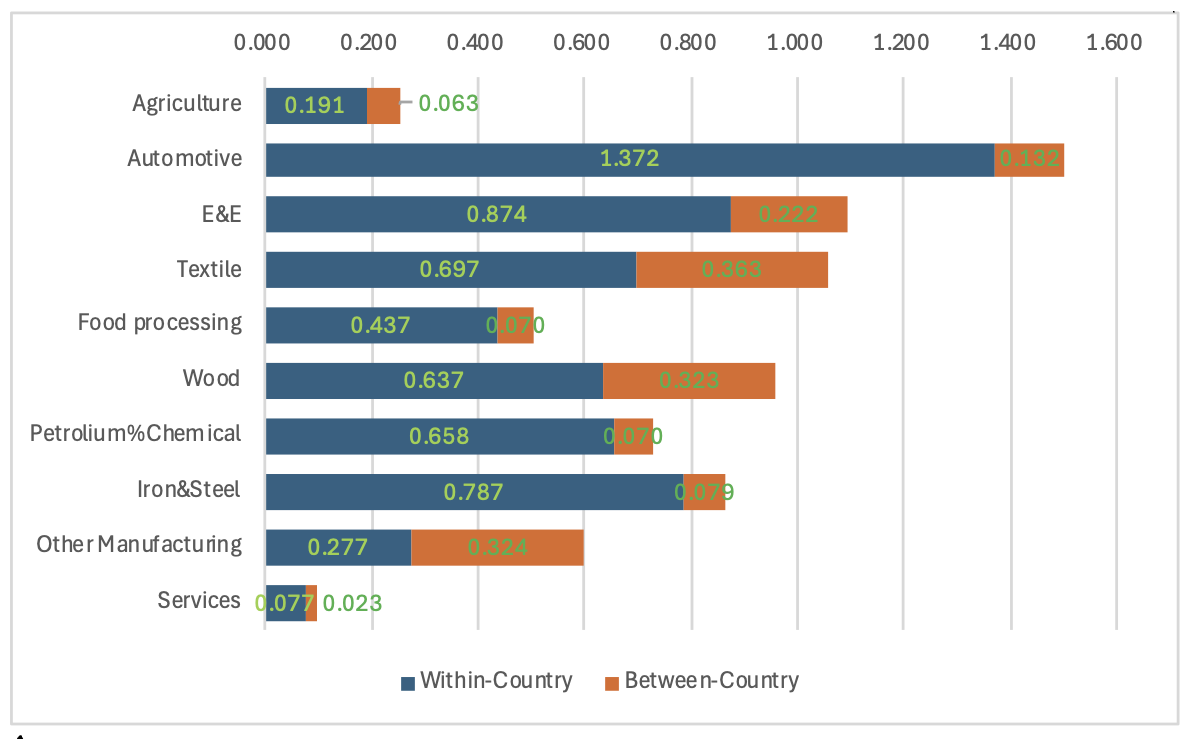

Figure 2. Theil Index of 10 Industries for East Asia (2005).

Source: Reproduced by the authors based on data from the study by Kumagai (2024).

Figure 2 provides a comparative view of industrial concentration across different sectors. The higher the Theil index, the more concentrated the industry. This visualization helps us understand industries that tend to cluster in specific regions and are more evenly distributed across East Asia.

The agricultural and services sectors have very low Theil indices, indicating widespread regional distribution. This is not surprising given the local nature of these industries. The automotive industry exhibits the highest concentration among manufacturing sectors, which is likely due to economies of scale and the need for specialized infrastructure. On the other hand, the food processing industry has the lowest Theil index among manufacturing sectors, implying a more dispersed pattern that may be driven by the need to be close to raw materials and local markets.

Determinants of Industrial Location: A Sector-by-Sector Analysis

To understand the factors influencing industrial location, we conducted regression analyses using location quotients (LQs)i, a representative agglomeration index, as the dependent variable. Key explanatory variables include proximity to ports and airports, domestic market access (DMA), foreign market access (FMA), GDP per capita, and population density. The results reveal striking differences across industriesii.

The relationship this study found between ports/airports and industrial agglomeration represents correlation but not causation. While the direction of causality remains unclear, whether ports/airports lead to industrial clustering or industrial clusters prompt port/airport construction, the fundamental point is that these industrial agglomerations require the presence of ports or airports to function.

The automotive industry is strongly associated with DMA, and proximity to airports (within 100km) is important—likely for business travel. However, it is not significantly affected by port access. This pattern aligns with the historical development of the automotive industry in many East Asian countries as an import-substitution industry that focuses on serving domestic markets.

In contrast, the electronics and electrical (E&E) industry is highly dependent on FMA and benefits from proximity to both ports (up to 300km) and airports (within 100km), while the domestic market size is less critical. This reflects the export-oriented nature of the E&E industry in East Asia, which has been deeply integrated into global value chains since its inception.

The textile and garment industry benefits from both DMA and FMA, port access up to 300km, and airport access within 150km. Interestingly, consistent with labor cost sensitivity, it tends to be located in lower-income regions. This industry’s location patterns reflect its labor-intensive nature and historical role in the early stages of industrialization in many East Asian economies.

The food processing industry is primarily associated with population density, with other factors being less significant, implying a local market orientation. This is expected given the nature of food products, which often cater to local tastes and have relatively high transportation costs relative to their value.

Impact of Ports and Airports on Industrial Location

Our analysis reveals significant but varied spatial correlations between industrial location and transportation infrastructure across different sectors. Consistent with different sectors’ characteristics, the statistical associations with proximity to ports and airports reveal distinct patterns that vary by industry.

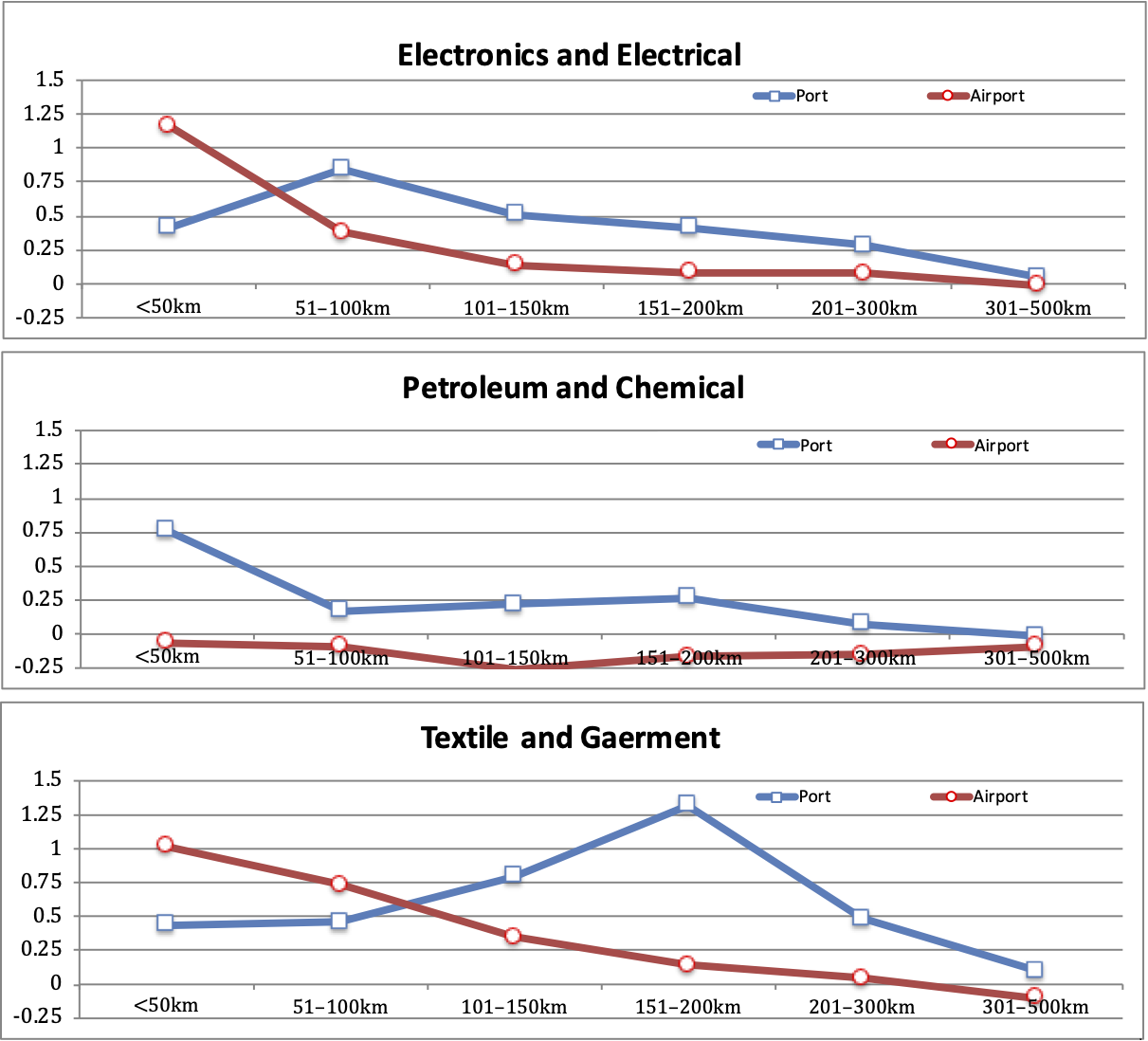

Figure 3. Economic Impacts of Ports/Airports on Selected Industries.

Source: Authors’ own compilation based on data from the study by Kumagai (2024).

Figure 3 illustrates how the economic impacts of ports and airports vary across different industries and distances. This information is crucial for policymakers when formulating infrastructure investments and industrial development strategies.

For the E&E industry, the correlation with proximity to airports is strongest within 50 km but diminishes rapidly beyond this distance. In contrast, the association with port proximity remains notable up to 200–300 km from the port. These spatial patterns imply a close relationship between the E&E industry location and transportation infrastructure. The strong correlation with airport proximity could reflect the importance of air transportation for high-value, time-sensitive electronic components. The broader geographic correlation with ports may indicate the continued relevance of sea transportation, possibly for bulkier items or larger shipments.

The petroleum and chemical industries exhibit a distinct spatial pattern. We find no significant correlation with airport proximity, while the association with ports is substantial but largely confined to areas within 50 km. These patterns are consistent with the industry’s characteristics, particularly its reliance on sea transportation for large volumes of liquid or gaseous products.

The textile and garment industry has a distinct spatial correlation pattern. The association with port proximity is strongest in a 151–200 km range, implying that industry clusters are not necessarily concentrated in areas immediately adjacent to ports, although they tend to be located within accessible distances. The correlation with airport proximity is most pronounced within 50 km and remains significant up to 150 km. These spatial patterns are consistent with the industry’s transportation needs, that is, bulk shipping of materials by sea and rapid movement of finished products or samples by air.

These findings highlight the complex relationship between transportation infrastructure and industrial location. They suggest that the optimal distance from ports and airports varies by industry, likely reflecting differences in transportation needs, the nature of inputs and outputs, and the role of face-to-face interactions in business operations.

Policy Implications

These findings lead to several key insights and policy implications. First, the determinants of industrial location vary significantly across sectors. Therefore, policymakers should consider these differences when developing industrial promotion strategies. A one-size-fits-all approach to industrial policy will likely be ineffective given the diverse needs of different industries.

Second, the importance of ports and airports differs by industry. For example, the E&E industry benefits significantly from airport proximity, while the chemical industry relies more on port access. This suggests that infrastructure investments should be tailored to the specific sectors a region wants to attract or develop.

Third, the impact of infrastructure proximity varies in terms of distance. Port effects generally extend up to 300km, while airport effects are more localized (50–100km). This has implications for regional development strategies and suggests that the benefits of major infrastructure projects can extend well beyond the immediate vicinity.

Fourth, some industries are more sensitive to domestic market size, while others prioritize access to foreign markets. This has implications for smaller countries or regions that aim to attract specific industries. Smaller economies may find it challenging to develop sectors that rely heavily on large domestic markets. Nevertheless, they may have advantages in attracting export-oriented sectors if they provide good international connectivity.

Lastly, historical factors, such as port development in earlier periods, continue to influence industrial geography, highlighting the long-term impact of infrastructure investments. This path dependence suggests that current policy decisions about infrastructure and industrial development will have long-lasting effects on economic geography.

These findings have important policy implications for the development of free trade zones (FTZs), special economic zones (SEZs), and industrial parks by national and local governments. For urban locations with strong airport connectivity, focusing on the E&E industry may be particularly promising. Such a strategy will benefit from complementary investments in high-quality road infrastructure connecting production sites and airports and streamlined customs procedures.

For FTZs/SEZs in suburban or peripheral locations, our analysis suggests that considering access to major international ports within 200–300km is a critical factor. These locations have significant correlations with industries that require bulk transportation capabilities. Development strategies for such areas include parallel investments in specialized cargo handling infrastructure and broader road/rail networks connecting production sites and ports.

The probability of successful regional industrial development will be enhanced by carefully considering the spatial relationships between FTZs/SEZs and their supporting infrastructure. Therefore, policymakers will benefit from conducting detailed assessments of location–industry matching, considering both transportation infrastructure accessibility and industry-specific infrastructure requirements.

Author’s Note:

This column’s main analysis is based on the following study: Kumagai, Satoru. 2024. “Spatial Aspect of Global Value Chain in East Asia: How Ports and Airports Shape Industrial Clusters in East Asia.” Economies 12(6): 151.

Notes:

- LQ for industry I in region r is calculated as where qir is industry I’s employment in region r; qr is total employment in region r; Qi is industry I’s employment in the reference area; and Q is the total employment in the reference area.

- For a comprehensive presentation of the regression results, see Table 3 in the study by Kumagai (2024). While we find notable differences across industries, these differences may reflect country-specific factors in addition to industry effects, as our analysis does not control for country-fixed effects.

Reference

Kumagai, Satoru. 2024. “Spatial Aspect of Global Value Chain in East Asia: How Ports and Airports Shape Industrial Clusters in East Asia.” Economies 12 (6): 151.

https://www.mdpi.com/2227-7099/12/6/151

Author's Profile

Satoru Kumagai is a Senior Researcher at the Institute of Developing Economies, JETRO (IDE-JETRO). His research focuses on spatial economics, economic integration in East Asia, and the development of economic geography simulation models. He has published extensively on regional economic development and is a key contributor to IDE-JETRO’s Geographical Simulation Model (IDE-GSM).

* Thumbnail image: PSA Singapore Terminal by William Cho (Wikimedia Commons)

** The views expressed in the columns are those of the author(s) and do not represent the views of IDE or the institutions with which the authors are affiliated.