IDE Research Columns

Column

Moving Closer or Not? Measuring the Technological Distance between Chinese and Global Firms

Koichiro KIMURA

Institute of Developing Economies, JETRO

December 2022

This article overviews the patterns of technology accumulation by firms in the industrial robotics industry in China. To analyze the technological characteristics of the firms, I measure technological distances between the firms based on their patent applications. First, I find that Chinese firms move technologically closer to a first-mover firm to some degree. Second, they tend to develop both core and peripheral technologies to enhance the basic functions of technologies and product sophistication, respectively. These patterns represent the process through which the firms specialize in their new business.

Technology Accumulation by Firms

How do firms develop while accumulating technologies? As firms within the same industry generally run their businesses using a combination of multiple technologies, their positions in technology portfolios vary depending on their backgrounds and strategies. My recent study (Kimura 2022) overviews how Chinese robotics firms have accumulated technologies and how their technological distances and positions against a first-mover global firm, Yaskawa, have changed.

Measuring Technological Distances

Technological distance is an indicator of the degree of technological differences between firms in an industry. It can be measured by comparing firms’ technologies, specifically using the cosine similarity of firms’ technological positions (Jaffe 1986). The cosine similarity is 1 if technologies are similar between firms and 0 if they are not (or −1, depending on the value of technological positions). In addition, the technology position is defined as a vector that consists of the following values in each technology field: the amount of research and development expenditures, the number of patents for each code in the International Patent Classification (IPC), or the classification in the IPC based on the results of natural language processing of the patents’ text, such as titles and abstracts (Kimura et al. 2022).

Technological distance can also be used to compare the processes through which technologies accumulate within firms. Specifically, I examine the distances of the following firms based on their technological positions. The first-mover firm is Yaskawa, a Japanese firm, and the major Chinese firms used for the comparison are Siasun, Step, Estun, and Efort. For further comparison to understand the effects of the technological distance across industries, I introduce another major Chinese firm in a different industry—Huawei, which is in the telecommunications equipment industry. The technological positions of all the Chinese and Japanese firms are measured by the number of patent applications filed in China and published by the end of 2018. Here, the technological positions are measured by the cumulative number of patent applications for each IPC code.

Findings

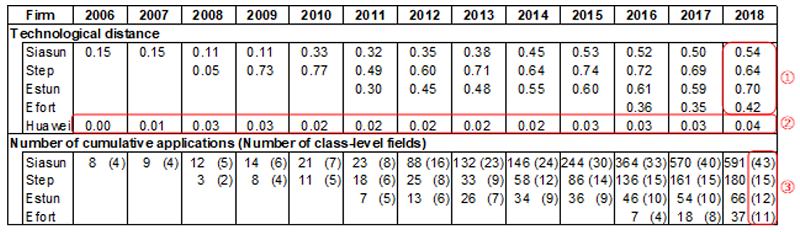

First, for an intraindustry comparison, I measure the technological distances of the Chinese firms from Yaskawa by calculating the cosine similarity between them. Their technological distances increased to some degree and then leveled off approximately 0.5–0.6 (values ① in Table 1). Thus, as the number of patent applications increased in the early 2010s, the technological fields of the Chinese firms became closer to those of the first mover—Yaskawa—but then stabilized.

The remaining distance, i.e., between 0.5 and 1, does not necessarily mean negative outcomes. However, it may imply that after moving close enough to the first-mover Japanese firm, the Chinese firms attained their own technological positions with their original technologies and product lineups as the source of competitiveness. For example, Siasun has continued to focus on robots for hospitals and Efort on painting robots, whereas the first mover, Yaskawa, has kept its position in servo motors. Another Chinese robotics firm, Step, whose main business lies in elevator controlling equipment, has successfully maintained its uniqueness even today by using machine control technology that is different from that of its competitors.

Table 1: The Technological Distances from Yaskawa and the Cumulative Patent

Applications by the Firms (2006–2018)

Notes: The technological distances are calculated as cosine similarity between the

technological positions of two firms. The numbers in parentheses represent patent

applications filed in the class-level fields, i.e., the second-highest IPC division.

Source: The author’s creation is based on the data from CNIPR, the intellectual property

database published by Intellectual Property Publishing House in China.

Next, for an interindustry comparison, I calculate the technological distance of Huawei (46,876 applications [66 fields] as of 2018) from Yaskawa. Although Chinese robotics firms reduced their technological distance from Yaskawa, the technological distance between Huawei and Yaskawa remained very large (values ② in the table). This means that the technology accumulation of Chinese robotics firms, which is partially in line with Yaskawa’s technology position, has led to their specialization in the field. In other words, Chinese robotics firms have gradually developed to form a new industry over the years by specializing in relevant technologies and differentiating themselves from existing industries such as the telecommunications equipment industry, which is the one that Huawei is in.

Finally, I compare Chinese robotics firms in terms of technological fields based on their patent applications. In their early stages of development, the firms tend to file most of the patents in their core technological fields. As they grow, they begin to file patent applications in peripheral technological fields, such as the ones for robot applications and product sophistication. The widening scope of technology accumulation by the firms is represented by the increasing number of patent applications in technological fields (values ③ in Table 1).

Implications

Chinese robotics firms file more patent applications as their technologies develop in core and peripheral fields, thus establishing their own technological positions. The different combinations of technologies have led to product differentiation, and, thus, have been a source of the market competitiveness of each firm.

The technological distance can be an index to reveal the process of concentration of technological development within an industry and technological differentiation from other industries. Through these two processes, a new industry may emerge, as we see here in the case of the robotics industry in China. In other words, the technological distance may have the potential to contribute to understanding how future industries will develop, which is an area of interest for further research.

Author’s Note

This column is mainly based on the following research:

Kimura, Koichiro. 2022. “How Do Firms Specialize? The Technological Positions of Chinese Robotics Firms.” Journal of Chinese Economic and Business Studies 20 (4): 339–353. https://www.tandfonline.com/doi/full/10.1080/14765284.2022.2036577

This above article in JCEBS is supported by JSPS KAKENHI (JP19K20560).

References

Jaffe, Adam. 1986. “Technological Opportunity and Spillovers of R & D: Evidence from Firms’ Patents, Profits, and Market Value.” American Economic Review 76 (5): 984–1001.

Kimura, Koichiro, Hiroshi Matsui, Kazuyuki Motohashi, Shun Kaida, and Janthorn Sinthupundaja. 2022. “Competition and Technology Position: The Case of China’s Industrial Robotics Industry.” IDE Discussion Paper No. 834. https://www.ide.go.jp/English/Publish/Reports/Dp/834.html

Author’s Profile

Koichiro KIMURA is a Senior Research Fellow at Institute of Developing Economies, JETRO. His research interest is in the impact of competition on the growth of firms. To analyze the growth patterns of firms, he has been working on comparing the make-or-buy decisions (the boundaries of the firm) in value chains among competing firms as well as their technological positions in innovation activities, as demonstrated in this article. Regarding the former topic, he published The Growth of Chinese Electronics Firms: Globalization and Organizations (Palgrave Macmillan) in 2014.

*Thumbnail image: Making a car (Andriy Onufriyenko / Moment/ Getty Images)

**The views expressed in the columns are those of the author(s) and do not represent the views of IDE or the institutions to which the authors are attached.