Kyat Appreciation Calls for Liberal Controls on Imports and Foreign Exchange

Policy Review on Myanmar Economy

No.4

KUBO Koji

August 2012

PDF (34.8KB)

PDF (Burmese) (751KB) BUSINESS , Union of Myanmar Federation of Chambers of Commers & Industry, Vol.12 No.10, October 2012.

Kyat appreciation is damaging traditional export industries

National leaders of Myanmar, including President U Thein Sein and Daw Aung San Suu Kyi, emphasize that economic development should go with poverty alleviation and equitable income distribution. For these objectives, growth of the export industries of rice, pulses and beans, and garments is indispensable as they provide income opportunities for a large number of poor households.

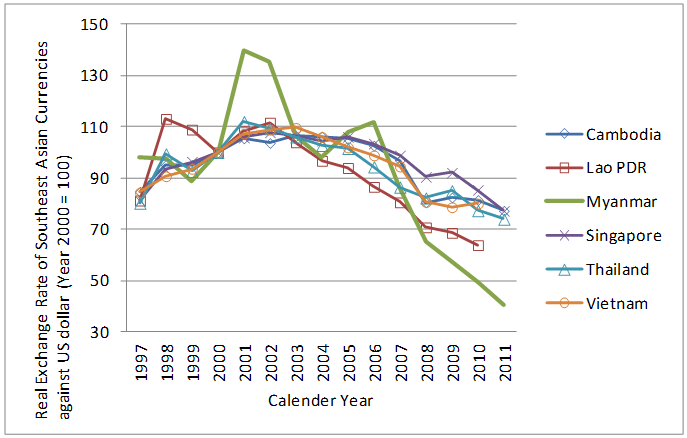

The market exchange rate under the dual exchange rate system in Myanmar has exhibited extraordinary appreciation since late 2006. The value of the US dollar in terms of the Myanmar consumption bundle has diminished to one-third of its previous level in the five-year period of 2007 to 2011. This is the sharpest appreciation among Southeast Asian currencies. There is concern that the appreciating kyat is dampening the growth of the above-mentioned traditional export sectors.

Foreign exchange market structure and sources of kyat appreciation

Due to pervasive controls on foreign exchange and trade, the foreign exchange market has been segmented between the public and private sectors. The allocation of foreign exchange in the public sector has been centrally controlled by the government. On the other hand, the private sector has not been required to surrender export earnings, nor has it been granted foreign exchange allocation for imports at the official rate. The government has tolerated the private sector trading foreign exchange in negotiated transactions. As a result, the parallel market exchange rate has been determined mostly in accordance with the supply and demand of foreign exchange in the private sector.

Despite the reform by the new government inaugurated in March 2011, the structure of the foreign exchange market is mostly intact. Since October 2011, the Central Bank has permitted private banks to run foreign exchange counters where the private sector can legitimately buy and sell foreign exchange, though within limits. In April 2012, the Central Bank began to announce a reference rate that explicitly guides the prices of foreign exchange at the exchange counters. In addition, the Central Bank initiated auctions of foreign exchange with private commercial banks. Although this series of reforms offers an additional channel for foreign exchange transactions, convertibility of kyat for current account transactions is still limited, and negotiated transactions of foreign exchange outside the banking sector persist. Moreover, state economic enterprises are still separated from the private sector foreign exchange market.

Given the segmentation of the foreign exchange market, the impact of the large inflows of foreign exchange from natural gas exports and FDI on the parallel market exchange rate is not straightforward. Such foreign exchange inflows concentrated in the public sector, and remained in the public sector, so that they could not be the cause of the appreciation in the parallel market. On the contrary, there should be other sources that sharply increased the supply of foreign exchange to the parallel market; sales at gem emporiums, which seem to be unrecorded in the balance of payments statistics, are a suspected source.

National leaders of Myanmar, including President U Thein Sein and Daw Aung San Suu Kyi, emphasize that economic development should go with poverty alleviation and equitable income distribution. For these objectives, growth of the export industries of rice, pulses and beans, and garments is indispensable as they provide income opportunities for a large number of poor households.

The market exchange rate under the dual exchange rate system in Myanmar has exhibited extraordinary appreciation since late 2006. The value of the US dollar in terms of the Myanmar consumption bundle has diminished to one-third of its previous level in the five-year period of 2007 to 2011. This is the sharpest appreciation among Southeast Asian currencies. There is concern that the appreciating kyat is dampening the growth of the above-mentioned traditional export sectors.

Foreign exchange market structure and sources of kyat appreciation

Due to pervasive controls on foreign exchange and trade, the foreign exchange market has been segmented between the public and private sectors. The allocation of foreign exchange in the public sector has been centrally controlled by the government. On the other hand, the private sector has not been required to surrender export earnings, nor has it been granted foreign exchange allocation for imports at the official rate. The government has tolerated the private sector trading foreign exchange in negotiated transactions. As a result, the parallel market exchange rate has been determined mostly in accordance with the supply and demand of foreign exchange in the private sector.

Despite the reform by the new government inaugurated in March 2011, the structure of the foreign exchange market is mostly intact. Since October 2011, the Central Bank has permitted private banks to run foreign exchange counters where the private sector can legitimately buy and sell foreign exchange, though within limits. In April 2012, the Central Bank began to announce a reference rate that explicitly guides the prices of foreign exchange at the exchange counters. In addition, the Central Bank initiated auctions of foreign exchange with private commercial banks. Although this series of reforms offers an additional channel for foreign exchange transactions, convertibility of kyat for current account transactions is still limited, and negotiated transactions of foreign exchange outside the banking sector persist. Moreover, state economic enterprises are still separated from the private sector foreign exchange market.

Given the segmentation of the foreign exchange market, the impact of the large inflows of foreign exchange from natural gas exports and FDI on the parallel market exchange rate is not straightforward. Such foreign exchange inflows concentrated in the public sector, and remained in the public sector, so that they could not be the cause of the appreciation in the parallel market. On the contrary, there should be other sources that sharply increased the supply of foreign exchange to the parallel market; sales at gem emporiums, which seem to be unrecorded in the balance of payments statistics, are a suspected source.

|

Sources: Kubo (2012)

|

Countermeasures against kyat appreciation

Intervention in the open market of foreign exchange is an immediate countermeasure against the real appreciation. For intervention in the open market, the Central Bank should be able to buy and sell foreign exchange from foreign exchange dealer banks. This in turn requires convertibility of kyat for current account transactions; whenever they like, exporters and importers should be permitted to buy and sell export earnings with foreign exchange dealer banks so that the possession of export earnings would shift from exporters to the banking sector. Then, by setting the reference rate above the parallel market rate, the Central Bank can stimulate exporters to sell foreign exchange to the banks, and can absorb the foreign exchange from the banks through auctions.

Alleviation of real exchange rate appreciation in the long run requires structural policies. The tight controls on imports and the ‘export first’ policy constrained the growth in imports and repressed the demand for foreign exchange. Per capita imports of Myanmar are the lowest among Southeast Asian countries, and about one-third of those of Cambodia. There is ample room for growth in imports. While the abolition of the ‘export first’ policy in April 2012 is a change in the right direction, further facilitation of imports would be necessary; this includes full convertibility of kyat for current account transactions.

Finally, it must be reminded that the introduction of the Central Bank reference exchange rate and the unification of the segmented foreign exchange market are two different things. The unification must entail abolition of centrally controlled allocation of foreign exchange. Such a unification of the market will improve the efficiency of the allocation of foreign exchange for the whole economy in the long run. Nonetheless, as long as public sector foreign exchange is in surplus, the unification of the segmented market would channel more foreign exchange to the open market, which would aggravate currency appreciation. The unification of the foreign exchange market should be suspended as long as the appreciation problem remains.

References

1. International Monetary Fund (IMF) Myanmar: 2011 Article IV Consultation, IMF Country Report No. 12/104, May 2012.

2. Kubo, Koji “ Real Exchange Rate Appreciation, Resource Boom, and Policy Reform in Myanmar ,” IDE Discussion Paper No. 358, Institute of Developing Economies, July 2012.

Intervention in the open market of foreign exchange is an immediate countermeasure against the real appreciation. For intervention in the open market, the Central Bank should be able to buy and sell foreign exchange from foreign exchange dealer banks. This in turn requires convertibility of kyat for current account transactions; whenever they like, exporters and importers should be permitted to buy and sell export earnings with foreign exchange dealer banks so that the possession of export earnings would shift from exporters to the banking sector. Then, by setting the reference rate above the parallel market rate, the Central Bank can stimulate exporters to sell foreign exchange to the banks, and can absorb the foreign exchange from the banks through auctions.

Alleviation of real exchange rate appreciation in the long run requires structural policies. The tight controls on imports and the ‘export first’ policy constrained the growth in imports and repressed the demand for foreign exchange. Per capita imports of Myanmar are the lowest among Southeast Asian countries, and about one-third of those of Cambodia. There is ample room for growth in imports. While the abolition of the ‘export first’ policy in April 2012 is a change in the right direction, further facilitation of imports would be necessary; this includes full convertibility of kyat for current account transactions.

Finally, it must be reminded that the introduction of the Central Bank reference exchange rate and the unification of the segmented foreign exchange market are two different things. The unification must entail abolition of centrally controlled allocation of foreign exchange. Such a unification of the market will improve the efficiency of the allocation of foreign exchange for the whole economy in the long run. Nonetheless, as long as public sector foreign exchange is in surplus, the unification of the segmented market would channel more foreign exchange to the open market, which would aggravate currency appreciation. The unification of the foreign exchange market should be suspended as long as the appreciation problem remains.

References

1. International Monetary Fund (IMF) Myanmar: 2011 Article IV Consultation, IMF Country Report No. 12/104, May 2012.

2. Kubo, Koji “ Real Exchange Rate Appreciation, Resource Boom, and Policy Reform in Myanmar ,” IDE Discussion Paper No. 358, Institute of Developing Economies, July 2012.

You can download this policy review at the IDE-JETRO website: http://www.ide.go.jp

Contact: Bangkok Research Center, JETRO Bangkok TEL:+66-2253-6441 FAX:+66-2254-1447