Murray & Roberts

Murray & Roberts

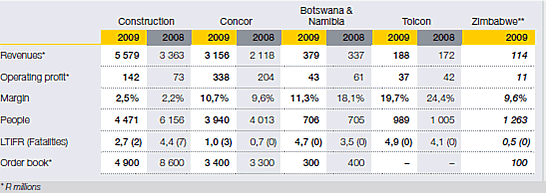

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Murray & Roberts is South Africa’s leading engineering, contracting and construction services company. Murray & Roberts operates in Southern Africa, Middle East, Southeast Asia, Australasia and North and South America from its home-base in Johannesburg South Africa, where it has a public listing on the JSE Limited. It has an international coordinating office in the United Kingdom and principle offices in Australia, Botswana, Canada, Namibia, United Arab Emirates and Zimbabwe.

Douglas George Murray, a civil engineer, was the son of, and successor to John Murray, the founder of the Cape-based construction company, Murray and Stewart which John established in 1902. After the death of his father in 1928, D G Murray continued to build the company into one of the most successful construction enterprises in South Africa. Along the way he also became the major shareholder in Roberts Construction which was founded by his friend Douglas Roberts. In 1967, after Murray’s death, the two firms joined together to become Murray & Roberts.

The Group holds 49% in associate company Murray & Roberts (Zimbabwe) Limited. Despite exceptionally difficult socio-economic and political conditions, the company has continued to trade well, completing the new British Consulate in Harare during 2009 and maintaining its involvement in a depressed mining sector. A major restructuring commenced during the year to reposition the business for anticipated opportunities in the future infrastructure, commercial and mining sectors. Murray & Roberts has agreed to facilitate the future development of the business by recapitalising it with new plant and equipment, training and development and leadership mentoring.

In Country Location

44 Tilbury Road, Willowvale, Harare;

Telephone: +263 4 61 1641-5 / 61 1741-7

Telefax: +263 4 61 2986

Services and Products

Murray & Roberts is primarily focused on resources driven construction markets in industry & mining, oil & gas and power & energy and offers civil, mechanical, electrical, mining and process engineering; general building and construction; materials supply and services to the construction industry; and management of concession operations

Murray & Roberts Construction, Concor and operations in Botswana, Namibia and Zimbabwe engage the large to medium sector building, civil engineering, industrial and roads & earthworks construction markets of South Africa and the rest of SADC

Number of Employees

1,000 employees in Zimbabwe

Financial Information

Market Share

Murray & Roberts Zimbabwe is the country's largest engineering, contracting and construction services company with an approximate 60 percent market share. M&R is the only contractor in the country with sliding technology for mining expansion projects, and has been contracted by Zimplats, Mimosa and many other big mining corporations.

Business Objective

“Our commitment to sustainable earnings growth and value creation is non-negotiable. The Murray & Roberts value proposition is defined through its non-negotiable commitment to sustainable earnings growth and value creation. The Group aspires to world class fulfilment in everything it does, through its core competence in industrial design, delivering major projects and services primarily to the development of emerging economies and nations”

Business Model

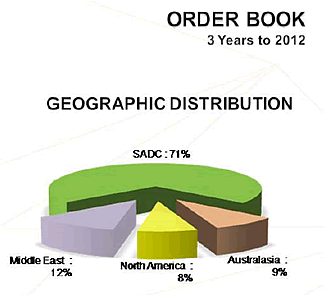

“Murray & Roberts is wholly focused on the construction economy, serving two linked market drivers through a diverse range of clustered operating companies. The two linked market drivers Murray & Roberts is focused on are: South African gross fixed capital formation (GFCF), which is expected to drive annual growth of 15% to 25% through to at least 2014 and probably beyond to 2025; and Global demand for natural resources, which will continue to drive economic development in many developing markets and growth in demand for extraction infrastructure.

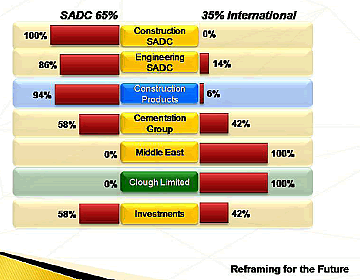

‘’Our plan is to maintain about two thirds of group activity in our domestic market, where we seek to build sufficient critical mass in a variety of key sectors and play a leadership role in the major opportunities that will flow from the country's infrastructure development agenda.

‘’On the other hand, the majority of group activities are directly geared to the infrastructure requirements for accessing, extracting, beneficiating and industrialising natural resources. This is particularly true of our operations in South Africa, Canada and Australia, while our operations in Middle East are geared to deliver economic infrastructure funded by free cash flows from buoyant resource demand.

‘’Project Khaya is a strategy to acquire greater critical mass in Murray &Roberts over time, both in the Group’s domestic market and where appropriate, in support of its global business model. The Group has utilised its balance sheet capacity to acquire a number of key assets in recent years, including Cementation, Concor, Clough and Wade Walker.

‘’Murray & Roberts continues to seek merger opportunities in its markets, either to build on its existing capacity or add new capacity and extend its domestic and global footprint. The past financial year is the first in five years where organic growth has not been boosted by acquisition. The Group’s new organisational structure comprising six large clusters each focused on a clearly identified market sector, has allowed for the attraction of new levels of executive capacity in preparation for future potential acquisition integration.

‘’The Board has approved a new strategic phase referred to as Reframing Murray & Roberts. While retaining the core elements of our strategy, Reframing Murray & Roberts prioritises organic growth and acquisitions required to build the critical mass necessary to remain competitive and maintain future growth in our targeted sectoral and geographic markets.

‘’Reframing Murray & Roberts is our strategic response to the global economic challenges and market uncertainties. This essentially reframes our established business model on the principle “ same picture but against a different context, background and surrounding ”.

‘’This follows the strategic success of Rebuilding Murray & Roberts between 2000 and 2005 and Globalising Murray & Roberts through 2006 to 2008. Our primary strategic action has been to regroup our operations into six large business clusters. Three will be focused on the domestic and regional SADC market and three on our international and global markets. We have identified and appointed new and experienced executive leadership into the top levels of the organisation to complement the high level capacity already in place.

‘’Rebuilding Murray & Roberts was a change process that commenced on 1 July 2000. At its heart was a non-negotiable commitment to sustainable earnings growth and value creation. Through this process we committed to world class fulfilment in the construction economy as our core market, enhanced our core skill in engineering and our core capability in contracting, and leveraged our value proposition through our core competence in industrial design. Globalising Murray & Roberts was a growth strategy that sought new opportunity and value from the platform created over more than 100 years since 1902. We identified global best-in-class benchmarks against which we measure our performance in engaging our chosen natural resources and regional markets. Reframing Murray & Roberts will ensure stability and performance between 2009 and 2014 as the Group introduces new leadership capacity and builds greater critical mass against the backdrop of changed economic and market conditions brought on by the global economic crisis.”

Ownership of Business

Murray & Roberts Zimbabwe is a 49% held associate of Murray&Roberts

| TOP 10 BENEFICIAL OWNERS | |||

|---|---|---|---|

| Rank | Beneficial Owner | Holding | % |

| 1 | Public Investment Corporation (ZA) * | 47,598,272 | 14.34 |

| 2 | New World Fund Inc (US) | 15,555,000 | 4.69 |

| 3 | Liberty Life Assoc of Africa (ZA) | 12,834,894 | 3.87 |

| 4 | Murray & Roberts Letsema Sizwe (Pty) Ltd (ZA) | 11,616,331 | 3.50 |

| 5 | Letsema Vulindlela Black Executives Trust (ZA) | 9,956,779 | 3.00 |

| 6 | Murray & Roberts Trust (ZA) * | 7,757,368 | 2.34 |

| 7 | Murray & Roberts Letsema Khanyisa (Pty) Ltd | 7,374,893 | 2.22 |

| 8 | Lazard Emerging Mkts Portfolio (US) * | 6,097,992 | 1.84 |

| 9 | Old Mutual Life Assurance Co Ltd (ZA) | 5,598,372 | 1.69 |

| 10 | Investment solutions (ZA) * | 5,526,571 | 1.66 |

Benefits Offered and Relations with Government

In November 2009 it was announced that Zimbabwe plans to grab a 51 percent stake in foreign-owned firms within 60 days of the gazetting of the Indigenisation and Economic Empowerment Act regulations. The regulations seek to transfer ownership of any foreign-owned businesses valued at US$500,000 or above to indigenous Zimbabweans in terms of the Indigenisation and Empowerment Act passed in 2007. While the Act has been public knowledge for several years, the regulations reveal a hardening of government's approach. The documents spell out thresholds, time frames and the process of compliance. "Any business that within the 60-day period referred to in subsection (1) fails to enter into a transaction that results in 51 percent or a controlling interest, as the case may be, being held by indigenous Zimbabweans shall within the next 30 days submit a proposal within the next six months from the date of publication of these regulations on how it intends to achieve compliance with the Act," read the regulations.

Companies opposed to the proposed legislation would be required to show cause through Indigenisation and Empowerment minister Saviour Kasukuwere why they will not be able to comply with the provisions of the law. Upon completion of the transaction, shareholding should be transferred inside a month or the company should show cause to the Indigenisation minister why the firm failed to comply. Three weeks from the date of adoption of the regulations, the minister would be empowered to effect a merger or restructure if indigenous Zimbabweans fail to acquire the controlling stake in a related sector in line with the Competition and Tariff Commission rules.

Mobile, tourism, finance, transport, communication and construction sectors will need to attain empowerment within three years.

In 2009 the Harare City Council decided to engage a little-known Ukrainian company - that on paper appears to be run by Zimbabweans – to construct the Joshua Mqabuko Nkomo Expressway without going to tender. Murray & Roberts planned to bid for the tender. The deal involves the city parcelling out huge chunks of land in return for the construction of the expressway. The Ukrainian company is supposedly funding the project in return for land.

Another projected eyed by Murray & Roberts, the Beitbridge-Chirundu highway, was also signed out as to a foreign consortium, again without going to tender.

Product Development

Murray & Roberts Zimbabwe Limited said in 2009 that it is ready to compete with foreign contractors for some US$15 billion potential projects in the country and capture at least a third of that business. Group chief executive officer (CEO), Canada Malunga, said the company’s board had approved a capital expenditure of US$4 million for the procurement of new equipment to replenish the contracting division’s stock of machinery following a disposal of some old equipment at the beginning of the year. The acquisition is part of the M&R Zimbabwe’s efforts to rebuild its capacity to handle a more diverse range of projects in mining, road construction, building, water and other infrastructure-related services more competitively.