Vicat Group

Vicat Group

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

The Vicat Group (Vicat) is the third largest cement company in France. The Vicat group is the heir to an industrial tradition dating back to 1817, when Louis Vicat invented artificial cement. The Vicat group was founded in 1853, and now operates in three principal business segments, namely Cement, Ready-Mixed Concrete and Aggregates.

Vicat has also extended its operations over the years into a number of complementary activities, including specialty concrete coatings; prefabricated concrete products, including sewage and drainage pipes; transportation and logistics of concrete and other building materials; wholesale distribution of concrete and other building products through a chain of ten depots; and paper.

The Vicat group has a presence in eleven countries: France, Switzerland, Italy, the United States, Turkey, Egypt, Senegal, Mali, Mauritania, Kazakhstan and India. About 52 percent of its sales come from outside France.

In the 1990s, Vicat widened the scope of its international interests. Amongst others it acquired SOCOCIM in 1999. That company was not only the leader in the Senegalese market but also held a leading position supplying cement to neighbouring markets. In 2004 Vicat launched a new aggregates joint-venture in Senegal and built a new rock crushing facility there as well, launching operations in February 2004. Sococim Industries (Sococim) is its wholly owned subsidiary in Senegal.

In Country Location

BP 29, Rufisque, Dakar, Senegal;

Telephone: +221 33 839 88 88, 221 33 836 11 37.

Sococim has its cement manufacturing facility in Rufisque, 30 km West of Dakar.

Services and Products

Production of Cement and Concrete & Aggregates in Senegal

Number of Employees

Employees: 420 permanent employees; and 400 subcontractors

Financial Information

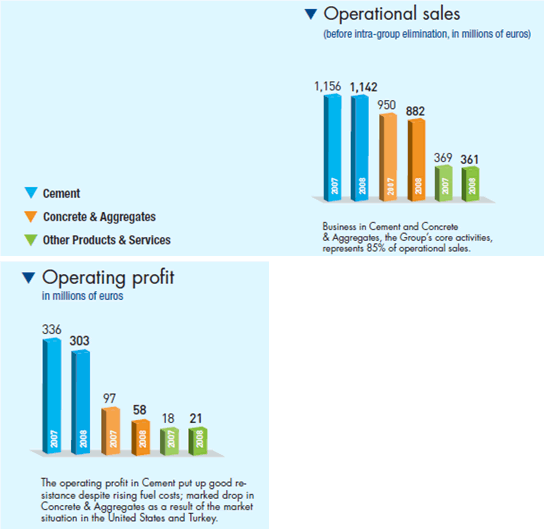

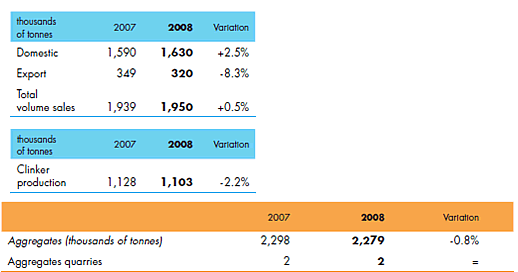

Company statistics

Senegal Statistics

2.3 million Tonnes of aggregates sold

2.3 million Tonnes of aggregates sold

Market Share

Vicat is the largest manufacturer of aggregates in Senegal and Sococim is the largest cement plant in West Africa. Sococim provides 70 percent of domestic consumption of cement.

Business Objective

The Group objective is to continue expansion in the cement industry.

Business Model

“The Group focuses primarily on its historical business expertise, cement, and through vertical integration develops into the ready-mixed concrete and aggregates markets in order to provide secure access to the markets that use cement. In addition, on some markets, it benefits from synergies with complementary activities that consolidate its offering and strengthen its regional positioning.

The Group stresses controlled development of its different businesses, associating a fine balance of dynamic organic growth sustained by industrial investment to meet market demand and a policy of selective external growth for tackling new markets with an attractive growth potential or for accelerating vertical integration.

On the markets it operates, the Group is constantly making industrial investments aimed at: modernizing its production resources to achieve greater efficiency and better economic performance in its plants, and thus to have the industrial capacity to respond to more intense competition; and increasing its production capacity in order to keep pace with the development of its markets and consolidate or enhance its position as regional leader.

The Group has thus implemented the Performance 2010 plan targeting an increase in cement production capacity of around 50percent while at the same time appreciably improving the productivity of its existing industrial resources. This program has already been applied in France, Turkey, and Egypt, is being implemented in Senegal and Switzerland in 2009, and will subsequently be introduced in the United States.

The Group’s strategy is to penetrate new markets through the cement business, but only very selectively. In its external growth policy, the Group thus aims to meet all the following criteria: projects to be located near large markets with attractive growth potential; projects to guarantee availability of long-term mineral reserves (target of 100 years for cement) through land acquisition and award of definitive operating licenses; projects to be net contributors to Group profits in the short term.

The Group may also seize opportunities to penetrate new developing markets by building new “greenfield” cement plants. Such projects are examined very selectively, however, in accordance with the Group’s external growth criteria.

By combining investment in developed countries, which generate more regular cash flows, and in emerging countries which, while they do have greater potential for long-term growth, can suffer more pronounced market fluctuations, the Group’s strategy aims to diversify geographical exposure.

The strategy developed by the Group has demonstrated how robust it is in the current highly unfavourable macroeconomic climate. Supported by a sound financial situation, with levels of gearing and leverage among the lowest in the sector, the Group will proceed with its Performance 2010 plan for internal growth generating lower production costs through modernization of industrial facilities and increased Group production capacity in Senegal and Switzerland.

Because of the economic crisis, the Performance 2010 plan has been complemented by the Performance Plus plan which will produce an overall operating cost saving of 50 million euros and a reduction in non-strategic investment and working capital requirements which, together, will have a positive impact on Vicat's free cash flows of around 140 million euros.”

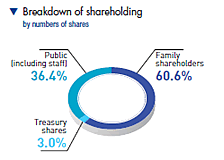

Ownership of Business

The Vicat family remains the company's largest shareholder. SOCOCIM is a wholly owned subsidiary (99, 91 percent) of Vicat.

Benefits Offered and Relations with Government

Law No2003-36 of 2003, concerning the mining code, introduced several innovations, including: Fiscal incentives allowing the holder of a mining concession to benefit from exemptions for a seven year period; and total exemption of all taxes for the holder of a research permit during the period of validity of the permit and any renewals.

In addition incentives include exoneration of all Customs duties and taxes, including VAT and the Conseil Sénégalais des Chargeurs (Senegalese Council of Shippers, COSEC) withholding tax on: equipment, materials, supplies, machines, equipment and utility vehicles included in the registered programme, and replacement parts and functional items not produced or fabricated in Senegal, which are specifically destined to be used in mining research operations and which are vital to the realisation of the research programme; fuels and lubricants for fixed facilities, drilling instruments, machines and other equipment destined for research operations under the permit granted; petrol products for producing energy used during the research programme; and spare parts and pieces for machines and equipment, specifically used in the realisation of the research programme; during the period of the realisation of investments and the commencement of an exploration or the expansion of the production capacity of an existing mine, the exploration permit holder or the beneficiary a small mine exploration authorization and the contractors working on its behalf benefit from exemption from taxes and duties including VAT and COSEC; on materials, equipment, supplies, machines and utility vehicles included in the registered programme and equipment directly destined for mining operations; fuels and lubricants for fixed facilities, materials and drills, machines and other equipment destined for mining operations; and spare parts and pieces for machines and equipment, specifically destined for mining operations.

Financial benefits are granted in the development phase. Throughout the duration of the exploration, holders of exploration or concession contracts or the beneficiaries of a small mine exploration authorization are exempted from the exploration tax on products issuing from their exploration activities within the scope of the awarded title.

The holder of an exploration permit is exempted for three years, and the holder of a mining concession is exempted for seven years from company tax until recovery of all bans and exploration expenses, as well as exemptions from: VAT on goods and services purchased from local or foreign suppliers; Entrance fees; Minimum basic tax; Property taxes except for residential property; Basic tax payable by employers; and from Duties and taxes when setting up a new company or raising capital. The Tax Code has also been reformed over the past few years.

For greater effectiveness of the fiscal tool and to promote investment, some bodies such as the Commission Technique Consultative Fiscale (Technical Consultative Tax Committee, CTCF), initiated by the prime minister and Conseil Présidentiel de l’investissement (CPI) have been set up. Many proposals were made and adopted after series of bills on the initiative of the president of the republic.

In February 2004, Law No2004-07, establishing special procedures to assist in the regulation, was promulgated. The aim of this law was to set up a tool aimed at promoting the emergence of fiscal duty, strengthening of the voluntary contribution to public life, the shift of economic operators to structured activities as well as the reduction of distortions related to sectors that are already taxed enough.

Law No2004-12 (of February 2004), which amended the General Tax Code, includes a substantial relief on the corporate tax, reducing it from 35 percent to 30 percent. Additionally, in order to encourage investment in Enterprises the so-called priority sectors, the new Investment Code (Law No2004-06 of February 2004) has been introduced. Many tax benefits are granted to investors who invest in economic sectors identified as priorities.

Law No2006-17 (of June 2006) amended the General Tax Code including a new lower rate of income tax of 25 percent. Law No2007-25 of May 2007 allows companies investing more than CFA250 billion to be exempted from the investment and mining codes.

The Government and particularly also President, Abdoulaye Wade is strongly committed to develop local energy resources and is specifically supportive of Sococim’s Jatropha project.

Product Development

In 2007 Sococim Industries started a E150-million investment program aimed at increasing its cement production capacity to 3.5 million tons by mid 2009. This involved building a new Polysius kiln using the latest cement technologies. Under the same program, early in 2007 Sococim Industries commissioned a new power plant enabling the cement plant to be self-sufficient in terms of electric power. Under a sustainable-development project, Sococim Industries has also launched an extensive jatropha growing program to develop the use of biofuel. The purpose of the project activity is the partial replacement of a fossil fuel, coal, by Jatropha fruits and biomass residues for combustion in the cement plant.

Until the start-up of the new milling and bagging lines in the third quarter of 2009, sales to the sub region were deliberately restricted in order to favour supply of the local market.

Implementation of the Performance 2010 plan continued through the year. The increase in the plant’s capacity, which began with commissioning of a new power-generation plant in 2007, continued through 2008 with addition of a 10,000 tonne cement silo, a vertical cement mill, and a bagging machine. The new mill with annual production capacity of about 900,000 tonnes means Sococim Industries can fully meet the demand of the local market and also take up a position on export markets ahead of start-up of the new kiln line in 2009.