Barclays Bank of Botswana Limited

Barclays Bank of Botswana Limited

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Barclays is a major global financial service provider engaged in retail and commercial banking, credit cards, investment banking, wealth management and investment management services with an extensive international presence in Europe, the Americas, Africa and Asia. With over 300 years of history and expertise in banking, Barclays operates in over 50 countries and employs approximately 145,000 people.

Barclays is made up of two ‘Clusters’: Global Retail and Commercial Banking (GRCB), and Investment Banking and Investment Management (IBIM), each of which has a number of Business Units.

Barclays Bank of Botswana Limited is a subsidiary of Barclays Bank Plc. Barclays Bank PLC commenced operations in Botswana in 1950. In 1975 the bank was incorporated locally, as Barclays Bank of Botswana Limited. Until May 1986, it operated as an autonomous, wholly owned subsidiary of Barclays Bank PLC and was managed from its head office in Gaborone.

In 1986, ordinary shares in the Bank were issued to employees of the bank. Following a further right issue to Botswana citizens in 1987, the Barclays Bank PLC shareholding was reduced to 80.4%. A subsequent rights issue in 1991 diluted this shareholding to 74.86%.

In Country Location

Barclays House, 6th Floor, Plot 8842, Khama Crescent, Gaborone, Botswana;

Telephone: +267 395 2041

Telefax: +267 390 6604

Services and Products

The Bank is engaged in providing personal and business banking services and products. The Bank operates in three business segments: Personal Banking, which includes current accounts, instant savings account, loans, as well as foreign currency accounts; Business Banking, which provide solutions for corporate customers and Securities Services for institutional investors in Africa.

Number of Employees

1,484 employees

Financial Information

Barclays Bank of Botswana (BBB) recorded positive results for the six months ended 30th June, 2009. Total income increased by 21 percent to P652 million and its profit before tax grew by 17 percent to P305 million. Net interest income increased by 41 percent to P 489m (2008: P346m). The bank has recorded an increased impairment charge of P81.4 million which is in line with the growth in customer loans, and is reflective of the challenging economic environment within the country. Operating expenses have been maintained at 2008 levels on a like-for-like basis. Through a deliberate effort to manage costs in all expense lines, as well as general efficiency improvements, Barclays Botswana has seen its cost to income ratio fall to 41 percent (Dec 2008: 48 percent; June 2008: 47 percent).

Market Share

BBB has the dominant market share of retail asset and liability balances in the local market.

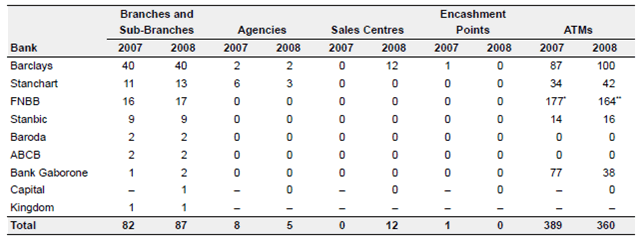

Licensed Banks’ Representation: 2007–2008

Business Objective

“To become one of a handful of universal banks leading the global financial services industry, helping customers and clients throughout the world achieve their goals.”

”Barclays Bank of Botswana aims to become the leading contributor to Botswana’s banking service future”

Business Model

Barclays' strategy is to achieve good growth through time by diversifying its business base and increasing its presence in markets and segments that are growing rapidly. The strategy is based on the principles of earn, invest and grow. Supporting this are four strategic priorities: build the best bank in the UK; accelerate the growth of global businesses; develop retail and commercial banking activities in selected countries outside the UK’ and enhance operational excellence.

BBB has put in place a plan that will enable it to ameliorate the potential effects of the global economic crisis and take advantage of any opportunities that arise while continuing with its growth strategy. The expansion strategy of BBB focuses on “expanding our footprint and diversified and expanded our customer base.”

BBB states the following on its strategy: “Overall, our excellent 2008 results are a tribute to the holistic approach we have taken to driving the bank’s growth strategy forward. Every aspect of our operation - people, processes, and technology - has been evaluated and, where necessary, changed to deal with the challenges associated with sustainable growth. We were acutely aware that growth, unaccompanied by improvements in service delivery, would be unsustainable. While we introduced new products to meet the needs of our different customer segments, we also recognise that ultimately, one bank’s products are remarkably similar to another’s. The key differentiator is service. We know that our continued growth will depend on how good our customer service is; on our efficiency; and on our cost of delivery.

We have enhanced our Information Technology platforms, migrating away from the unreliable VSAT (satellite-based) network to a far more robust, considerably faster, terrestrial backbone. All branches are now linked via a high-capacity, high-redundancy fibre optic network, which we can monitor proactively and remotely. This has resulted in a marked improvement from 88% to 96% of systems’ uptime and availability. The result is better service for our customers, regardless of where they are located.

More importantly perhaps, our upgraded, enhanced systems enabled us to expand our role in the retail mass market. Indeed, the doubling of our retail asset book during the review period was possible only because we were able to put in place a system that allows us to provide loans to this relatively untapped market responsibly, both from the customers’ and the Bank’s perspective.

At the same time, we have embarked on a programme to enhance efficiencies which will drive down costs while simultaneously improving customer service. To date, our efforts have achieved measurable success. One example is the fact that whereas the standard time for the approval of a loan was four days at best, but more usually one week, we can now turn around a loan within 24 hours. Our goal is to reduce this still further without, in any way, increasing risk to the Bank.”

Ownership of Business

Barclays Bank of Botswana Limited is a subsidiary of Barclays Bank Plc. The Bank operates through two wholly owned subsidiaries: Barclays Botswana Nominees (Pty) Limited and Barclays Insurance Services (Pty) Limited

Benefits Offered and Relations with Government

Botswana’s banking sector consists of a central bank (Bank of Botswana) and seven commercial banks (Barclays Bank Botswana, Standard Chartered Bank Botswana, First National Bank Botswana, Bank of Baroda Botswana Ltd., Stanbic Bank Botswana, Capital Bank and Bank Gaborone).

The Bank of Botswana is responsible for monetary policies, central banking services, supervision of financial institutions, issuing of bank notes, implementing exchange rate policies, administering exchange controls and foreign exchange reserves management. The bank's financial statements comply with international standards.

The liberalization of the Botswana economy created the necessary environment for growth in the financial sector. The Botswana Government is encouraging the establishment of new and diverse financial institutions to support increased foreign and domestic investment and to fill the existing gaps where finance is not currently commercially available. Botswana’s International Financial Services Center (IFSC) is tasked with developing a recognized financial services regional hub in an effort to diversify the economy and to manage the country’s real comparative advantages.

Botswana banks may lend to non-resident controlled companies and other non-resident owned business entities in Botswana without specific approval from the Bank of Botswana. In fact, foreign investors generally enjoy much better access to credit than local firms due to the often-limited capital base of the local entrepreneur, conservative lending policies by commercial banks, and the variety of strengths (personnel, technological, and logistical) that the bigger foreign investors possess. Commercial lenders generally apply a debt to equity ratio of 4:1. Authorized dealers and credit institutions licensed by the Bank of Botswana are allowed to make foreign currency-denominated loans, financial leases and other forms of financial support to their customers in Botswana whether or not they have onshore accounts.

In accordance with the Banking Regulations, 1995, the Bank can issue banking licenses in the different categories indicated below:

Commercial banks

A commercial banking licence shall enable the holder to undertake conventional commercial banking business, including the following main activities:

(i) acceptance of deposits and savings for such maturity and amounts as may be determined from time to time by the board or management of the bank; (ii) extension of credit in the form of loans, overdrafts, financial leasing, etc of short, medium and long-term maturities; (iii) sale and purchase or placement of securities, certificates of deposits, etc.; (iv) Underwriting the issuance of securities by clients; (v) undertaking surety and issuing of bank guarantees of an obligation to be fulfilled in monetary terms; (vi) sales and purchases of money market instruments on own account or on behalf of their customers; (vii) dealing in foreign exchange, options, futures, swaps, and in transferable securities; and (viii) such other conventional banking activities as may be approved by the Bank.

A commercial bank shall normally be prohibited from doing non-banking business or acquiring or holding shares in other financial institutions or any other company, except as stated under Sections 17(10) and 17(11) of the Banking Act and, more generally, activities that could undermine safety of the depositors’ funds.

Product Development

BBB introduced mobile banking, Hello Money, to support the full range of retail and business banking services already being offered to its customers in 2009. The product, offers a 24 hour service opportunity to customers to transact in either in Setswana or English. Mobile banking is a large part of the bank’s financial inclusion strategy for the previously unbanked market and maximizes the use of technology. Currently, Barclays operates in 13 areas where no other financial service provider operates across the country.

Barclays has partnered with Orange and Mascom in this project and will soon extend this service to beMobile customers as well. The service will also enable customers to pay bills from their handsets in the not so distant future. In 2009 BBB acquired Barclaycard Botswana’s business from Barclays Bank PLC.