Norilsk Nickel

Norilsk Nickel

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Norilsk Nickel, a corporation incorporated under the laws of the Russian Federation, is the largest mining and metals company in Russia and the world's largest producer of nickel and palladium and one of the world's largest producers of platinum and copper. In addition to this, Norilsk Nickel produces a large number of by-products, including cobalt, rhodium, silver, tellurium, selenium, iridium and ruthenium.

Norilsk Nickel's international mining and metallurgical operations encompass nickel sulphide and laterite mining, processing and refining operations spanning Finland, Australia, Botswana and South Africa.

Norilsk began operating in Russia in the 1930’s. By 1953 the Norilsk Combine

was producing 35% of the Soviet Union’s total nickel output, 12% of its copper, 30% of its cobalt and 90% of its platinum group metals. Meanwhile on the Kola Peninsula there were two enterprises that produce copper and nickel: Pechenganickel and Severonickel. In 1989 the Russian mining industry was restructured and Norilsk Nickel was established, bringing together the Norilsk Combine, the Pechenganickel and Severonickel combines, the Olenegorsk mechanical works, the Krasnoyarsk non-ferrous metal processing works, and the Gipronickel Institute (in St Petersburg).

In 1993, the “Russian State Concern for the Production of Non-Ferrous and Precious Metals Norilsk Nickel” was transformed by a Presidential decree into the “Russian Joint Stock company (RAO) Norilsk Nickel for Production of Non-Ferrous and Precious Metals.” In 2001 it was re-named the Mining and Metallurgical Company Norilsk Nickel (MMC Norilsk Nickel).

In 1994 the privatization of the company saw Norilsk Nickel retaining 38% of shares or 51% of the voting shares. In 1997 the 38% was acquired by the investment company Swift (which represented Uneximbank interests). The company was further restructured in 2000 aimed at improving the performance and investment appeal of the Norilsk Nickel group. As at July 1, 2006 MMC Norilsk Nickel held more than 95% of total RAO Norilsk Nickel share stock.

Norilsk Nickel acquired 85% shares of Tati Nickel in Botswana as a result of the acquisition of LionOre Mining International Limited on 28 June 2007. The Botswana government owns the remaining 15% in Tati Nickel. Tati Nickel includes the Phoenix open pit nickel mine and the Selkirk underground nickel mine, which was put on care and maintenance. The $6.8 billion LionOre transaction is Norilsk’s largest international acquisition.

The Phoenix open pit mining operations started in 1995 and include the concentrator which processes ore mined using the traditional flotation technique. The concentrator capacity is 5 million tonnes of ore per year. The Selkirk mine and the underground mining operations began in 1989. In 2002, the underground mine was put on care and maintenance due to the depletion of copper and nickel ores accessible for underground mining.

Following the acquisition of LionOre, Norilsk commissioned the Activox® Refinery Project which was aimed to improve overall recoveries of nickel from concentrates that are currently being treated by traditional pyrometallurgical means. However it abandoned the project in later 2008 due to substantial project cost escalation. The major contributing factors to the cost escalation were an increase in construction, equipment and project management costs worldwide. Norilsk Nickel continues to develop the Activox® hydrometallurgy technology as a viable process for nickel sulphides and the Activox® Demonstration Plant in Botswana will continue to operate as a large scale test site producing LME grade nickel and copper cathodes.

In Country Location

The Phoenix mine is located 35 km east from Francistown (the second largest city in Botswana, located in the north east part of the country). The Selkirk mine is located 15 km from the Phoenix mine

Services and Products

The Group is involved in prospecting, exploration, extraction, refining, and metallurgical processing of minerals and production, marketing, and sale of base and precious metals. Norilsk produces four main metals-nickel, copper, palladium, and platinum and a variety of by-products, such as cobalt, rhodium, silver, gold, tellurium, selenium, iridium, and ruthenium.

Number of Employees

1,183 employees in Botswana

Financial Information

| 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | |

|---|---|---|---|---|---|---|

| Metal sales revenue | 11,799 | 15, 909 | 11,550 | 7,169 | 6,591 | 5,196 |

| Gross profit on metal sales | 6,354 | 11,237 | 8,420 | 4,175 | 3,653 | 2,326 |

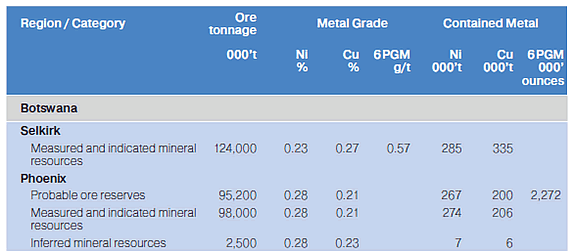

Minerals resources and ore reserves of Norilsk Nickel international as of December 31, 2007: Botswana

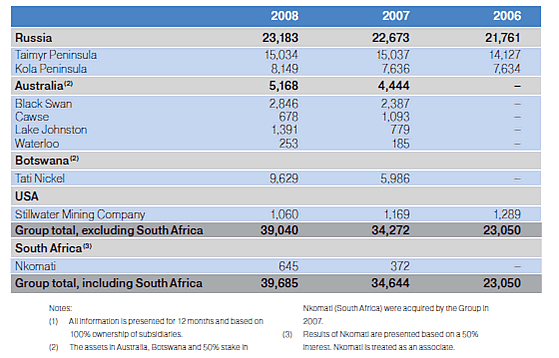

Group ore production (‘000 tonnes)

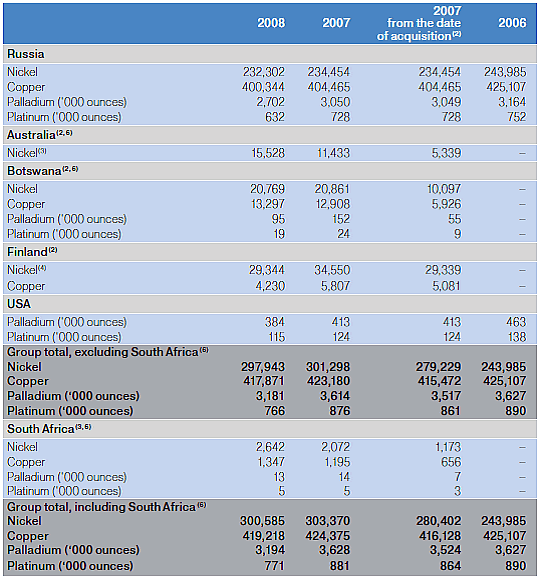

Group saleable metal production (tonnes or as noted)

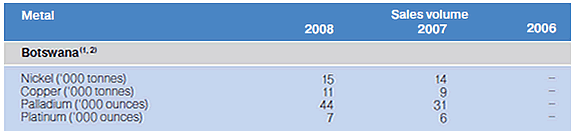

Sales of metal produced

Market Share

MMC Norilsk Nickel is the world’s largest producer of nickel (21.4%). Botswana’s nickel production accounts for about 2% of world production. In 2008, Norilsk Nickel’s saleable metal production (tonnes) was 300,585 tonnes and from Botswana 20,769. Total nickel production in Botswana in 2008 was 28,940. Total nickel production in Botswana in 2008 was 28,940. MMC Norslicks Nicckel market share was 71.7% in 2008.

Business Objective

“Norilsk Nickel aims to strengthen its leadership position in the global mining and metals industry and its role as a reliable producer and supplier of base and precious metals.”

Business Model

The group’s model in based on the following strategic objectives: improvement in corporate governance through restructuring of assets and optimization of management processes; effective use of unique mineral resourc¬es and stability of operating costs; growth in prospecting, exploration and development of world class mineral deposits; support of sustainable development in the regions in which the Company oper¬ates; improved capacity utilization of the Group’s mining and processing facilities; modernization of production facilities in ore beneficiation and metallurgy in order to ensure the most effective processing of mined ore and better metals recovery; sustaining the stable level of costs based on strong skills of continuous improve¬ment in operations, development and implementation of effective technical solutions; and strengthening independence in terms of secure supply of low-cost services and resources, including energy supply, transportation and logistics services.

Ownership of Business

Norilsk Nickel Africa's assets include 85% ownership of both the Tati Nickel Mining Company and the Botswana Metal Refinery in Botswana (the remaining 15% is held by the Government of the Republic of Botswana).

Benefits Offered and Relations with Government

In July 1999 Botswana’s parliament passed a new Mines and Minerals Act replacing the Mines and Minerals Act that had been in place since independence. A summary of the new law is as follows: prospecting Licences for up to 1000km2 are issued for an initial period of three years and renewed for two further periods of two years each; upon each renewal a reduction in the size of the licence by 50% is required; following the conclusion of the seven year period of a Prospecting Licence a Retention Licence can be applied for. The Retention Licence may be granted for an initial period of three years, renewable for not more than three years; the holder of a Prospecting Licence or Retention Licence may apply for a Mining Licence in order to mine a mineral deposit within the Prospecting Licence or Retention Licence; upon the grant of a Mining Licence the Botswana Government has the option of acquiring up to a 15% working interest in the proposed mine, on commercial terms; a Mining Licence will be for a term of 25 years and renewals can be applied for.

Mining companies resident in Botswana are subject to income tax, withholding tax and mining royalties. Botswana’s company tax rate is 25%. A general Withholding Tax of 15% is deductible in Botswana from the payment of dividends, interest and commercial royalties paid to non-residents of Botswana (including non-resident companies). The value of the Additional Company Tax is accumulated and can be used as an offset against the payment of Withholding Tax.

A royalty of 3% of gross market value is payable to the government on production from a nickel, or base metal mine. The term “gross market value” is defined as the sale value received at the mine gate in an arms length transaction without discounts, commissions or deductions. The Minister has the power to defer the payment of a royalty for such a period that the Minster may determine. Exchange control regulations in Botswana have been significantly relaxed, effectively allowing the free remittance of funds from Botswana.

Product Development

Despite the postponement of the Activox refining process Norilsk begun commissioning the 12 million tonne per annum Dense Media Separation (“DMS”) plant at Tati Nickel. The 12 million tonne per annum DMS plant, which selectively increases the head grade of run of mine material, is expected to increase annual production at Tati from 14,500 to 22,000 tonnes of contained nickel in concentrate, reduce total cash operating costs and extend the life of mine by seven years to 2019.

In 2008 US$ 36 million was spent on mining operations, including: US$ 34 million on preparing and stripping the Phoenix open pit; and US$ 2 million on restoring pillars, performing purification work and conducting a bankable feasibility study for open-pit mining at the Selkirk mine. At the end of 2008, the Selkirk project was suspended.

US$ 79 million was invested in concentration operations, including: US$ 60 million on building the Dense Media Separation (DMS) Phase II concentrator; US$ 16 million on increasing the capacity for supplying electricity to industrial sites; and US$ 3 million on modernizing and installing additional filtration and concentration equipment at Phoenix site.