IDE Research Columns

Column

Benefit or Cost? The Impact of Capital Control on China’s Gross Domestic Product Growth Distribution

Yang ZHOU

Institute of Developing Economies, JETRO

July 2024

Capital control policies in China have significant and varied impacts on gross domestic product (GDP) growth distribution, particularly in mitigating downside risks. This column examines the heterogeneous effects of China's capital control indices on GDP growth distribution. The findings indicate that although aggregated capital control policies reduce the downside risks in the medium term, they may constrain the upswings of GDP growth in the short term. Notably, outflow control and resident transaction control indices exhibit pronounced short-term heterogeneous effects. The implications show that policymakers should strategically implement capital control measures to balance the benefits of reducing the downside risks with the potential costs of constraining economic growth during upswings.

Background and Motivation

Capital control liberalization is widely considered beneficial for emerging economies in promoting efficient resource allocation, financial development, and societal welfare (Prasad et al. 2007). However, capital control policies can offer protective measures in the presence of downside risks, such as capital flight and financial volatility (IMF 2022). Previous studies have primarily focused on the mean effects of capital control policies on economic growth, and they have often overlooked the distributional impacts and the specific downside or upside risks associated with GDP growth distribution. This column aims to fill this gap by analyzing the marginal effects of China's capital control policies on the entire distribution of GDP growth.

This study addresses the following key research questions: (i) How do different capital control policies impact the distribution of gross domestic product (GDP) growth in China? (ii) What are the short- and medium-term effects of these policies on GDP growth quantiles? (iii) How can policymakers balance the benefits of reducing downside risks with the potential costs of constraining economic growth during upswings? This study seeks to contribute to the broader literature on financial stability and economic policy in emerging markets by answering these questions. The findings have significant implications for policymakers in China, providing guidance on how to strategically implement capital control measures to enhance economic stability and growth.

Data and Methodology

This study utilizes a comprehensive monthly time series dataset for China from January 1999 to December 2018. Key data sources include the Bank for International Settlements statistics, the "China Economy Time Series" database by Chang et al. (2016), and the capital control dataset compiled by Chen and Qian (2016). The capital control indices used in this study are finely compiled. They also capture various dimensions of capital control policies, including inflows, outflows, and resident versus non-resident transactions. Moreover, the dataset encompasses various macroeconomic control variables, such as real GDP, CPI, real central bank policy rate, and real effective exchange rate. Furthermore, the dataset includes China's Financial Condition Index, which captures financial conditions across money, debt, equity, and housing markets.

If capital control policies are implemented in response to factors affecting the current or expected economic activities (GDP growth), they are considered endogenous. This study adopts a narrative approach to identify the causal effects of capital control policies. The study scrutinizes the background and reasoning of specific policy actions from the IMF’s Annual Report on Exchange Arrangements and Exchange Restrictions, and the rules, regulations, and notices related to the capital account listed on the website of the State Administration of Foreign Exchange of China. If any policy actions are motivated by “GDP growth,” they will be excluded to ensure that the remaining policies are exogenous. This approach ensures that the analysis focuses on the policy actions that are not directly motivated by immediate economic conditions, thereby mitigating potential endogeneity issues. The analysis employs quantile regressions with local projections and skewed t-distribution fitting proposed by Adrian, Boyarchenko, and Giannone (2019). The objective is to examine the marginal effects of capital control policies on the distribution of GDP growth. This approach allows for a detailed examination of how these policies influence different quantiles of GDP growth, highlighting the heterogeneous effects across the distribution.

Heterogeneous Effects of Capital Control Policies

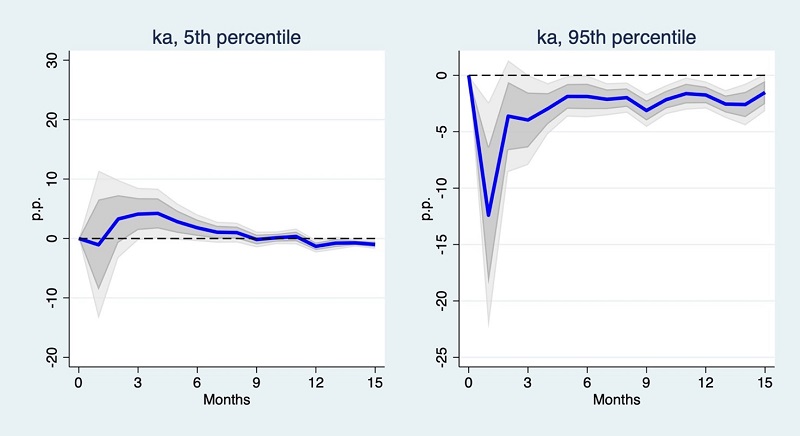

The analysis shows that the effects of China’s capital control policies are highly heterogeneous. Specifically, aggregated capital control indices, which measure the overall intensity of capital controls, have a dual impact on GDP growth (Figure 1). These indices significantly reduce the downside risks of GDP growth in the medium term, acting as a buffer against financial instability. This protective effect is crucial for mitigating the risks associated with capital flight and external financial shocks. Conversely, the same policies constrain the upswings of GDP growth in the short term. This short-term cost is attributable to the capital controls’ restrictions on capital inflows and outflows, which can hinder investment and economic dynamism during periods of economic recovery.

The detailed breakdown of capital control indices in this study further highlights these heterogeneous effects. The outflow control indices, which specifically target the regulation of capital leaving the country, and the resident transaction control indices, which focus on domestic transactions, show strong short-term heterogeneous effects. These findings indicate that although outflow controls effectively in stabilize the economy by preventing sudden capital flight, they can also limit the availability of capital for domestic investment, thereby slowing growth.

Figure 1 Term Structure: The Heterogeneous Effects of Aggregated Capital Control Index

Note: The blue lines denote the impulse response of the downside (left) and upside (right) risk of GDP growth distribution to a one-point increase in aggregated capital control index “ka” for 1–15 months ahead. The y-axis indicates the percentage point change in real GDP growth. These results indicate that the capital control index “ka” enhances the downside GDP growth (left) in the mid-term (from the third to the sixth month) and reduces the upside GDP growth (right) in the near-term (from the first to the third month).

Source: The author’s calculation was based on Zhou (2024).

Impacts on Different Quantiles of GDP Growth

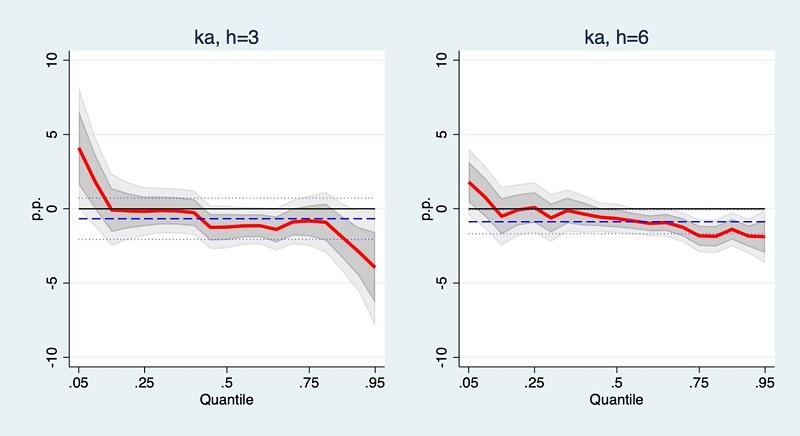

The use of quantile regressions provides a nuanced understanding of how capital control policies influence different segments of the GDP growth distribution. The analysis shows that capital controls’ positive effects are highly pronounced in the lower quantiles of GDP growth. This result indicates that capital controls are particularly effective in reducing the risks of extreme adverse outcomes, such as recessions or severe economic downturns. These policies help to maintain economic stability during periods of financial stress by stabilizing the lower tail of the GDP growth distribution.

By contrast, the negative impacts of capital controls are highly pronounced on the upper quantiles of GDP growth. This asymmetry demonstrates that although capital controls are beneficial for mitigating risks during downturns, they do not significantly enhance growth during periods of economic expansion (Figure 2). This finding is consistent with the notion that capital controls, by nature, are more geared toward preventing adverse outcomes rather than fostering high growth.

Figure 2 Quantiles: The Heterogeneous Effects of Aggregated Capital Control Index

Note: The red lines denote the impulse response of GDP growth distribution to a one-point increase in aggregated capital control index “ka” in the third (left) and sixth (right) month ahead. The y-axis indicates the percentage point change in real GDP growth, whereas the x-axis shows the distribution of GDP growth from the fifth percentile to the 95th percentile. This result also shows that the capital control index “ka” enhances the downside (fifth percentile) GDP growth and reduces the upside (95th percentile) GDP growth.

Source: The author’s calculation was based on Zhou (2024).

The skewed t-distribution fitting used in the study supports these conclusions. That is, the distribution of GDP growth becomes less volatile in the presence of capital controls. This reduction in volatility is particularly evident in the left tail of the distribution, highlighting the effectiveness of capital controls in reducing downside risks.

Policy Implications

The findings have significant implications for policymakers in China. Evidence shows that capital control policies can stabilize GDP growth during financial instability. This result indicates that such measures would be integral to the policy toolkit in emerging economies such as China. However, the short-term growth constraints imposed by these policies indicate that they should be used judiciously and purposefully.

Policymakers should consider the timing and context of implementing capital controls. During periods of economic stability or growth, the restrictions imposed by capital controls may hinder investment and economic dynamism. Therefore, these controls should be relaxed to foster a conducive environment for economic expansion. Conversely, tightening capital controls can provide the necessary protection against external shocks during financial instability or when facing the risk of capital flight.

Therefore, strategic implementation of capital controls can help balance the dual objectives of maintaining economic stability and promoting growth. Policymakers can mitigate the risks associated with volatile capital flows while minimizing the potential constraints on economic growth by preemptively adjusting capital controls based on economic conditions. This balanced approach can enhance the resilience of the economy, ensuring that it remains robust in the face of financial volatility while still capable of achieving sustained growth.

Conclusion

China's capital control policies exhibit complex and varied effects on GDP growth distribution. They provide benefits in terms of reduced downside risks but also pose constraints on growth during economic upswings. The findings highlight the importance of strategic policy implementation to balance the protective benefits against potential growth limitations. Policymakers are encouraged to use capital control measures preemptively and in response to specific economic conditions to maximize their effectiveness.

Author's Note

This column is based on Zhou, Yang. 2024. “Benefits and Costs: The Impact of Capital Control on Growth-at-Risk in China.” International Review of Financial Analysis 93: 103161. https://doi.org/10.1016/j.irfa.2024.103161

References

Adrian, Tobias, Boyarchenko, Nina, and Giannone, Domenico. 2019. “Vulnerable Growth.” American Economic Review 109(4): 1263–89. http://dx.doi.org/10.1257/aer.20161923

Chang, Chun, Kaiji Chen, Daniel F. Waggoner, and Tao Zha. 2016. “Trends and Cycles in China’s Macroeconomy.” NBER Macroeconomics Annual 30(1): 1–84. http://dx.doi.org/10.1086/685949

Chen, Jinzhao, and Xingwang Qian. 2016. “Measuring On-going Changes in China’s Capital Controls: A De Jure and a Hybrid Index Data Set.” China Economic Review 38: 167–82. http://dx.doi.org/10.1016/j.chieco.2016.01.002

IMF (International Monetary Fund). 2022. “Review of the Institutional View on the Liberalization and Management of Capital Flows—Background Note on Capital Flows and Capital Flow Management Measures—Benefits and Costs.” Policy Papers 009: A001.

https://www.imf.org/en/Publications/Policy-Papers/Issues/2022/03/29/Review-of-The-Institutional-View-on-The-Liberalization-and-Management-of-Capital-Flows-515888

Prasad, Eswar S., Kenneth Rogoff, Shang-Jin Wei, and Ayhan M. Kose. 2007. “Financial Globalization, Growth and Volatility in Developing Countries.” In Globalization and Poverty, edited by Ann Harrison, 457–516. Chicago: The University of Chicago Press.

Author's Profile

Yang Zhou is a research fellow at the Institute of Developing Economies, Japan External Trade Organization (IDE-JETRO). He acquired a Ph.D. degree in Economics from the Kobe University in 2023. His research interests include international finance, monetary economics, and macro-prudential and capital control policies in emerging countries. His work has been published in the Journal of Real Estate Finance and Economics, International Review of Financial Analysis, and Finance Research Letters.

Other Articles by This Author

Kitano, Shigeto, and Yang Zhou. 2024. “Effects of China’s Capital Controls on Individual Asset Categories.” Finance Research Letters 49: 103032. https://doi.org/10.1016/j.frl.2022.103032

Zhou, Yang. 2024. “The Effects of Capital Controls on Housing Prices.” Journal of Real Estate Finance Economics. https://doi.org/10.1007/s11146-024-09983-2

Zhou, Yang, and Shigeto Kitano. 2023. “Effectiveness of Capital Controls: Gates versus Walls.” Preprint, SSRN. http://dx.doi.org/10.2139/ssrn.4359931

Zhou, Yang, and Shigeto Kitano. 2024. “Capital Controls or Macroprudential Policies: Which is Better for Land Booms and Busts?” RIEB Kobe University Discussion Paper Series No. DP2023-12. https://www.rieb.kobe-u.ac.jp/academic/ra/dp/English/DP2023-12.pdf

* Thumbnail image: Chinese yuan cash bills and Chinese flag (Javier Ghersi/ Moment/ Getty Images).

** The views expressed in the columns are those of the author(s) and do not represent the views of IDE or the institutions with which the authors are affiliated.