Zimplats Holdings Limited (Zimplats)

Zimplats Holdings Limited (Zimplats)

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

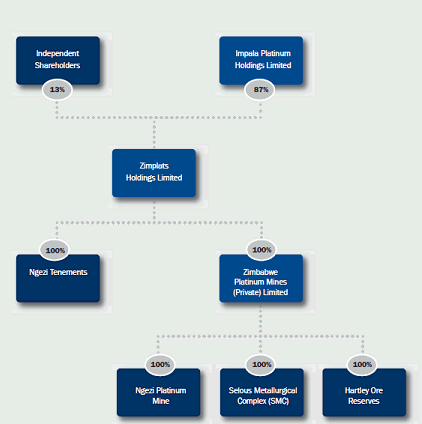

Zimplats Holdings Limited (Zimplats) is owned by Implats and is located on the Hartley Geological Complex on the Zimbabwean Great Dyke south-west of Harare. Zimplats operates both an opencast and an underground mine at Ngezi. The Selous Metallurgical Complex (SMC) where the ore is concentrated and smelted is located some 77 km north of the mine. The company also owns the Hartley Platinum Mine situated at the SMC which is currently under care and maintenance.

Zimplats was established by Delta Gold Limited (Delta) in 1998 to take over its platinum interests. In May 1999 the company purchased BHP's interests in the Hartley Platinum and the Mhondoro Platinum Joint Ventures which included a concentrator and smelter. Zimplats initiated the Ngezi/SMC project in 2001 and the first converter matte was exported in April 2002.

In 2001 Implats acquired a 30 percent stake in Zimplats from Delta in a joint venture with ABSA Bank Limited of South Africa (ABSA). Implats held pre–emptive rights over ABSA’s 15% stake as well as a 30% direct stake in the then Makwiro Platinum (Pvt) Limited. The remaining 70% was held by Zimplats. In August 2002, the Group acquired a further 21% stake in Zimplats from Aurion Gold and in June 2003 purchased ABSA’s 15% stake. Implats subsequently made an unconditional cash offer to minority shareholders in Zimplats.

Currently the group holds 87 percent as a result of the buyout of minority holders and the receipt of 14.9 million ordinary Zimplats shares issued in 2006 on the sale of its 30 percent stake in Zimbabwe Platinum Mines (Pvt) Limited (formerly Makwiro Platinum (Pvt) Limited) to Zimplats.

Zimplats commenced production at the Ngezi opencast mine in December 2001. However, due to the increase in opencast contractor mining costs, Zimplats decided to reduce the volume of opencast tonnes mined replacing them with underground tonnage from the Portal 2 underground mine which employs the conventional bord and pillar mining method.

Following the signing of an agreement with the Government of Zimbabwe in May 2006, Zimplats announced the approval of the Ngezi Expansion - Phase 1 project which is the start of the company's long term expansion plan. This project heralds the replacement of the remaining opencast operation with underground mining operations. The investment of US$340 million will see the simultaneous development of two new underground mines (Portal 1 and Portal 4) at Ngezi and the construction of a new 1.5 million tonne per annum concentrator. Platinum production is set to rise from the current 90,000 ounce level to 160,000 ounces of platinum in matte per annum by 2010.

In Country Location

Block B (Green), Emerald Park, 30 The Chase (West), Emerald Hill, Harare, Zimbabwe;

Telephone: +263 (0) 4 332 590-3

Telefax: +263 (0) 4 332 496

Services and Products

Exploration and production of platinum group metals

Number of Employees

1,997 employees

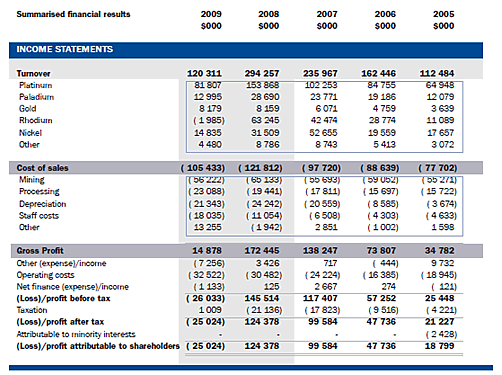

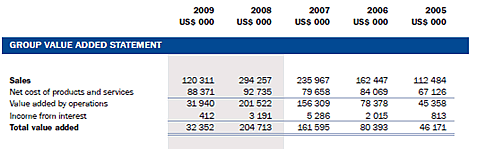

Financial Information

Market Share

Zimplats has the largest reserves of PMGs in Zimbabwe. Zimplats’ reserves (proven and probable) are 217.4 million tonnes; Mimosa’s 33.2 million tonnes; and Unki’s 48.4 million tonnes. Within the Great Dyke four geological complexes are known to contain PGM and base metal deposits. These are the Wedza Complex (Mimosa-Aquarius and Implats), the Selukwe Complex (Unki-Anglo Platinum), the Hartley Geological Complex (Hartley and Ngezi Platinum Mines- Zimplats) and the Musengezi Complex. The Hartley Geological complex is the largest of the PGM bearing complexes containing 85 percent of the known PGM resources in Zimbabwe.

Business Objective

“To be the best platinum company producing in excess of a million platinum ounces per annum whilst generating superior returns for the benefit of our shareholders, employees and Zimbabwe”

Business Model

“The profile of your company has changed significantly in the year under review. The essential conversion to the substantially lower cost underground ore production and the optimisation of the processing capacity is almost complete. With this restructuring the company has lowered the cost structure to a level where Zimplats has now positioned itself to be one of the lowest cost platinum producers and is profitable at the present basket of prices being achieved.

‘’However, with the dramatic fall off in commodity prices in 2008 this essential restructuring has come at a cost and your company now has a debt profile of US$140 million that will need careful managing in the short to medium term. Zimplats has developed a world class mining operation in Zimbabwe and has demonstrated that it is ready and committed, given a conducive investment environment, to play its part in the recovery and growth of Zimbabwe by continuing to implement its expansion programme.”

Ownership of Business

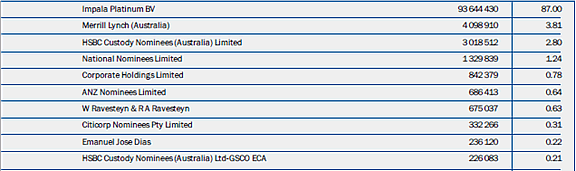

Ten largest shareholders

Benefits Offered and Relations with Government

The investment climate, particularly in the mining sector remains uncertain and confusing. The Zimbabwean local ownership bill was passed by parliament in late September 2007 and seeks indigenisation of 51% of foreign owned firms. Zimplats supports the aims of localisation and has agreements in place that will be taken into account when looking at overall compliance with these requirements. Subsequently the Zimbabwe Mines and Minerals Amendment Bill was withdrawn and the Government began a process of consulting stakeholders. Then in November 2009 it was announced that the government plans to introduce a law that will force foreign-owned companies to allocate a majority stake to black Zimbabweans. Any foreign-owned company worth more than US$500,000 will be required to transfer 51 percent ownership to black Zimbabweans within 60 days, according to a draft law published on 5 November 2009.

“Any business that within the 60-day period fails to enter into a transaction that results in 51 percent, or a controlling interest, as the case may be, being held by indigenous Zimbabweans shall within the next 30 days submit a proposal within the next six months from the date of publication of these regulations on how it intends to achieve compliance with the Act,” the proposed regulations state.

Zimbabwe’s Finance Minister Tendai Biti, a member of the Movement for Democratic Change party in the power-sharing national government, said he was unaware of the government proposal. “I have not seen that law and certainly it has not been discussed in Cabinet so it will be very difficult to comment on something that is speculative,” Biti said in an interview.

In May 2006 Implats reached a landmark agreement with the Government of Zimbabwe which ensures that the ground required for a steady state 1 million ounce per annum platinum mine with a fifty year life is secured under two mining licence regimes. In terms of the agreement Zimplats released 36 percent of the company’s resource base amounting to 51 million ounces of platinum in return for empowerment credits and/or cash. The agreement secured Zimplats 19.5 percent empowerment credits, as well as a cash credit of US$51 million or 9.75 percent empowerment credit if no cash is forthcoming.

In 2009, Zimplats begun the process of engaging the new Government on the resolution of all issues related to the non-promulgation by government of legislation designed to give full effect to agreements that the company entered into, including the following: non-promulgation of legislation giving effect to contractual undertakings given to the company by the Government in 2001, in particular exemption from Additional Profits Tax (APT). Following an audit of the operating subsidiary by Alex Stewart International LLC (ASI), ASI had reported to the Reserve Bank of Zimbabwe that the company owed the tax authorities significant amounts in unpaid APT for the period to June 2007, plus penalties and interest for late payment. ASI had computed the APT liability at US$70 million, US$70 million late payment penalty and interest of US$125 million at an interest rate of 340% per annum, a total of US$265 million. On the basis of the ASI report, in April 2009, the Zimbabwe tax authorities issued an assessment on the operating subsidiary of US$140 million for the principal APT liability and late payment penalty.

Following an objection to both the demand for payment of a tax that the Government had undertaken to exempt the company from and also the computation of the potential liability, the tax authorities issued an amended assessment of US$23 million for the principal APT liability and penalty of US$5 million, a total of US$28 million. An objection has again been lodged to the assessment and the Government has been called upon to honour its obligations in terms of agreements in place. These discussions are yet to be concluded.

In October 2009 President Mugabe commissioned Zimplats’ Ngezi expansion programme where he praised the company for complementing government development goals through projects "outside the realm of mining". He went further to say: "I have no doubt that the achievements you have made are of great benefit for the future of both your operations and that of the local community, and ultimately, the well-being of our country's population.”The strides that you have made in assisting government to invest in infrastructural development will go a long way in creating a conducive environment for those businessmen who may wish to set up their operations in this area." However a few days later Media, Information and Publicity minister, Webster Shamu, said Zimplats was "self-centred" in its approach to business.

Product Development

Work on the Ngezi Phase 1 Expansion project has continued. The development of the Portal 1 underground mine was completed and the mine reached full production during the year. Portal 4 development is on schedule to reach full annual production capacity of 2 million tonnes by May 2011.

Zimplats should complete a preliminary study on the second phase of the Ngezi expansion project by the first quarter of 2010. The second phase expansion will consist of a two-million ton a year underground mine, a concentrator module of the same capacity, and related infrastructure.