Tongaat Hulett

Tongaat Hulett

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Tongaat Hulett is an agri-processing business, which includes integrated components of land management, property development and agriculture.

The Tongaat Group Limited evolved from a partnership between Edward Saunders and W J Mirrlees, which dates back to 1875. On 7 September 1892 the partnership was incorporated into the Tongaat Sugar Company Limited in Pretoria, South Africa. In the years 1969 to 1970, the company, which had diversified into other businesses, was renamed the Tongaat Group Limited.

The Huletts Corporation Limited had its beginnings in the 1850s, with the original incorporation in 1892 as Sir J L Hulett and Sons, which changed its name to Huletts Sugar Corporation Limited and then to Huletts Corporation Limited. In 1962, Anglo American plc bought its first shares in the Tongaat Group Limited. Anglo American plc has retained its investment in THG and has held an interest of more than 50% in THG since 1998.

The company, like many South African entities, was a diversified industrial business with interests in aluminium, building materials, consumer foods, cotton, edible oils, industrial and commercial catering, mushrooms, sugar and agricultural land development, starch and glucose, textiles and transport. Since the early 1990s the Group has systematically divested from a number of these businesses and refocused its operations, leveraging the synergies that exist between its agri-processing operations and prime agricultural land holdings.

Capitalising on the investments in its operations and a solid platform of earnings growth, a strategic review of the Tongaat Hulett’s Group’s operations culminated in the announcement in 2006 of the proposed listing of Hulamin on the JSE and the Hulamin unbundling to create two separately listed, focused companies in 2007, namely: Tongaat Hulett (TH), an agri-processing business, which includes integrated components of land management, property development and agriculture; and Hulamin, an independent niche producer of aluminium rolled, extruded and other semi-fabricated and finished products.

This was achieved by the listing of Hulamin on the JSE, followed immediately by the unbundling of the 50% shareholding in Hulamin by THG to its shareholders. It was accompanied by the simultaneous introduction of broad-based BEE equity participation in both TH and Hulamin. On the implementation of the above transactions, Tongaat Hulett Group’s name changed and is now known as, Tongaat Hulett Limited.

Tongaat Hulett has a primary listing on the Johannesburg Stock Exchange (JSE), which dates back to 1952, and a secondary listing on the London Stock Exchange (LSE), which dates back to 1939. It employs over 35,000 people, working in about 25 locations in 6 countries, South Africa, Botswana, Namibia, Swaziland, Mozambique and Zimbabwe.

Zimbabwe is recognised as the lowest cost sugar producer in Southern Africa. Sugar operations in Zimbabwe consist of Triangle and Hippo Valley Estates, representing a combined installed sugar milling capacity of 600,000 tons.

Hippo Valley Estate was established in 1956 as a citrus estate and soon it diversified with the first cane planted three years later in 1959. Canned Hippo Valley fruit was exported across southern Africa until the 1970s. In the wake of the sugar marker crush in 1975, the estate initiated irrigation programs to water its sugar plantations. In 2006 Anglo American sold its 50.4 percent stake in Hippo Valley Estates to Triangle Sugar, the Zimbabwean unit of Tongaat-Hulett.

Triangle Limited is an agri-based sugar company and is wholly owned by The Tongaat Hulett Group. Murray MacDougall, assisted by Tom Dunuza founded the company in 1919 to ranch cattle but a severe downturn in the economy during the post World War 1 recession led Triangle into crop production in the late 1920s. The main crop cultivated was wheat but Triangle started growing sugar cane in 1934 with only 18 hectares under irrigation. The first sugar-processing mill in Zimbabwe was opened at Triangle on 11 September 1939. Numerous problems followed, which saw the Government taking over the company in 1944. In 1954 a South African company, the Natal Syndicate purchased Triangle, only to be taken over in 1957 by Guy Hulett who was running a business consortium in Natal. This marked the beginning of the Tongaat Hulett association with Triangle. Triangle's expansion was started in the early 1960's, with the development of water storage and conveyance infrastructures for the irrigation of sugar cane.

In Country Location

Triangle Limited is situated in the south-east lowveld of Zimbabwe, 445 km south east of the capital city of Harare. Hippo Valley Estates is located in Chiredzi in south-eastern Zimbabwe, bordering the Triangle estate

Services and Products

Through its sugar and starch operations in Southern Africa, Tongaat Hulett produces a range of refined carbohydrate products from sugar cane and maize.

A total of 15,732 tonnes of cane at a yield of 58.9 tonnes cane per hectare was delivered from the Mkwasine Estate Joint Venture with Triangle Limited, a decrease of 17 percent from the previous season’s deliveries of 18,940 tonnes. Mkwasine Estate outgrowers delivered a total of 81,808 tonnes of cane from 2,100 hectares harvested compared to 138,448 tonnes cane from 2,376 hectares harvested in 2007, at an average yield of 39.0 and 58.3 tonnes cane per hectare, respectively.

A total of 119,024 tonnes cane was delivered by the Hippo Mill Group, comprised of the Chiredzi Sugar Cane Farmers’ Association of Zimbabwe (CSFAZ) and commercial growers under the Zimbabwe Cane Farmers Association (ZCFA) at an average yield of 53.0 tonnes cane per hectare, a decrease of 38 per cent from the 185 533 tonnes cane, at an average yield of 48.8 tonnes cane per hectare, delivered in 2007.

Number of Employees

8,000 people in Zimbabwe.

Financial Information

The Zimbabwe sugar operations are now consolidated in Tongaat Hulett’s financial results. This consolidation follows the macroeconomic changes that occurred when Zimbabwe moved to a US dollar and Rand based economy and, in so doing, restored relevant key fundamentals to the economy. The accounting treatment, in terms of International Financial Reporting Standards, on the commencement of consolidation of these operations gives rise to a balance sheet take-on gain of R1, 969 billion. This gain is excluded from the profit from operations and excluded from headline earnings.

The profit from operations in the first half of 2009 in Zimbabwe was R305 million (compared to the dividend received of R35 million in 2008).

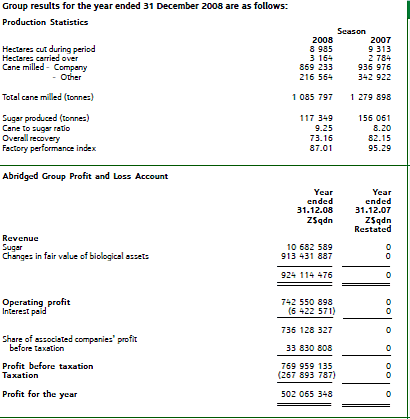

Zimbabwe: Group results

Market Share

Triangle Limited is the largest producer of sugar and Hippo Valley the second largest producer in Zimbabwe

Business Objective

“To create value for all stakeholders, is sustainable and contributes meaningfully to the social and physical environment in which it operates. A high priority is placed on all aspects of safety, health and environment”

In Zimbabwe Triangle's vision is to continue expanding sugar production in the lowveld of Zimbabwe, thereby significantly contributing towards the growth of The Tongaat Hulett Group and Zimbabwe.

Business Model

“Over the past century, Tongaat Hulett has established itself as a leading large scale agri-processing business which has its base firmly established in Southern Africa. Demand for food products is increasing worldwide, renewable energy has introduced a new dimension to agriculture and agricultural trade regimes are changing, with Africa and the European Union (EU) moving closer as a trade bloc. Further opportunities for expansion and growth in Africa are thus emerging. Tongaat Hulett has the established business platform and size to capitalise on these opportunities.

‘’The successful management of the socio-economic and political dynamics of agriculture, land, water, agri-processing, food and energy are integral to the business. The growth and development of Tongaat Hulett’s operations, in the selected regions in which it operates, have involved establishing credible partnering relationships with local communities, governments and employees over time. Its 25 percent South African Black Economic Empowerment (BEE) equity participation transactions and involvement in post settlement land claim solutions, the partnership with the Mozambique government in establishing the Mozambique sugar operations and its programmes to establish indigenous cane farmers in Zimbabwe illustrate the level of understanding and extent of relationships in the region.

‘’The integrated business model involves land and water management, agriculture, agri-processing and the transition to property development and other uses at the appropriate times. Tongaat Hulett is able to maximise value through the various phases of land usage, from acquisition, agriculture and agri-processing to the transition to property development. This carefully managed process continues to enhance the value of Tongaat Hulett’s remaining land.’’

In Zimbabwe Tongaat Hulett’s strategy under extremely difficult circumstances is to manage these operations as far as possible to ensure that the infrastructure and skills base is maintained. In addition there is an increasing emphasis on re-establishing outgrower production to former levels.

“Over the past century, Tongaat Hulett has established itself as a leading large scale agri-processing business which has its base firmly established in Southern Africa. Demand for food products is increasing worldwide, renewable energy has introduced a new dimension to agriculture and agricultural trade regimes are changing, with Africa and the European Union (EU) moving closer as a trade bloc. Further opportunities for expansion and growth in Africa are thus emerging. Tongaat Hulett has the established business platform and size to capitalise on these opportunities.

‘’The successful management of the socio-economic and political dynamics of agriculture, land, water, agri-processing, food and energy are integral to the business. The growth and development of Tongaat Hulett’s operations, in the selected regions in which it operates, have involved establishing credible partnering relationships with local communities, governments and employees over time. Its 25 percent South African Black Economic Empowerment (BEE) equity participation transactions and involvement in post settlement land claim solutions, the partnership with the Mozambique government in establishing the Mozambique sugar operations and its programmes to establish indigenous cane farmers in Zimbabwe illustrate the level of understanding and extent of relationships in the region.

‘’The integrated business model involves land and water management, agriculture, agri-processing and the transition to property development and other uses at the appropriate times. Tongaat Hulett is able to maximise value through the various phases of land usage, from acquisition, agriculture and agri-processing to the transition to property development. This carefully managed process continues to enhance the value of Tongaat Hulett’s remaining land.’’

In Zimbabwe Tongaat Hulett’s strategy under extremely difficult circumstances is to manage these operations as far as possible to ensure that the infrastructure and skills base is maintained. In addition there is an increasing emphasis on re-establishing outgrower production to former levels.

Ownership of Business

Triangle Sugar Corporation is 100 percent owned by Tongaat; Hippo valley estate is 50.35 percent owned by Tongaat; and Hippo Valley and Triangle are equal shareholders in the Mkwasine estate.

Benefits Offered and Relations with Government

Zimbabwe's sugar production has been in decline since 2000, from a high of 600,000 tonnes when President Robert Mugabe's government started seizing white-owned commercial farms, including sugarcane plantations, to resettle landless blacks.

Zimbabwe has been grappling with a serious shortage of sugar for almost six years running despite the fact that Tongaat were producing enough for the domestic market. The smuggling of the product by senior government officials and refusal by the government to decontrol the price of sugar has impacted negatively on the availability of the product on the local market. Hordes of Zanu-PF supporters, including so-called war veterans and senior civil servants, including police officers, invaded sugar cane fields at the height of farm invasions in 2000 and subsequently but some have since abandoned their plots due to their inability to produce the crop.

In the 2008 season, the company’s sugar production was 298 000 tons compared to the 349,000 tons produced in 2007. The business has had to contend, inter alia, with the extreme effects of hyperinflation, exchange rate movements, foreign currency shortages and price controls. In addition to the impacts of the low cane throughput, principally from outgrower cane land, the crushing season has been affected by production stoppages caused by the non-availability of spares and a shortage of boiler fuel. Refined sugar and alcohol production levels were significantly impacted by poor energy balances in the two sugar mills. Alcohol has been produced at the sugar operations in Zimbabwe since 1980, with Zimbabwe as an ACP country enjoying similar preferential market access to attractive European markets, as do Tongaat Hulett’s Mozambique operations. Local market sales for 2008 remained at selling prices significantly below world and regional levels.

Zimbabwe’s land reform programme was undertaken with various shortcomings including a lack of provision for equipment, working capital, finance and training for the newly settled farmers to grow and harvest the established sugar cane crop. This has led to yield reductions of 72 percent on outgrower farms, with the crops perishing on 38 percent of these farms. In addition, shortages of agrochemicals, spares and foreign currency have detrimentally affected both the company’s as well as outgrower estates. Despite efforts in 2008 to commence with the rehabilitation of outgrower estates, the deteriorating macroeconomic environment that prevailed restricted meaningful progress in this regard.

It is estimated that under improving macroeconomic conditions the rehabilitation of the outgrower sector of approximately 15,000 hectares will take place over a period of three to four years. The most significant source of funding for this rehabilitation will be accessing the EU Adaption Aid Funding. In the case of Zimbabwe, Euro 45 million has been allocated, most of which will be channelled through the Canelands Trust that has been set up by the company, with oversight provided by the EU and the Government of Zimbabwe.

The company is still in dispute with the government over the Mkwasine Estate, because subsistence farmers have settled on 90 percent of the estate without permission. Mkwasine helps supply sugar cane to sugar mills at Hippo Valley and Triangle. In 2004, parts of the estate were listed for confiscation by the government as part of its land reform project.

Only 598 hectares are under the maintenance of the consortium partners, Hippo Valley Estates and Triangle, whilst 4 283 hectares of the Mkwasine Estate cane land is under the control of the CSFAZ outgrowers. In spite of the reduced size of the Mkwasine core estate, an establishment of employees continues to be carried, to provide extension services to the outgrower farmers. Consultations with the relevant authorities on the applicability of 99-year leases to large agro-industrial entities under the Constitutional Amendment Act No.17 promulgated in 2005 are ongoing. A ruling on the long outstanding appeal by the A2 and commercial farmers against an earlier ruling by the High Court on the disputed ownership of cane deliveries in 2003, following the inter-pleader proceedings instituted by the Company, was given on 16 September 2008. The Supreme Court confirmed the ruling of the High Court that ‘the settlers be awarded the proceeds of the sugar cane produced during the existence of the acquisition orders made by the Minister of Lands, Agriculture and Rural Resettlement’ and dismissed the appeal by commercial farmers with costs.

The signing in September 2008 of the Global Political Agreement between the ruling Zanu-PF party and the main MDC opposition party culminating in the formation of an inclusive Government in February 2008 has injected some impetus and stability into the key macroeconomic fundamentals for the sugar business. The removal of price controls, adoption of certain foreign currencies as legal tender, a liberalised foreign exchange environment and anticipated balance of payment support inflows, as well as direct foreign investment, is expected to stimulate economic recovery.

The Government is currently developing a new National Agriculture Policy Framework designed to boost productivity and enhance exports.

Product Development

In 2008 Tongaat signed an initial accord with the Infrastructure Development Bank of Zimbabwe (IDBZ), Triangle Estates and Loita Capital for the construction of the Tokwe Murkosi Dam. Tongaat wants to use water from the dam for its operations. The Tokwe Murkosi Dam project has been on the cards for a decade and its completion has been scuttled by foreign currency shortages. Construction is yet to start.

In addition about R70-million will be spent on Tongaat Hulett’s two mills in Zimbabwe to ensure that they could ramp up to full capacity, while a further R75-million will be spent on upgrading the firm’s transport fleet, which transport sugar cane to the mills.