Mwana Africa Holdings

Mwana Africa Holdings

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

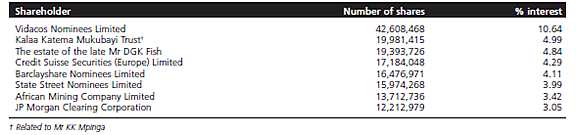

Mwana Africa Holdings (Proprietary) Limited, a private South African company, was established in 2003 by Kalaa Mpinga (born and raised in the DRC) and completed three major mining acquisitions, including the Bindura nickel mine in 2003, the Anmercosa base metal and gold prospects in the Katanga copper belt in 2004, and the Freda Rebecca gold mine in 2005. The shareholder group which funded these acquisitions included Kalaa Mpinga, David Fish and Tim Wadeson from South Africa and several prominent members of the business communities in Angola, Zimbabwe, Kenya and Zambia, who run successful businesses across Africa. Mwana Africa PLC was formed through a reverse takeover of African Gold plc, the AIM-listed African gold explorer and miner, by Mwana Africa Holdings (Proprietary) Ltd in 2005.

In 2004 AngloGold Ashanti sold its entire interest in Ashanti Goldfields Zimbabwe Limited to Mwana Africa Holdings. The sole operating asset of Ashanti Goldfields was the Freda-Rebecca Gold Mine. The mine and plant complex were developed by Cluff Gold and the first gold pour took place in 1988. In 1996, the mine was acquired by Ashanti Goldfields Zimbabwe, which was itself acquired by AngloGold in 2004. Freda Rebecca achieved production of 98,000 ounces of gold in 2002, however as a result of the social and economic difficulties in Zimbabwe, output from the mine declined sharply and the mine was placed onto care and maintenance in 2007.

In Country Location

Freda Rebecca Mine (FRM) is situated near the town of Bindura, some 90km north-east of Harare. Bindura Nickel Corporation (BNC) is near the town of Bindura, 90 kilometres north-east of Harare.

Services and Products

Freda Rebecca Mine (FRM)

The FRM gold mine has suffered from the low revenue receipts in Zimbabwe's hyperinflationary environment. Following the introduction of a number of proactive economic policies in early 2009 by the new government in Zimbabwe, including the dollarization of the economy, the revision of export procedures for gold and permission to operate foreign currency accounts, Mwana Africa announced its intention to resume gold production at the Freda Rebecca Mine in March 2009.The company is implementing a two-phase programme to bring the mine back into production. A budget of approximately £4m has been allocated to bring the mines and the first phase of the plant to production.

Reserves and Resources

| Freda Rebecca Mine – Resources and Reserves as at 31 March 2009 | |||||||

|---|---|---|---|---|---|---|---|

| Classification of reserves | Tonnage (000t) | Grade (%) |

Gold (000oz) |

Classification of reserves | Tonnage (000t) | Grade (%) |

Gold (000oz) |

| Proven | Measured | ||||||

| Underground | 2,138 | 2.58 | 177 | Underground | 10,408 | 2.51 | 841 |

| Surface | 270 | 3.47 | 30 | Surface | 826 | 1.40 | 37 |

| Total | 2,408 | 2.68 | 207 | Total | 11,234 | 2.43 | 878 |

| Probable | Indicated | ||||||

| Underground | 1,744 | 2.50 | 140 | Underground | 2,106 | 2.52 | 170 |

| Surface | – | – | – | Surface | – | – | – |

| Total | 1,744 | 2.50 | 140 | Total | 2,106 | 2.52 | 170 |

| Total March 2009 | 4,153 | 2.60 | 347 | Total March 2009 | 13,340 | 2.44 | 1,048 |

| Total March 2008 | 4,153 | 2.60 | 347 | Total March 2008 | 13,340 | 2.44 | 1,048 |

Bindura Nickel Corporation (BNC)

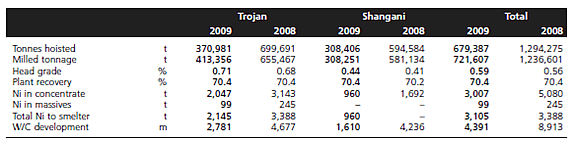

The company owns and operates the Shangani and Trojan nickel mines, which have hoisting and treatment capacity of 1.0Mt and 1.1Mt a year respectively. The

Bindura smelter and refinery complex produces high quality nickel cathodes,

copper sulphide and cobalt hydroxide. Alongside material from the Trojan and

Shangani mines, the plant has toll treated nickel concentrates and nickel matte

from third parties to utilise spare capacity. Current smelter capacity is

17,000tpa and for the refinery 14,500tpa.

The Shangani and Trojan mines and the Bindura smelter and refinery complex were placed on care and maintenance in November 2008 as a result of continued production difficulties and a sharp decline in the price of nickel. As part of the care and maintenance programme, further expenditure on capital projects has been put on hold.

Following an improvement in commodity prices and changes in Zimbabwe mining regulations, Mwana and BNC, working with BNC’s stakeholders, are developing options for a new business model at BNC that may result in a lower cost of supply from BNC’s mines while maintaining BNC’s smelting and refining capacity, and are investigating the availability of external funding for any additional investment that may be required.

Reserves and Resources

| Bindura Nickel Corporation - Resources and Reserves as at 31 March 2009 | |||

|---|---|---|---|

| Classification of Resources | Tonnage (000t) | Grade (%) | Nickel (t) |

| Measured | |||

| Trojan | 2,560 | 0.93 | 23,710 |

| Shangani | 870 | 0.42 | 3,690 |

| Hunter's Road | – | – | – |

| Total | 3,430 | 0.80 | 27,400 |

| Indicated | |||

| Trojan | 3,640 | 1.93 | 70,230 |

| Shangani | 6,030 | 0.47 | 28,130 |

| Hunter's Road | 45,060 | 0.54 | 243,230 |

| Total | 54,730 | 0.62 | 341,590 |

| Measured & Indicated | |||

| Trojan | 6,200 | 1.52 | 93,940 |

| Shangani | 6,900 | 0.46 | 31,820 |

| Hunter's Road | 45,060 | 0.54 | 243,230 |

| Total March 2009 | 58,160 | 0.63 | 368,990 |

| Total March 2008 | 16,020 | 0.88 | 141,050 |

| Inferred Resources | |||

| Trojan | 7,940 | 0.72 | 57,410 |

| Shangani | 4,850 | 0.53 | 25,540 |

| Hunter's Road | – | – | – |

| Total | 12,790 | 0.65 | 82,950 |

| Total March 2008 | 13,180 | 0.64 | 84,850 |

Hunter’s Road

The Hunters road deposit was discovered by means of a soil geochemical

anomaly and was initially explored through trenches. Currently, Mwana is

considering a development programme at the deposit.

A feasibility study for the Hunters Road project was completed in 2008. The project involves development of a probable reserve, estimated based on a nickel price of $7.50 / lb, of some 175,086 tonnes and indicated resource of 53,890 tonnes of contained nickel, and construction of a new concentrator. Production from the first phase of the project, estimated in December 2007 to cost approximately £47.8million, is expected to be approximately 2,500 tonnes of contained nickel per year, with phases two and three bringing total production to 10,000 tonnes of contained nickel per year.

Maligreen Gold Mine

The dormant Maligreen Gold Mine produced 22,500oz of gold by heap-leaching 213,000t of weathered ore from August 2000 to September 2002. Irrigation of the dumps continued to August 2004 with some minor gold recovery. An extensive drilling campaign was conducted to evaluate the deposit and the sulphide indicated resource, which is open in depth and to the north. An indicated resource of 371,000 ounces at a cut-off grade of 1 gram per tonne was defined by Cluff Mining.

Makaha Deposit

Situated 140km north-east of Harare, the deposit has oxidised mineralisation up to 50m in width. Makaha would lend itself to open-pit mining. Resource estimation was carried out in 1996, showing an indicated resource of approximately 350,000 ounces at 1.2 grams per tonne.

Number of Employees

BNC has approximately 2,800 employees

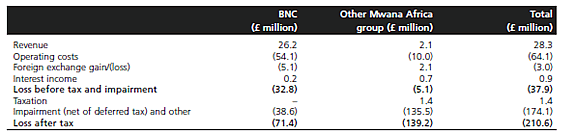

Financial Information

Company Statistics

BNC

Market Share

Shangani and Trojan nickel mines are Zimbabwe's largest nickel mines, although under care and maintenance. BNC is the only integrated nickel mine, smelter and refinery operation in Africa.

Business Objective

“Mwana Africa intends to create value by developing a broad- based portfolio of operations and exploration programmes in a range commodities and countries across the African continent, securing production and cashflow, building trusted partnerships and being the preferred vehicle for African investors and entrepreneurs”

Business Model

“Mwana Africa's strategy is based on: Pan-African reach: activities in a portfolio of countries across the African continent; Multi-commodity exposure: production and exploration assets in a range of commodities including nickel, gold, copper, cobalt, and diamonds; Development of synergies: value creation through the transfer of skills and realisation of synergies across the portfolio; Trusted partnerships: being the preferred vehicle for African investors, entrepreneurs and partners; High-quality management: led by a highly skilled and experienced management team able to secure beneficial deals, projects and returns.”

Ownership of Business

Benefits Offered and Relations with Government

In February 2009 the Central Bank relinquished its role as sales agent for gold, allowing firms for the first time to sell the metal and keep all the proceeds. Previously gold firms got 40 percent of proceeds in Zimbabwean dollars, a currency made worthless by hyper-inflation. Gold producers are also entitled to receive a price based on that prevailing on the international bullion market, thereby removing the historic surrender requirements to the RBZ. Following the February announcement Mwana Africa announced in March 2009 its intention to restart gold production at the Freda Rebecca mine.

Meanwhile Zimbabwe is currently working on a new mining law in order to comply with new World Bank standards for the extractive industries. Every mining contract that has been signed in Zimbabwe will be reviewed. A law already limits foreign ownership of businesses, including mines, to 49 percent.

In April 2009 Zimbabwe was expelled from the London Bullion Market Association (LBMA) after failing to meet the organisation's membership requirement. LBMA accreditation certifies the quality of gold sold by members who must produce a minimum of 10 tonnes per annum to maintain membership. The country's bullion production nose-dived from 10,960 kilogram’s in 2006 to 3,072kg last year - a massive 40 percent drop in two years.

In May 2009 the government ordered Mwana to pay US$15 million in retrenchment packages to at least 2,000 BNC workers that were made redundant at Shangani and Trojan. BNC appealed against the retrenchment package at the Labour Court.

Product Development

In October 2009 Mwana announced the first pour of gold following completion of Phase 1 of its refurbishment programme at the Freda Rebecca gold mine -180 ounces of gold doré were produced on 13th October 2009. Production rates from Phase 1 are forecast to increase to 30,000 ounces of gold per year by the end of 2009.

Planning for Phase 2 of the refurbishment programme, which is expected to increase output to in excess of 50,000 ounces of gold per year, is well advanced. This will involve the rehabilitation of the second milling circuit and an increase in the capacity of underground mining equipment.