Standard Bank Swaziland Limited

Standard Bank Swaziland Limited

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Standard Bank Swaziland Limited is an international bank and a member of the Standard Bank Group of South Africa, which, through its Stanbic Africa Division, owns banks in 14 other African countries apart from South Africa. It began its local operation in 1988 and has a network of 13 branches and 16 ATMs at strategic points. International ATMs at the Royal Swazi Sun hotel and the Swazi Plaza enable holders of international cards to draw cash from their home-based accounts.

The International Trade Centre, supported by Treasury, is the hub of all international activity and communications, thus concentrating expertise into one area. They offer advice on related services, including interest rates, international transfers, foreign exchange, letters of credit and documentary bills. Treasury also has access to derivative instruments and products via Stanbic's offices worldwide, and has the advantage of close links with the other banks in Africa which are under the Stanbic umbrella.

In Country Location

Standard House, Swazi Plaza, Mbabane;

Telephone: +268 40 46 587, 268 40 46 589, 268 40 46 592

Telefax: +268 40 45 899

Services and Products

The three main pillars of business are Personal and Business Banking, Corporate and Investment Banking, and Wealth. Other services include corporate advisory services and transactional services such as cash management, trade-related and custodial services, complemented by electronic banking solutions. It provide finance such as term lending, structured debt and asset finance and structured trade and commodity finance, and offer trading and risk management solutions for foreign exchange, money markets and interest rates.

The Global Transactional Products & Services team provides a range of transactional services, primarily across Africa. The Corporate and Investment Banking division maintains a specific focus on industry sectors that are most relevant to emerging markets, including targeted financial solutions for infrastructure and services including energy, power, mining, construction and telecommunications in high-growth markets.

Number of Employees

400 people

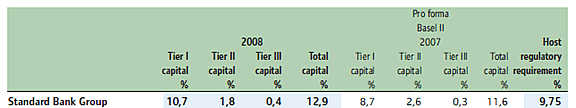

Financial Information

Market Share

Standard Bank Swaziland is the country’s largest bank by capital and assets.

Business Objective

“We aspire to be a leading emerging markets financial services organisation. We do everything in our power to ensure that we provide our customers with the products, services and solutions to suit their needs, provided that everything we do for them is based on sound business principles. We understand that we earn the right to exist by providing appropriate long-term returns to our shareholders. We try extremely hard to meet our various targets and deliver on our commitments.”

Business Model

The Group has played a central role in the development of the Southern African economy for more than 140 years. It has done this by constantly aligning its presence in the market place with the evolving needs of the region's economies, and delivering relevant banking and financial services.

The group continued to invest in technology and infrastructure mainly in its African operations as part of a strategy of confining its efforts to building robust operations in selected emerging markets. This investment has contributed to substantial cost growth. A strong capital position and healthy liquidity profile has positioned the group to take advantage of business opportunities in its chosen growth markets. The emerging markets focus insulated the group from the initial effects of the financial crisis, which originated in developed economies.

The strategic partnership of the two largest banks in Africa and China, Standard Bank and the Industrial and Commercial Bank of China (ICBC taking a 20% stake in Standard Bank), will generate significant cooperation benefits and new capacity for growth.

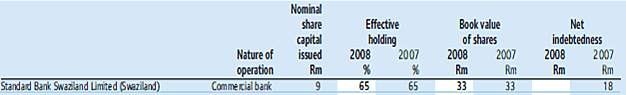

Ownership of Business

Benefits Offered and Relations with Government

The Central Bank of Swaziland, which is the bank of issue within the country's financial structure, was established as the monetary authority in April 1974 under the Monetary Authority Order of the same year. This empowers the bank to monitor, regulate and develop Swaziland's financial infrastructure. The Authority took on the function of a central bank in 1978 when the name was changed under the Monetary Authority (Amendment) Act of 1979 and additional powers were granted through amendment to the Acts in 1982 and 1986.

The bank issues the national currency, advises government, manages the country's official reserves and deals in foreign exchange markets, activities which involve both spot trading and dealings in the forward market. The commercial banks may manage limited sums of forex, reverting to the Central Bank if necessary. CBS also provides central clearing facilities for the commercial banks.

Product Development

In 2009 Standard Bank started providing free financial advisory services in Swaziland as part of a pilot project in Africa together with the Geneva-based Global Fund to Fight AIDS, Tuberculosis and Malaria. Standard Bank's partnership with Global Fund will see the bank provide financial and management expertise to Global Fund grant recipient countries. The pro bono services will ensure that funds are distributed inside the country in a timely manner as well as assisting with reporting requirements.

In 2008 Standard Bank and MTN Swaziland launched mobile banking in the Kingdom. The two companies also partnered to offer a mobile top-up service, where customers can load airtime from the ATM.