Milliom International Cellular

Milliom International Cellular

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Millicom International Cellular (also known as Tigo) is a global emerging markets mobile communications operator. It operates in Asia, Latin America and Africa. On the African continent, MIC is present in Senegal, Tanzania, Ghana, DRC, Sierra Leone, Chad and Mauritius.

In 1979 Industriförvaltnings AB Kinnevik, acquired a small mobile telephone company in Sweden which developed into Comviq GSM. Also in 1979, Millicom Incorporated (“Millicom”) was formed to pursue cellular telephone opportunities in America, and in 1982, was awarded by the US Federal Communications Commission one of three cellular development licenses. In 1982, Millicom founded, with Racal Electronics Plc, a joint venture which evolved into Vodafone Group Plc. From early 1983 Kinnevik and Millicom began applying for cellular licenses internationally.

Millicom International Cellular S.A. (“MIC”, “the Group”) was formed on December 14, 1990 when Industriförvaltnings AB Kinnevik and Millicom, contributed their respective interests in international cellular joint ventures to form the Group. MIC was incorporated under Luxembourg law on June 16, 1992.

During 1993, MIC entered into discussions with Millicom, formerly the owner of approximately 49% of MIC, regarding the acquisition of Millicom in order to obtain a NASDAQ listing and providing Millicom shareholders with direct ownership in MIC, then Millicom’s principal asset. On December 30, 1993 a resolution was placed before the shareholders of Millicom proposing an acquisitive merger with MIC. The resolution was endorsed and MIC officially began trading on NASDAQ on December 31,1993. As a consequence of the merger MIC acquired all Millicom’s interest in MIC plus MACH and Millicom’s interest in 3C (U.K.), a UK based pay telephone operation. The remaining businesses of Millicom, including its successful satellite TV operations, the broadband license for Britain and Innova Inc, a computer networking company, were contributed to a new company, American Satellite Network Inc.

In 2008 Millicom acquired Amnet Telecommunications Holding Limited, the leading provider of broadband and Cable TV Services in Central America.

TIGO was launched in Senegal on 2006, to replace the old national brand SENTEL GSM with a new international brand. It uses GSM/GPRS/EDGE over 900 MHz technologies. It has 583 cell sites in Senegal. Sentel GSM S.A. was founded in 1999. Tigo Sentel has 2.1 million subscribers in Senegal.

In Country Location

15, Route de Ngor BP :146-Dakar, Senegal;

Telephone: +(221) 33 869 74 20

Telefax: +(221) 33 820 67 88

Services and Products

Millicom provides prepaid cellular telephony services. In Senegal it provides cellular services, including prepaid, post paid, and messaging services; call holding, call waiting, voice-mail, fax, Internet, ring tones, picture messages, e-greetings, group logos, and text pictures. The company also provides SMS to email, SMS chat, games, bill and balance, information service, and national long distance services. In addition, Sentel manufactures and exports telephone terminals and cordless phones.

Tigo is the first operator in Senegal to offer GPRS (General Packet Radio Service).

Number of Employees

Total: 6,607 employees

Senegal: Not available

Financial Information

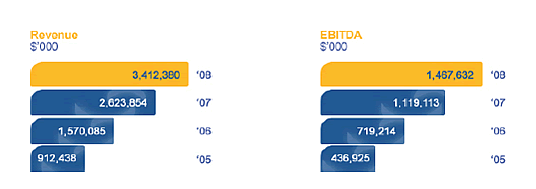

Sentel GSM represents less than 5% of MIllicom's worldwide revenues, and less than 3% of its EBITDA in 2008.

Company Statistics

Africa Revenue

| KEY PERFORMANCE INDICATORS - ANNUAL | ||||||

|---|---|---|---|---|---|---|

| AFRICA | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| Revenue (US$ '000) | 76,995 | 139,121 | 194,054 | 306,090 | 469,833 | 711,366 |

| EBITDA (US$ '000) | 33,681 | 64,811 | 86,998 | 124,638 | 154,819 | 237,580 |

Market Share

Sentel has a 33.6 percent market share.

Business Objective

“Create economic growth in the countries in which we operate and bring excellent returns for our shareholders. Our aim is to drive growth by getting ever closer to our customers through our consumer insight and by providing new, targeted “Value Added Services” (VAS), data and broadband services to meet their needs.”

Business Model

Millicom’s model is driven by heavy investment, a focus on innovation cost control and the rollout of its Triple ‘A’ strategy which is focused on making services ’Affordable’, ’Accessible’ and ’Available’ to customers in emerging markets.

“The three A’s of our strategy-Affordability, Accessibility and Availability-are vital and inter-dependent ingredients that are needed to sell mobile services successfully in emerging markets.

Affordability

Affordability does not just mean offering competitive prices but also having prepaid payment terms in low denominations so that the services are suitable for low-income customers and represent the best value for money.

Accessibility

Accessibility means providing easy access to prepaid services. We achieve this through our mass-market distribution network, which takes into account where customers live and their daily work routines.

Availability

Availability means having an extensive network with sufficient capacity so that mobile services are readily available to our customers in as many locations as possible.

Millicom is today one of the fastest growing cellular operators in emerging markets and we believe we can continue to grow more rapidly than our competitors. Our ability to take or hold market share is made possible by our inherent culture of cost control, innovation and our successful marketing oriented strategy that is specifically tailored to emerging markets and has become embodied in our Tigo brand.

The emerging markets in which we operate provide us with the continued opportunity to develop and grow our businesses as they represent a total population under mobile license of close to 300 million. Today our markets have an average mobile penetration of just above 40% and our proven ‘Triple A’ strategy, together with our ability to attract customers through our ‘aspirational’ products and services and original promotions, will continue to allow us to exploit the fast rising penetration rates in Africa and Asia in the coming years. In Latin America penetration is today above 70% in the majority of our markets which inevitably means that we need to accelerate the pace of innovation in order to continue to drive growth.

In the less developed markets in Africa and Asia we will continue to focus on increasing market share by providing affordability in predominantly voice services and also by marketing VAS to specific market segments.

Extensive network expansion was a key activity in Africa in 2008 and Millicom built over 1,000 new cell sites across the region during the year to accommodate the projected growth in the subscriber base. In 2008 Africa received 43% of Millicom’s total capex as the geographical coverage and capacity of the networks across the region were extended. The operating focus during the year was on aligning resources in order to achieve the best return on this investment and on rolling out the Distribution Management System (DMS) in the more mature markets.

Our African operations continued to focus on product innovation and competitive pricing in order to enhance further the customer’s perception of the Tigo brand as offering value for money. Millicom continues to invest heavily in marketing and promotion activities across Africa as it is important to establish a strong presence in terms of brand awareness at this early stage in mobile development when penetration rates are relatively low and in the face of increasing competition from new market entrants. Our operations met the challenge of new competition head on by introducing best in class customer loyalty promotions such as Tigo 4 Life. The second half of the year was dominated by communication initiatives to create awareness of Tigo's products, services and advantages such as Coverage, Affordability, Entertainment, Ring Back Tones, Internet, Xtreme Value, Text a Lot and Free Nights. Tigo also introduced Customer segmentation techniques in order to retain customers and reduce churn. “

Ownership of Business

SENTEL is a subsidiary of Millicom International Cellular (MIC). On March 14.2006, Millicom purchased for a total consideration of $35 million the remaining 25% ownership interest in Sentel GSM, its operation in Senegal in which Millicom now has 100% ownership.

Benefits Offered and Relations with Government

In Senegal, the government continues to challenge the validity of Millicom’s operating licence and this is currently being disputed at the International Centre for the Settlement of Investment Disputes. The government published on November 12.2008 a decree dated as of 2001 that purports to revoke Sentel’s license.

Sentel’s twenty year license was granted in 1998 by a prior administration, before the enactment in 2002 of Senegal Telecommunications Act. Although the current Senegalese government has, since 2002, acknowledged the validity of Sentel license, it has also requested that Sentel renegotiate the terms of the license. Sentel has indicated its willingness to negotiate only certain enhancements to the license and data services and the extension of the duration of the license.

On November 11.2008 Millicom International Operations B.V. (MIO B.V.), a wholly-owned Millicom subsidiary and Sentel instituted arbitration proceedings with the International Center for the Settlement of Investment Disputes (ICSID) against the Republic of Senegal under provisions of Sentel license and international law. MIO B.V. and Sentel seek compensation for the purported expropriation of the Senegal license and monetary damages for breach of the license.

On the same day, the Republic of Senegal instituted court proceedings in Senegal against Millicom and Sentel and has sought court approval for the revocation of Sentel's license and sought damages against Sentel and Millicom. Millicom believes that the action filed by the Republic of Senegal is baseless and also ignores the agreement between Sentel and the Republic of Senegal to submit any dispute concerning the license to an international arbitration forum.

In early 2009 the Senegal regulator (ARTP) classified Sentel GSM, as the dominant operator in the mobile call termination market in 2009 despite the fact that Sonatel holds 77% of mobile call termination traffic in comparison to Sentel’s 23%. Sonatel has approximately 66 percent market share against Sentel’s 33.6 percent.

The case is ongoing.

Product Development

Sentel is running several promotions including a wrestling promotion whereby with each US$2 refill, subscribers were entered into a draw to win tickets for a promotional wrestling event. This promotion converted a projected churn in subscriber numbers into an almost equal number of gross additions.

DMS was implemented in Senegal in 2008 and two mega dealers were selected to cover almost 80% of the market. Every single shop is visited regularly to ensure inventory levels and point of sales material remain stocked up and brand visibility is consistently high.

Millicom also runs health promotions in Senegal-for example, a caravan called “Triple Sensibilization” commutes between the most remote regions, going through all the big cities educating the local people and making direct donations.