Mineral Deposets Limited (MDL)

Mineral Deposets Limited (MDL)

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

MDL is a public company listed on the Australian Securities Exchange and Toronto Stock Exchange focusing on gold and mineral sands. Its tenements are situated mainly in Senegal. MDL’s key projects are the Sabodala Gold Project and the Grande Côte Mineral Sands Project in Senegal. In FY08, MDL and the Government of the Republic of Senegal (GRS) established two Senegalese operating companies, Grande Côte Operations SA and Sabodala Gold Operations SA, to complete construction of the two projects.

MDL has a history that can be traced back to the Mineral Deposits Syndicate which commenced operations in Southport, Queensland during 1940. Nimbus Resources NL (now MDL) was listed on the ASX in April 1997.

In 2004, the Government of Senegal announced the Sabodala area was available for Tender. Encouraged by the new Senegal Mining Code of 24 November 2003 and MDLs established interests in Senegal with the Grande Cote Zircon Project, it was decided to submit a competitive bid. The company was awarded the Sabodala Gold Project (SGP) as an Exploitation Licence comprising 20.3 square kilometres by open tender on 25 October 2004. The Mining Convention was signed on 23 March 2005 and exploration drilling commenced on the deposit on 29 June 2005. MDL is also engaged in an active regional gold exploration program with seven joint venture Exploration Permit areas located within 10-50km of the Sabodala mining operation. The objective is to discover additional resources for the Sabodala mill.

Since the commencement of drilling in July 2005, the team in Senegal has managed to develop Sabodala in just over three years. With mining having commenced in June 2008 involving initial pre-stripping followed by ore stockpiling, a substantial “run of mine” stockpile (“ROM pad”) of over 1.0Mt had been established by March 2009 in readiness for the plant commissioning. The Sabodala plant commissioned with the first gold bars being produced in mid-March 2009.

The existing port facilities at Dakar are used for unloading of all project construction freight and for long term operations freight. Road access to the project site from the regional centre of Tambacunda is via a good regional all-weather sealed road 230 kilometres south east to Kedougou, then 96 kilometres of lessor sealed and laterite-surfaced roads. These roads are used for the delivery of supplies to the project during construction and long term operations. There is a 1,250 metre sealed airstrip at Sabodala capable of handling light to medium sized aircraft.

In Country Location

The SGP is located in Senegal, some 650 kilometres east of the capital Dakar within the West African Birimian gold province and about 90 kilometres from major gold discoveries in Mali including Sadiola (13.5 million ounces).

Head Office: Rue 26, N’Gor, Dakar, Senegal;

Telephone: +221 338 693 181

Telefax: +221 338 603 683

Services and Products

The company is involved in the exploration and exploitation of gold and mineral sands. The principal activities of the company continue to be focused on its two major projects in Senegal.

Number of Employees

During the construction period through March 2009, some 1,400 people were employed, with the great majority being Senegalese. When in full production in 2009, there will be about 600 people employed on site.

In addition, there is significant activity undertaken by specialist staff under contract in the areas of drilling and final plant design. In total about 200 people are involved under such contracts, 30 of who are working in Senegal for extended periods of time.

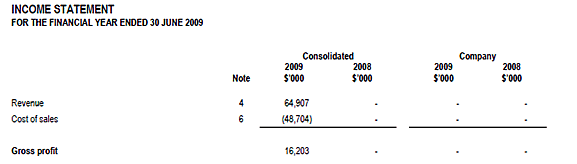

Financial Information

The first gold pour took place in March 2009 and by 30 June 2009; 62,477 ounces of gold had been produced. In August 2009 the third tonne of gold, or 96,450 ounces, was produced.

Company Statistics

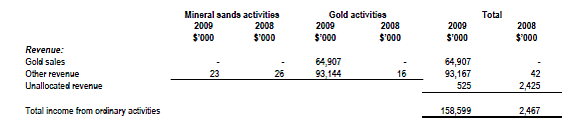

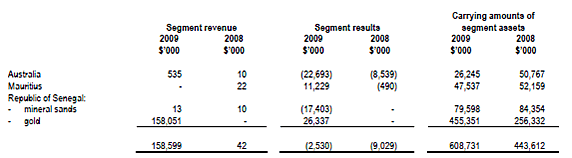

Segment Reporting

The affairs of the company can be separated into mineral sands and gold activities respectively. Mineral sands activities incorporate exploration activities in Senegal in relation to the GCZP. Gold activities incorporate the company’s exploration, development and production activities in Senegal at Sabodala and regional exploration work in the Sabodala area.

Primary Reporting- Business Segments

Secondary Reporting – Geographical Segments

Market Share

In Senegal, the gold mining sector was formerly an economically and politically marginalized area. Sabodala is Senegal’s first modern gold mine. The project has proven-probable reserves of 24.4 million tonnes grading 2.07 grams/tonne and measured-to-indicated resources of 42.7 Mt @ 1.37 g/t gold. If fully converted to reserves this represents more than 3.4 Moz of gold.

The November 2008, proven plus probable ore reserve for the project totalled 24.3 million tonnes, grading 2.1g/t gold for 1.63 million ounces of contained gold.

Canada’s Oromin Explorations Ltd has been awarded an exploration licence for a surrounding area of 230km2. To date, resources are valued to 1.4Moz. Randgold Resources has discovered an important gold potential of some 3Moz at Massawa.

Business Objective

“To build a growing mid-tier mining house”

Business Model

“MDL's strategy is to build a leading diversified mining company and further grow by identifying additional opportunities utilising the Groups exploration and development experience.

We use our wide-ranging industry relationships to identify and employ the best available exploration, technical and management personnel and consultants. The Sabodala project, with a projected 10 year mine life and an average of 150,000 ounces of annual gold production, provides an excellent base for MDL to build a growing mid-tier mining house.

Over the remainder of the current and coming year, the company intends to investigate various opportunities to expand the footprint of its Sabodala operation. The processing plant and associated infrastructure will establish a commanding presence in the region from which to build a substantial gold business. The near term strategy includes: optimize current mine plan - 10 yrs to 6 yrs; and optimize mill throughput to 3mtpa.

Ownership of Business

Sabodala Gold Project-90% owned through Sabodala Gold Operations SA (“SGO”), 10% Government of the Republic of Senegal.

MDL, through its 100% subsidiary Sabodala Mining Company SARL, also has four joint ventures: Bransan Area (MDL 70%); Dembala Berola Area (MDL earning 80%); Heremakono, Sounkounkou and Sabodala NW (MDL earning 80%); and Makana Joint Venture (MDL 80%).

MDL’s largest 10 shareholders (percent): HSBC Custody Nominees (Australia) Limited (19.25); National Nominees Limited (14.35); ANZ Nominees Limited (13.09); Canadian Register Control (12.73); J P Morgan Nominees Australia Limited (7.68); Actis Capital LLP (3.28); Citicorp Nominees Pty Limited (2.63); Citicorp Nominees Pty Limited (1.91); Actis Capital LLP (1.67); Macquarie Bank Limited (0.69)

Benefits Offered and Relations with Government

Sabodala has been made possible by excellent relationships between the Senegalese Government, the Macquarie Banking resources unit and the resident MDL team. The Inauguration of the SGP on 3 June 2009 was undertaken by the President of Senegal, Abdoulaye Wade. On 24 January 2007, MDL and the government executed the supplementary deed to the existing Mining Convention for the development of the Sabodala Gold Project. The supplementary deed included the following key terms: Ten year mine lease, renewable; MDL will establish an exploitation company in which the GRS will hold an immediate 10 percent non-contributory interest; Capital recovery ahead of governments 10 percent interest; Eight year exoneration from taxation including Value Added Tax and Company Tax; No import duties. On 30 April 2007, the Presidential Decree for the Sabodala Gold Project was signed by Wade. The Notification Letter in regard to this was signed by the Minister of Industry and Mines, Madicke Niang, on 2 May 2007.

The government is generally pro mining and passed a new Mining Code in November 2003. Under the law, appropriate governmental authorisation is required to undertake any form of mining activity. In this regard, the right to explore for minerals is conferred only by a permit of exploration and the right to exploit minerals/ore is conferred only by a permit of exploitation or a mining concession.

An exploration permit for mineral exploration activities is granted for a period not exceeding three years, renewable. During the exploration phase, the permit holder is exempt from the sales tax and duties on imported equipment and supplies necessary for exploration activities, as well as on fuel used for operation of fixed installations.

Following exploration success, the permit holder may enter into a new contract agreement with the State; which will regulate the relationship between the two parties during the mining phase. Under the Senegalese Mining Code, numerous fiscal incentives are offered including a minimum seven year exemption from company tax for holders of a Concession Miniere, amongst other tax exemptions and the opportunity to secure a lease of up to 25 years for a major project. All mining activities are subject to a royalty of 3% payable to the Government of the value of the mine site.

During the construction and commissioning period, the permit holder also benefits from a special tax regime aimed at promoting the development of the mining sector in the country. A mining company, which operates autonomously in its activities, is allowed to expatriate its profits.

Product Development

Work over the 18 months to 30 June 2009 was focused within the Sabodala pit area. However, with the mine operating before year-end, attention returned to the numerous other prospects on the mine lease. Exploration within the Mining Concession during the closing months of 2008/09 comprised detailed geological and structural mapping and rock chip sampling. Some 13 target areas were identified, four of which were sufficiently advanced to warrant drilling which was in the planning stage at year-end. These are: Masato Extension-the southern strike extension of the Masato Trend; Faloumbo-detailed rock chip sampling returned high values for a northeast trending cross structure; Niakafiri East-the target was extensively rock chip sampled with peak values ranging from 1.1 to 3.4g/t gold; and Soukhoto-geological mapping defined a series of east-west trending quartz veins where outcrop, dump and spoil sampling from artisanal workings provided assays up to 29.88g/t gold.

Planned production is over a 10-year mine life. Average production from a 210 metres deep open pit is forecast at an initial 200,000 ounces per annum. Opportunities for growth include strike and depth extensions of the existing zones of mineralisation, exploration targets identified but not yet tested, and by the discovery of additional resources in the surrounding Mako Volcanic Belt.