Paladin Energy Ltd.

Paladin Energy Ltd.

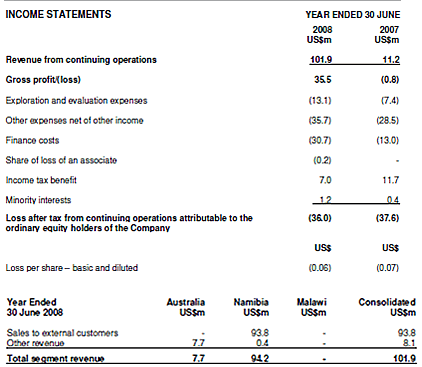

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Paladin Energy Ltd is listed on the Australian Securities Exchange, the Toronto Stock Exchange and the Namibian Stock Exchange under the symbol “PDN”. Paladin is a uranium production company with projects currently in Australia and two operating mines in Africa.

Paladin Energy Ltd., formerly Paladin Resources Limited is Australia's second biggest sole uranium mining company behind Energy Resources of Australia, which is majority owned by mining giant Rio Tinto. It is headquartered in Perth, Australia.

The main focus of Paladin is the identification and development of uranium deposits in Australia and overseas. Paladin has control of two of the most advanced uranium Deposits in Africa. Its Langer Heinrich mine started producing yellowcake in late 2006 and its Kayelekera mine in Malawi is currently in ramp up.

Paladin's history can be traced back to 1970 when Uranerz (Germany) set up operations. The company was interested in uranium, gold, base metals copper, platinum, and diamonds. Uranerz eventually lost interest in its Australian operations and when they packed up John Borshoff acquired their significant database. He then formed Paladin in 1993 and he listed the company on the Australian Stock Exchange.

The Langer Heinrich deposit in Namibia was discovered in 1973 after a government-sponsored airborne radiometric survey of the area. Between 1974 and 1980, General Mining Union Corporation Limited (Gencor) undertook extensive evaluation work at the site and suspended work on the project in the mid-1980s, following a fall in the prevailing uranium price. Acclaim Uranium NL acquired the project from Gencor in 1998 and completed a pre-feasibility study in 1999-2000. The project was again put on hold due to prevailing uranium prices.

In August 2002, the Company acquired Langer Heinrich Uranium (Pty) Ltd and its assets from Aztec Resources Ltd (formerly Acclaim Uranium NL). The purchase consideration was A$15,000 and a production royalty of 12 Australian cents per kilogram of yellowcake produced and sold.

In Country Location

Erf 3981 B, Extension 10, New Industrial Area, Swakopmund, Namibia;

Telephone: +264 64 413 450

Telefax: +264 64 413 451

The Langer Heinrich Project is located in the Namib Desert, 80km east of the major seaport of Walvis Bay and about 40km south-east of the large-scale, hard-rock Rössing uranium mine (Rössing Project) operated by the Rio Tinto Group.

Services and Products

The Company operates in the minerals resources industry focused on the development and operation of uranium projects in Africa and Australia, as well as pursuing evaluation and acquisition opportunities throughout the world.

Number of Employees

The Langer Heinrich workforce includes 198 employees, plus a further 200 personnel working for mining and security contractors. Fewer than five per cent are non-Namibian.

Financial Information

Langer Heinrich quarterly production sustained above nameplate at 693,116lb and marginally up on the March 2009 quarter; recoveries achieved for the June 2009 quarter were significantly higher than the March quarter (74.5%) averaging more than 82%; sales during the quarter of 445,000lb at an average price of US$51.27/lb U3O8 for a total revenue of US$22.8M.

Langer Heinrich quarterly production sustained above nameplate at 693,116lb and marginally up on the March 2009 quarter; recoveries achieved for the June 2009 quarter were significantly higher than the March quarter (74.5%) averaging more than 82%; sales during the quarter of 445,000lb at an average price of US$51.27/lb U3O8 for a total revenue of US$22.8M.

Market Share

Namibia's identified uranium resources are about 5% of the world's known total. Those recoverable at up to $130/kg are about 275,000 tonnes U. The Reasonably Assured Resources portion of this is 176,000 tU, accessible by open pit mining.

Production for the 12 months ending June 2009 amounted to 2,702,972lb. Crushed tonnes for the quarter amounted to 385,704t with an average mine grade of 933ppm U3O8. Langer Heinrich surpassed project life production of 4,000,000lb in early May 2009.

Langer Heinrich’s stage 3 is planned to take production to 2000 tU/yr from 2010. Reserves are 25,000 tU at 0.025% cut-off (JORC and NI 43-101 compliant) plus 1500 tU in stockpiles. Inferred resources are 32,200 tU, and it is expected that much of this will be upgraded with infill drilling. A further 12,000 tU will end up in low-grade stockpiles at the end of mining, and may be recovered then.

Rossing Uranium Ltd in 2008 produced 3,449 tU (2006: 3,067 tU, 2007: 2,582 tU), making it the third largest uranium mine in the world.

Rossing uranium resources

| End 2008 | Reserves | Resources | |||

|---|---|---|---|---|---|

| proven | probable | measured | indicated | inferred | |

| Contained: | 11,970 tU | 53,070 tU | 1,900 tU | 19,500 tU | 3,000 tU |

| Ore grade: | 0.035% U | 0.034% U | 0.022% U | 0.021% U | 0.023% U |

Other Uranium Resources

| deposit type | Known Resources | ||

|---|---|---|---|

| Measured & indicated | Inferred | ||

| Langer Heinrich | palaeochannel | 32,800 tU in 0.06% ore | 32,200 tU in 0.06% ore |

| Trekkopje | palaeochannel | 45,500 tU in 0.011% ore | 3,000 tU in 0.01% ore |

| Rossing South | hard rock | 9,250 tU in 0.038% ore | 93,660 tU in 0.0415% ore |

| Valencia | hard rock | 27,000 tU in 0.013% ore | 4,200 tU in 0.012% ore |

| Etango | hard rock | 41,500 tU in 0.021% ore | 20,000 tU in 0.0197% ore |

| Marenica | palaeochannel | 13,000 tU | |

| Tubas | palaeochannel | 15,000 tU in 0.019% ore | |

Business Objective

“Achieving across the spectrum with a clear and enduring commitment to become a major global uranium supplier”

Business Model

The Company has a strong commitment to both organic and inorganic growth in a sustainable fashion. The Company is committed to its strategy of progressive development of its uranium resources, complemented by strategic M&A activity, supported by opportunities arising from its new marketing entity, Paladin Nuclear, to establish a global footprint underpinned by significant uranium production to meet the growing demand for nuclear fuel. Paladin continues to evaluate uranium opportunities as part of its stated strategic objective to achieve an appropriate global production footprint. The Company is considering both specific advanced project opportunities and corporate acquisitions where good assets with clear production potential are identified that show value accretion potential.

Since 1998, during a period of sustained downturn in global uranium markets, Paladin accumulated a quality portfolio of advanced uranium projects each having production potential.

Ownership of Business

Deep Yellow Ltd (Dyl-Paladin Energy Ltd 15.3%) is a dedicated uranium exploration company listed on the Australian Securities Exchange and the Namibian Stock Exchange with exploration holdings in Namibia and Australia.

Langer Heinrich Uranium (Pty) Ltd is a member of the Paladin Energy Ltd group of companies and is the corporate entity that holds the group's 100% interest in the Langer Heinrich Uranium Mine. Through its wholly owned Namibian subsidiary, Reptile Uranium Namibia (Pty) Ltd, DYL is actively exploring for uranium on its four 100% owned Exclusive Prospecting Licences covering 2,872km2 in the Namib Naukluft Desert Park inland from Walvis Bay and south and west of Paladin’s Langer Heinrich Uranium Mine.

The Langer Heinrich Uranium Project (LHUP) consists of one mining licence-ML 140-covering 4,375 hectares in the Namib Naukluft Desert Rights conferred by the licence include the right to mine and sell base and rare metals and nuclear fuel groups of minerals and to carry out prospecting operations. Langer Heinrich Uranium (Pty) Ltd also holds an exclusive prospecting licence, EPL 3500 covering 30 sq. km. to the west of the mining licence.

Benefits Offered and Relations with Government

There is strong government support for expanding uranium mining and the government has committed to a policy position of supplying its own electricity from nuclear power by about 2018. Namibia is party to the Nuclear Non-Proliferation Treaty and has had a comprehensive safeguards agreement in force since 1998 and in 2000 signed the Additional Protocol.

Namibia's Mineral Act of 1992 and its Mineral Policy of 2003, is silent on the uranium and nuclear sectors. Government is, however, in the process of revising its legislative framework to deal specifically with uranium mining.

Mining in Namibia is subject to higher corporate income taxes than other sectors: 55% on diamond mining and 37.5% on other minerals. In spite of the higher basic income tax rate, mining companies in Namibia receive many tax benefits, some of which are unavailable to miners in other countries. These benefits include: 1) expensing of prospecting/exploration costs in the first year of production; 2) three-year accelerated write-off of development costs, with unlimited carry-forward (this applies to other sectors as well); 3) no ring-fencing. A 2% royalty is levied on industrial minerals and nuclear mineral fuels.

Paladin rewards employee performance and aligns the interests of its employees with those of its shareholders by offering participation in a share incentive scheme. In February 2008, the Company extended this scheme to include permanent employees of Langer Heinrich Uranium (Pty) Ltd in what is believed to be a first initiative for the Namibian mining industry.

Langer Heinrich supports certain initiatives that have long-term benefits to Namibia, specifically aimed towards education and skills development. In addition Langer Heinrich is working closely with a local artisan training facility whereby students are provided with practical training at the mine site, and senior artisans are made available to the college as lecturers whilst at the same time the usual lecturers spend time working on the mine site to expose them to the latest technology and practices.

Langer Heinrich Uranium Pty Ltd has entered into a contract with NamPower for the right to access power at the Langer Heinrich mine. In order to obtain this right, the power line connection to the mine was funded by Langer Heinrich, however, ownership of the power line rests with NamPower. The amount funded is being amortised over the life of mine on a straight–line basis.

Langer Heinrich Uranium Pty Ltd has entered into a contract with NamWater for the right to access water at the Langer Heinrich mine. In order to obtain this right, the water pipeline connection to the mine was funded by Langer Heinrich; however, ownership of the pipeline rests with NamWater. The amount funded is being amortised over the life of mine on a straight-line basis.

Product Development

Planning has commenced on a further expansion (Stage III), which is intended to increase production to 6.0Mlb U3O8 per year. In June 2009 Paladin announced that it has concluded a Feasibility Study on expansion options for Langer Heinrich. The Board has given its approval to proceed with the Stage III expansion on the following basis: nominal production to increase to 5.2Mlb pa U3O8 with a target completion date of September 2010; minimised capital cost now estimated at US$71M with no significant additional infrastructure required; adoption of new expansion concept has achieved 87% of the originally stated production utilising only 41% of the original CAPEX that was planned; payback 15 months based on current U3O8 term pricing; and mine life maintainable at approximately 20 years with further infill drilling.

The Stage II expansion currently being finalised has already made provision for expansion to the pre-leach thickening, precipitation, product drying and reagent dosing facilities.

During April 2009, Langer Heinrich Uranium (Pty) Ltd (LHU) obtained certification for its Environmental Management System (EMS) according to the Internal Standard ISO 14001:2004.