Banco Comercial Portugues (BCP)

Banco Comercial Portugues (BCP)

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

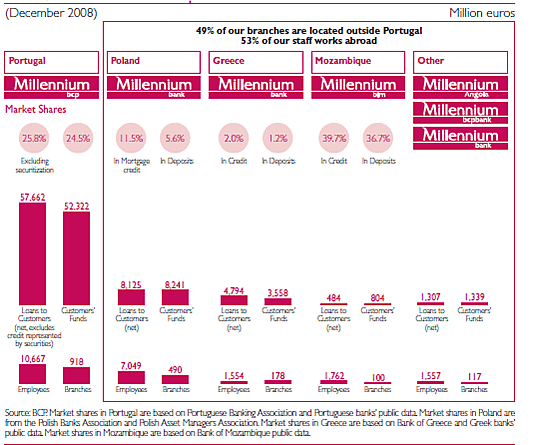

Banco Comercial Portugues SA (Millennium BCP) is a Portugal-based, privately owned bank. It has the country’s largest banking distribution network, with 918 branches. The Company operates under the Millennium brand and has numerous subsidiaries in Portugal, as well as overseas. As of 31December 2008, the company operated 885 branches in Poland, Greece, Romania, Switzerland, Turkey, Mozambique, Angola, and the United States. BCP is a member of the Euronext 100 stock index and has nearly 4,3 million customers throughout the world.

BCP was founded in 1985 by Jardim Gonçalves and a group of investors from the Porto region. One particularly notable member of the founding team was Americo Ferreira de Amorim. Amorim was one of Portugal's wealthiest and most important businesspeople at the time. Amorim owned and ran Corticeira Amorim, which controlled 35 percent of the world's cork market. He also owned and ran multiple other companies in financial services, real estate, and tourism through his investment company, Amorim Investimentos e Particpacoes.

When BCP was founded, Goncalves introduced a banking technique that became BCP's

hallmark: the segmentation of banking services by customer profile. The bank separated its core group of services into six branded segments: individual retail banking, commercial retail banking, private banking, the mass-market branch network, small banking, and telephone banking.

Since 2004, BCP operates a branch brand restyled as Millennium BCP, following a process of amalgamating all the brand names and complete incorporation of all commercial structures of the group's retail banking: Nova Rede (the bank's brand for his own network of retail banking branches since 1989); Crédibanco (network of branches created by the BCP itself in 1993); Banco Português do Atlântico (acquired in 1995 and incorporated in 2000); Banco Mello (acquired in 2000 and incorporated in 2000); and Banco Pinto e Sotto Mayor (acquired in 2000).

The Group is represented in Mozambique by Millennium International Bank of Mozambique (BIM, with 100 branches and 555 000 customers. The Millennium BIM stems from an agreement for a strategic partnership between BCP and the Mozambican State in 1995. BCP became the major shareholder in Millennium BIM in 2000 following the merger of BIM and Banco Comercial de Moçambique (BCM).

In Country Location

1800 Av 25 Setembro, Maputo, Mozambique,

Telephone: +258 21 35 15 00, 258 21 42 71 75

Services and Products

The company provides a range of banking products and services, including current accounts, payment means, savings products, investment products, mortgage loans, consumer credit, commercial banking, leasing, factoring, insurance, private banking, and asset management. It also offers strategic and financial advisory services; specialized financial services, such as project finance, corporate finance, securities brokerage, and equity research services; and in structuring risk hedging derivatives products and services. Further, the company provides Internet and telephone banking services.

Number of Employees

1,762 employees

Financial Information

BCP Statistics

|

Currency In Millions Of Euros |

As Of: |

Jan 02 2006 Restated |

Jan 02 2007 Restated |

Jan 02 2008 Restated |

Jan 02 2009 Restated |

4-Year Trend |

|---|---|---|---|---|---|---|

| Revenues | 1,550.5 | 1,411.4 | 1,177.6 | 859.7 | ||

| Other Revenues | -113.5 | -119.9 | -260.2 | -544.7 | ||

| Total Revenues | 2,903.4 | 2,754.8 | 2,482.5 | 2,072.8 | ||

| Gross Profit | 2,903.4 | 2,754.8 | 2,482.5 | 2,072.8 | ||

| Selling General & Admin Expenses, Total | 1,908.2 | 1,725.5 | 1,748.6 | 1,670.8 | ||

| Other Operating Expenses | 37.5 | 16.0 | -- | -- | ||

| Other Operating Expenses, Total | 1,945.8 | 1,741.4 | 1,748.6 | 1,670.8 | ||

| Operating Income | 957.7 | 1,013.3 | 734.0 | 402.0 | ||

| Ebt, Excluding Unusual Items | 957.7 | 1,013.3 | 734.0 | 402.0 | ||

| Other Unusual Items, Total | -19.7 | -19.4 | -45.8 | -60.0 | ||

| Ebt, Including Unusual Items | 937.9 | 993.9 | 688.2 | 342.0 | ||

| Income Tax Expense | 97.4 | 154.8 | 69.6 | 84.0 | ||

| Minority Interest In Earnings | -87.0 | -52.0 | -55.4 | -56.8 | ||

| Earnings From Continuing Operations | 753.5 | 787.1 | 563.3 | 201.2 | ||

| Net Income | 753.5 | 787.1 | 563.3 | 201.2 | ||

| Net Income To Common Including Extra Items | 721.1 | 787.1 | 514.4 | 152.3 | ||

| Net Income To Common Excluding Extra Items | 721.1 | 787.1 | 514.4 | 152.3 | ||

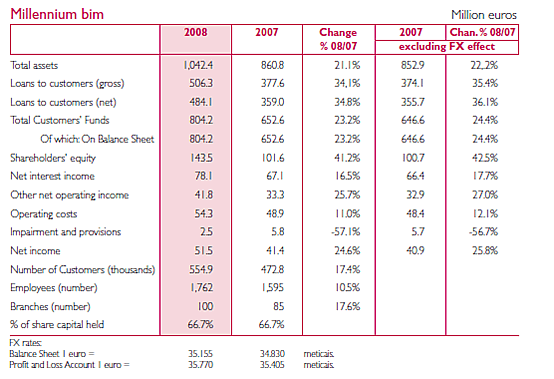

Millennium bim (Mozambique): Statistics

Consolidated net income at the end of 2008 amounted to 1,842.8 million meticals, or about 51.5 million euros, an increase of 25.8 percent (24.6 percent in euros) over the 2007 figures; total assets amounted to 36,645.2 meticals (about 1,042.4 million euros), a growth of 22.2 percent (21.1 percent in euros) compared to 2007; loans to customers rose significantly, up 36.1 percent (34.8 percent in euros), to stand at 17,017.4 million meticals (about 484.1 million euros); and customers’ funds increased 24.4% (23.2% in euros) over the 2007 figure to stand at 28,270.8 million meticals (about 804.2 million euros).

Market Share

Millennium BIM is Mozambique’s largest bank. It controls 48 percent of the loan market, 52 percent of the deposit market, and 67 percent of all other banking.

Millennium BIM is Mozambique’s largest bank. It controls 48 percent of the loan market, 52 percent of the deposit market, and 67 percent of all other banking.

Business Objective

“Millennium bcp aspires to be a reference bank in Customer Service, on the basis of innovative distribution platforms. Its growth will be focused on Retail, in which over two-thirds of the capital should be allocated to retail and companies, in markets of high potential, with an expected annual growth of business volumes of more than 10%. It also aims for superior efficiency levels, reflected in the commitment to achieve a benchmark cost-to-income ratio, and reinforced capital and cost management discipline”

Business Model

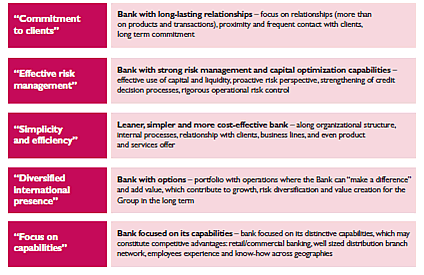

According to the bank, the “new priorities” of Millennium BCP for 2009 are based on three fundamental pillars: Soundness and Trust; Commitment and Performance; Sustainability and Value, defining six priority action vectors that aim to "Reinforce the Commitment, Towards the Future". The six action vectors integrated in the Programme "Rumo ao Futuro" consider a set of initiatives that are summarised as follows:

- Proactive and rigorous risk management;

Integrated and prudent liquidity and capital management; - Deepen the commitment to customers and maximization of balance sheet customers' funds and value;

- Acceleration of cost reduction and organisational streamlining;

- Adjustment of business models and materialization of growth opportunities; and talent management and employees' mobilization.”

In line with priorities for 2009, the key principles of the Bank’s strategy over the long term emerged:

Five key principles for a new Program “Towards the Future”

Ownership of Business

Millennium BIM

| 66.69% | BCP Internacional II, Sociedade Unipessoal, SGPS |

| 17.76% | Estado Moçambicano |

| 4.95% | INSS - Instituto Nacional de Segurança Social |

| 4.15% | EMOSE - Empresa Moçambicana de Seguros, SARL |

| 1.08% | FDC - Fundação para o Desenvolvimento da Comunidade |

| 5.37% | Gestores, Técnicos e Trabalhadores |

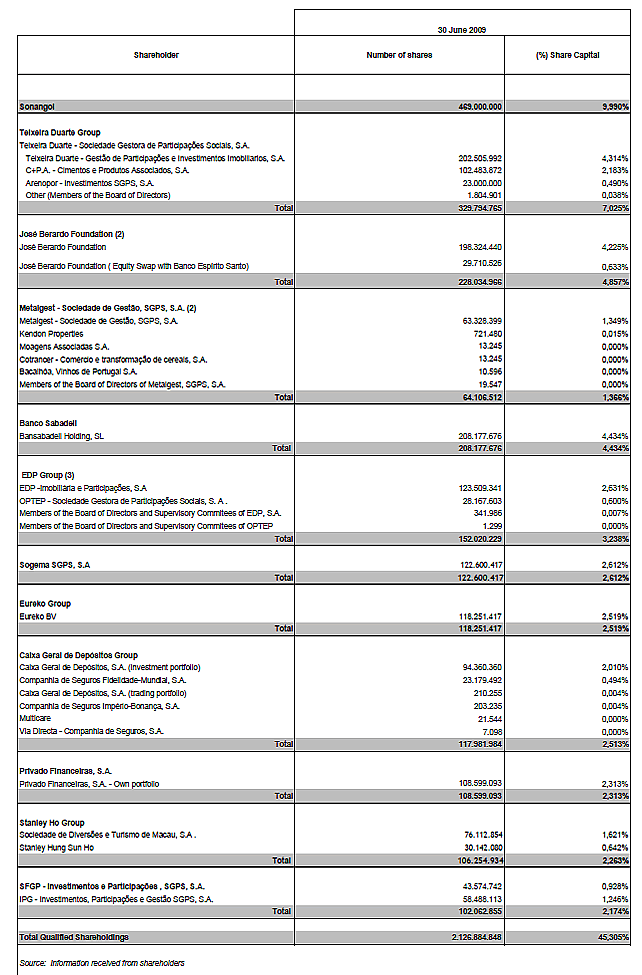

BCP

(1) According number 10 a) of Article 16 of Banco Comercial Português Articles of Association, votes exceeding 10% of the share capital are not considered

(2) The shares and voting rights held by Fundação José Berardo and Metalgest are subject to reciprocal imputation

(3) EDP Pension Fund held 52.285.541 BCP shares corresponding to 1, 11% of the Bank's share capital and 1, 12% of the voting rights.

Benefits Offered and Relations with Government

Privatization in the 1990s reduced the Government's role to that of a minority stake-holder in the banking sector. Banking and micro-finance activities are subject to the banking law. Several major changes were made to the law in 2004 concerning credit institutions and financial services, and micro-finance banks and in 2007 concerning the bankruptcy of credit institutions and a law on the national payments system.

Under the new regime, these regulations are administered by the Bank of Mozambique; previously, the Ministry in charge of finance had responsibility for managing the development of branches of credit institutions and financial services. The Bank of Mozambique also exercises supervisory activities, and these have been strengthened through capacity-building. Since 2008, the Bank of Mozambique uses the framework of Capital Adequacy, Asset Quality, Management, Earnings and Liquidity (CAMEL) to determine the soundness of banks and guide its supervisory activity. As from 1 January 2008, Bank of Mozambique has required the credit institutions to observe the norms of the International Financial Reporting Standards (IFRS) in order to increase transparency to international levels. The new law provides for a fund to be established to guarantee deposits.

Mozambican specific service commitments under the General Agreement on Trade in Services (GATS) concern only banking and other financial services (excluding insurance), in all four modes of supply. Foreign financial service providers (including insurance) can operate in Mozambique as long as they abide by the domestic rules and regulations governing investment and operations of such institutions.

Although Mozambique does not have specific legislation to regulate informal banking networks, Act no. 15/99 of 1 November 1999 governs the activities of institutions that provide credit and financial services. The exercise of bank activities in Mozambique is subject to the principle of exclusivity, under the terms of which only duly licensed/authorised entities can carry out bank and financial operations. Articles 98 and 99 of this Act qualify as a crime subject to a penalty of imprisonment by confinement for the illegal and undue exercise of activities reserved for credit institutions and financial societies.

Product Development

In 2008 BCP continued its plan of expansion of the Retail branch network in Mozambique, begun in 2007, having achieved the historic mark of 100 branches and over half a million customers. At commercial level, business segmentation was deepened and alternative access channels were promoted, involving the increase and replacement of ATMs and point-of-sales (POSs). Since Retail banking is Millennium bim’s dominant business area, the expansion of the branch network and of the number of ATMs, allied to greater dynamism in consumer credit (CNV) were the main strategic initiatives implemented to meet the goals of providing a wider range of products and services, preserving profitability and maintaining market share. Fifteen new branches were opened in 2008 and new ATM’s and POSs were installed, making a total of 100 branches, 240 ATMs and about 2 300 POSs in operation at the end of the year. Initiatives were also implemented to improve service quality: 16 branches were renewed, their image and comfort brought into line with the newer branches, providing an area for 24-hour access to the alternative electronic banking services.

During 2008 the greatest distinctions ever awarded to a bank headquartered in Mozambique were achieved, with Euromoney magazine awarding it with the “Best Mozambican Bank” prize; The Banker awarded the Bank with the “Bank of the Year in Mozambique” prize; and IC Publisher of African Banker Magazine named the Bank as “one of Africa’s seven best banks” at the Annual Forum of the World Bank and of the IMF in Washington.