BHP Billiton

BHP Billiton

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

BHP Billiton is the world's largest diversified natural resources company. It was created in 2001 by the merger of Australia's Broken Hill Proprietary Company (BHP) and the UK's Billiton. BHP Billiton Limited, which is the majority partner in the dual-listed structure, is listed on the Australian Securities Exchange. BHP Billiton Plc is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index.

BHP was incorporated in 1885, operating the silver and lead mine at Broken Hill in western New South Wales. In 1915, the company ventured into steel manufacturing, with its operations based primarily in Newcastle, New South Wales. The company began petroleum exploration in the 1960s with discoveries in Bass Strait, an activity which became an increasing focus. The inefficiencies of what was, by global standards, a small steel operation in Newcastle finally caught up with the company and the Newcastle operations were closed in 1999.

Billiton was a mining company whose origins dates back to 1860 when the company acquired the mineral rights to the tin-rich islands of Banka (Bangka) and Billiton (Belitung) in the Indonesian archipelago, off the eastern coast of Sumatra. Billiton's initial business forays included tin and lead smelting in The Netherlands, followed in the 1940s by bauxite mining in Indonesia and Suriname. In 1970, Royal Dutch/Shell acquired Billiton and accelerated the scope of progress of this growth. The tin and lead smelter in Arnhem, Netherlands was shut down in the 1990s. In 1994 Gencor acquired the mining division of Billiton excluding the downstream metal division. Billiton was divested from Gencor in 1997. In 1997, Billiton Plc became a constituent of the FTSE 100 Index.

Throughout the 1990s and beyond, Billiton Plc experienced considerable growth. Its portfolio included aluminium smelters in South Africa and Mozambique, nickel operations in Australia and Colombia, base metals mines in South America, Canada and South Africa, coal mines in Australia, Colombia and South Africa, as well as interests in operations in Brazil, Suriname, Australia (aluminium) and South Africa (titanium minerals and steel and ferroalloys).

BHP Billiton operates the Mozal aluminium smelter located 17 kilometres from Maputo harbour in Mozambique. The Mozal aluminium smelter uses Aluminium Pechiney AP35 technology to produce standard aluminium ingots. Mozal also developed and operates a dedicated berth and other port terminal facilities at Matola, the port of Maputo.

Mozal 1 was launched in 1998. The smelter was successfully completed six months ahead of schedule and more than US$100 million under budget. It was officially opened on 29 September 2000.

The Mozal 2 expansion project was approved in June 2001 and expanded the output of the smelter from 253 000 to 506 000 tpa of primary ingots. The first aluminium was cast at the expansion project on 7 April 2003. Mozal 2 was fully commissioned in August 2003 and completed below the budget of US$860 million. The smelter now has a total capacity of approximately 563 000 tonnes per annum. Mozal sources power from Eskom via Motraco, a transmission joint venture between Eskom and the national electricity utilities of Mozambique and Swaziland. Tariffs are fixed through to 2012 and will be linked to the LME aluminium price thereafter. The joint venture has a 50-year right to use the land, renewable for another 50 years under a government concession.

In Country Location

Mozal Beloluane Industrial Park, Boane District, Maputo, Mozambique;

Telephone: +(258) 21 735000

Telefax: +(258) 21 735082

Services and Products

BHP Billiton occupies significant positions in major commodity businesses, including aluminium, energy coal and metallurgical coal, copper, manganese, iron ore, uranium, nickel, silver and titanium minerals, and has substantial interests in oil, gas, liquefied natural gas and diamonds.

Aluminium: sixth largest producer of primary aluminium; Base Metals: third largest copper producer and a leading producer of lead and zinc; Iron Ore: BHP Billiton Iron Ore is one of the world’s premier suppliers of iron ore; Diamonds & Specialty Products: annual production represents nearly three percent of current world rough diamond supply by weight and six percent by value; Metallurgical Coal: BHP Billiton Metallurgical Coal is the largest global supplier of seaborne traded hard coking coal; and Stainless Steel Materials: the world's third largest nickel producer.

Number of Employees

Worldwide: 99,000 employees; Mozal 1,152 employees

Financial Information

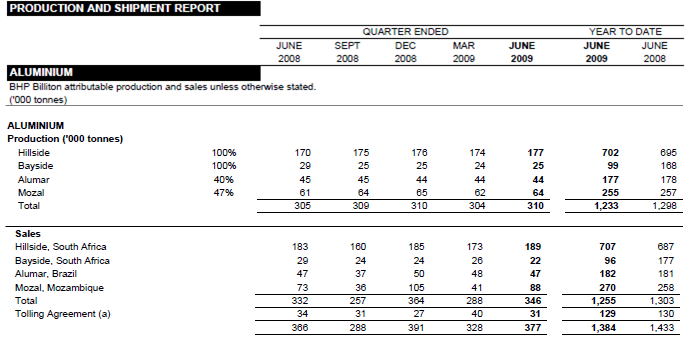

In FY2009, the company generated revenue of US$50,2 billion, attributable profit (excluding exceptional items) of US$10,7 billion and net operating cash flow of US$18,9 billion. As at 30 June 2009, it had a market capitalisation of approximately US$144 billion. Its share of Mozal’s FY2009 production was 255 000 tonnes.

Mozal Statistics

Market Share

Mozal is Mozambique's largest company. At an investment of about US$ 2 billion, primary aluminium smelter BHP Billiton's MOZAL industrial project is the largest ever undertaken in Mozambique. Despite the decline in the value of aluminium exports, the ingots produced at the MOZAL still account for well over half of Mozambique's export earnings. According to 2009 figures from the government Export Promotion Institute (IPEX), Mozambique's total exports rose from US$2,41 billion in 2007 to US$2,65 billion in 2008. The value of MOZAL's exports in this period fell from US$1,48 to 1,45 billion. As a percentage of all commodity exports, aluminium fell from 61,4 to 54,7 percent.

Business Objective

“Our purpose is to create long-term shareholder value through the discovery, development and conversion of natural resources and the provision of innovative customer and market-focused solutions. ‘

Business Model

The central tenet of the BHP Billiton business model is that its diversified portfolio of high quality assets provides stable cash flows and an enhanced capacity to drive growth. It will continue to invest in the future and have a deep inventory of growth assets. Its operations and investments are designed to ensure the Group remains stable in the long term and responsive to market volatility in the short term. To achieve this, it aims to own and operate a portfolio of upstream, large, long-life, low-cost, expandable, export-orientated assets across a diversified geographical and commodity base, and pursue growth opportunities consistent with its core skills by:

- Discovering resources through its Exploration activities;

- Developing and converting them;

- Developing customer and market-focused solutions through its Marketing arm; and

- Adding shareholder value beyond the capacity of these groups through the activities of the Group Functions.

Further, the company’s objective and commitments are pursued through the six strategic drivers of its strategy:

- People-talented and motivated people are considered its most precious resource;

- Licence to operate-win-win relationships and partnerships. This includes a central focus on health, safety, environment and the community;

- World-class assets which provide the cash flows that are required to build new projects, to contribute to the economies of the countries in which we operate, to meet our obligations to our employees, suppliers and partners, and ultimately to pay dividends to our shareholders;

- Financial strength and discipline - BHP-Billiton’s capital management programme has three priorities:

- Reinvest in its extensive pipeline of world-class projects that carry attractive rates of return regardless of the economic climate;

- Ensure a solid balance sheet;

- Return excess capital to shareholders;

- Project pipeline - focused on delivering an enhanced resource endowment to underpin future generations of growth; and

- Growth options – to use exploration, technology and its global footprint to look beyond its current pipeline to secure a foundation of growth for future generations.

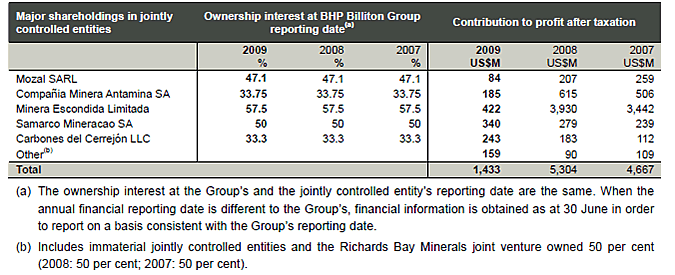

Ownership of Business

BHP Billiton has a 47.1 percent ownership interest in the Mozal joint venture. The other partners are: Mitsubishi Corporation (25 percent), Industrial Development Corporation of South Africa Limited (24 percent), and the Government of Mozambique (3.9 percent).

Benefits Offered and Relations with Government

Mining in Mozambique is governed by the Ministry of Mineral Resources and Energy in terms of Mining Law 14/2002 promulgated on 26 June 2002. The right for reconnaissance, exploration projecting and exploration and exploitation of mineral resources is obtained pursuant to the following mining titles and permits: reconnaissance licences, exploration licences, mining concessions, mining certificates and mining passes. Mining titles and permits are granted on the basis of first-come, first-served priority. It is stated in section 6 of that Act that any person, national or foreign, with juridical capacity can be the holder of a reconnaissance or exploration licence. In order to hold a mining concession the company must be established and registered in Mozambique. To hold a mining certificate, any person or company with domicile in Mozambique, national or foreign, with juridical capacity, can hold such mining certificate. A mining pass holder can only be a Mozambiqan individual with juridical capacity.

An exploration licence is granted for a period of five years, renewable for the maximum of the same period. In regard to mining concessions, and mining certificates, these may not be granted to any person other than the person who holds an exploration licence and thus the holder of an exploration licence has the exclusive right to apply for a mining concession or mining certificate.

Fiscal incentives include:

- Accumulation and carry forward of expenditure during the exploration and development stages until the first year of production when they are entered in the accounts;

- Accelerated depreciation terms for exploration and development expenditure, alternatively standard or life of mine straight-line rates may be used;

- Royalty levied on mineral production at a rate of 3 percent for most minerals, 5 percent for precious metals, 6 percent for gemstones and 10 percent for diamonds;

- Royalty is deductible for determination of taxable income; the income tax rate set at 40 percent with a 50 percent reduction to 20 percent for a period of ten years after start of production;

- Foreign non-resident sub-contractors of mining operations are exempt from the sales tax on services and pay a reduced income tax of 15 percent.

- Exemption of import duties, taxes and charges on exploration and mining equipment and other materials imported during and for the purposes of exploration and mining operations, this exemption extends to subcontractors; Exemption of duties and taxes on exports of mineral products; and

- Exemption of withholding tax on interest paid on foreign sourced loans (the rate is normally 18 percent).

Notwithstanding traditionally good relations between MOZAL and the government, relations in recent months have soured. In February 2009, the Mozambican Labour Ministry fined MOZAL for illegal redundancies. MOZAL made 80 workers redundant but, according to a press release from the Ministry, it did not follow the procedures laid down in Mozambican labour law. The Ministry spoke to the dismissed workers who said they did not wish to be re-employed by MOZAL. The Ministry then decreed that, under the terms of the Labour Law, they should receive twice the severance pay that the company has given them. The General Inspectorate of Labour also imposed two fines on MOZAL - one, of five times the monthly minimum wage, for violating the rules on collective redundancies, and a second, for preventing the exercise of trade union rights, of three times the minimum wage for each worker affected. The Ministry also announced that, together with the Ministry of Health, it is organising health check-ups for each of the 80 workers, and if any professional illness is detected, MOZAL will be held responsible.

MOZAL claimed it was making the workers redundant because it was overmanned, and so the Ministry declared that MOZAL is forbidden to hire foreign workers to replace the dismissed Mozambicans.

[ Note: This is the first time that MOZAL has had a serious dispute with the Labour Ministry. It is one of Mozambique's better private sector employees, paying far higher wages than any other factory in the country. It claims a world class health and safety record, and takes care that its emissions, into the atmosphere and into the Matola river, are well within environmentally acceptable levels.MOZAL also has excellent relations with local communities, and runs widely praised anti-malaria and anti-HIV/AIDS campaigns.]

Product Development

In 2009 Mozal reported a drop in attributable profit to US$440 million for the 2008 financial year. In the 2007 financial year, it reported an attributable profit of US$550 million. A fall in the price of aluminium hit the company's profits, as did a power supply cut of 10 percent after an energy crisis hit neighbouring South Africa.