Vivendi

Vivendi

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Vivendi is a leading global communications provider: number one worldwide in video games, number one worldwide in music, number two in France in telecommunications, number one in Morocco in telecommunications and number one in France in pay-TV.

In 1853, a water company named Compagnie Générale des Eaux (CGE) was created by an Imperial decree of Napoleon III. In 1854, CGE obtained a concession in order to supply water to the public in Lyon and for more than a century, CGE remained largely focused on the water sector. However in 1976, CGE extended its activities into other sectors with a series of takeovers. In 1998, CGE changed its name to Vivendi, and sold off its property and construction divisions the following year. Also in 1998 Vivendi went on to acquire stakes in Maroc Telecom.

In 2001, Vivendi became the Kingdom of Morocco’s strategic partner in Maroc Telecom after acquiring a 35% equity interest in the company following an auction process organized by the Moroccan government. In 2004 Vivendi announced that they had reached an agreement with the government regarding the sale of an additional 16% interest in Maroc Telecom to Vivendi.

Until 2006, Maroc Telecom was the sole provider of fixed-line telecommunications services and the main provider of Internet and data services in the Moroccan market. In 2005, these markets were opened to competition, with the grant of fixed-line licenses to two new operators that began operating in 2007.

In December 2007, pursuant to a share exchange transaction with Caisse de

Dépôt et de Gestion du Maroc , Vivendi acquired an additional 2% interest in Maroc Telecom.

In Country Location

Avenue Anakhil Hay Riad - Rabat – Maroc;

Telephone: +212 537 71 90 00

Telefax: +212 537 71 48 60

Services and Products

Maroc Telecom is a fixed and mobile telecommunications operator and Internet access provider. The principal fixed-line telecommunications services provided by Maroc Telecom are: telephony services; interconnection services with national and international operators; data transmission services for professional customers and Internet service providers, as well as for other telecom operators; Internet services (which include Internet access services and related services such as hosting); and television via ADSL.

In September 2006, in order to build customer loyalty and attract new clients, Maroc Telecom launched a new unlimited fixed telephony offering under the brand “Phony”, allowing customers to make unlimited local and national calls to Maroc Telecom fixed-line numbers.

Data transmission services provided by Maroc Telecom to corporate customers include X25, frame relay, digital and analog lease lines and IP VPN links. Maroc Telecom has an extensive direct and indirect distribution network comprising more than 45,000 points-of-sale which are subject to distribution agreements entered into with local resellers or national retailers.

Maroc Telecom manages a fully digital network and a fiber optic interurban transmission infrastructure capable of carrying data at high speed. To meet the needs of Internet users, the international Internet bandwidth has more than doubled from 12.1 Gbits/s at year-end 2006 to 25.1 Gbits/s at year-end 2008. In July 2007, in response to the increasing need for international bandwidth for offshore activities and Internet broadband in Morocco, Maroc Telecom installed a submarine cable network named Atlas Offshore between Asilah and Marseille with a capacity of 40 Gbits/s, which can be increased to 320 Gbits/s.

In mobile telephony, Maroc Telecom has focused on enhancing both population and geographic coverage. At year-end 2008, Maroc Telecom had more than 5,400 2G sites (compared to 5,000 in 2007) and over 1,100 3G stations (compared to 400 in 2007) covering more than 97% of the Moroccan population. As of December 31, 2008, Maroc Telecom had entered into a total of 466 roaming agreements with operators in 214 countries for its post-paid customers. In addition, Maroc Telecom also offers its pre-paid customers roaming through 89 operators in 54 countries, MMS and GPRS roaming through 116 operators in 75 countries, and 3G services with 12 operators in 11 countries.

Number of Employees

Total: 44,243; Morocco: 13,411 employees

Financial Information

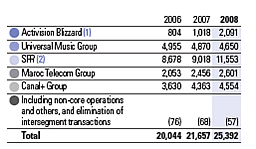

Revenues by Business Segment

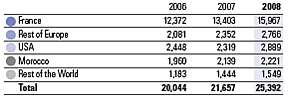

Revenues by Geographical Zone

Market Share

Maroc Telecom is Morocco’s largest fixed and mobile telecommunications operator and Internet access provider with 14.4 million cell phone customers and approximately 1.3 million fixed line customers. At year-end 2008, the market penetration rate for mobile telephony in Morocco was 74% and Maroc Telecom held a 63.4% market share.

Business Objective

“Our objective is to outperform our competitors. We strive to advance our competitive position by building upon our historical strengths, and our commitment to quality in all that we do.”

Business Model

“Vivendi’s strategy is aimed at strengthening its leading position in telecommunications and entertainment through the production and distribution of content and services, by capitalizing on the needs of the entertainment industry, the strength of its engineers, creative teams and major brands. The Vivendi group’s business lines have numerous common points: they each belong to the digital and new technologies sector and they are aimed specifically at end-consumers through the leveraging of strong brands (i.e., Activision Blizzard, UMG, SFR, Maroc Telecom and Canal+) which provide customers with subscription-based access to digital quality and creative content. These common points give Vivendi competitive advantages through fruitful know-how and advanced technology sharing, which in turn generate considerable expertise in the management of subscribers, brands, distribution platforms, creation and copyrights.

Vivendi intends to rely on the success of its subscriber-based economic model: the group’s expertise mainly relies on subscriber gains and the management of subscribers’ revenue and loyalty. This model gives Vivendi a significant advantage, because it is a recurring and therefore predictable source of revenue. Combined with a high level of customer response, it allows the group to offer innovative new services to address the growing demand for mobility and high-speed services.

The digitalization of content and the development of online consumer communities, together with the increasing development of high-speed communications, create major challenges and opportunities that Vivendi strives to anticipate in order to identify the growth drivers of its business units.

Investment projects are selected based on the results of a multi-criteria analysis: the ability to generate growth having an impact on increased adjusted net income per share as well as the group’s ability to generate cash; the return on capital employed versus the weighted average cost of capital, as well as the medium and long term return on investment; and in-depth risk assessment.

They are reviewed by the Vivendi Investment Committee, followed by the Management Board, while the most significant investments are reviewed by the Strategy Committee of the Supervisory Board followed by the Supervisory Board itself. Each investment is also subject to a “post-acquisition audit” intended to analyze and assess actual results. In 2008, the group continued to focus on its results and the development of its businesses’ performance, and to invest in the strengthening of its businesses in their respective markets as well as growth creation.”

Ownership of Business

Main shareholders

| Groups | % of capital share | % of voting rights |

|---|---|---|

| Capital Research and Management | 4.91 | 4.91 |

| Natixis (Ixis Corporate & Investment Bank) | 4.30 | 4.30 |

| CDC-Caisse des Dépôts et Consignations | 3.71 | 3.71 |

| Groupe Crédit Agricole | 3.58 | 3.58 |

| Natixis Asset Management | 3.43 | 3.43 |

| Paris International Investment | 2.97 | 2.97 |

| PEG Vivendi | 1.25 | 1.25 |

| Prudencial Plc | 0.94 | 0.94 |

| BNP Paribas | 0.72 | 0.72 |

| UBS Investment Bank | 0.71 | 0.71 |

| ADIA (Abu Dhabi Investment Authority) | 0.66 | 0.66 |

| Crédit Suisse Securities (Europe) Limited | 0.58 | 0.58 |

| Rothschild - Asset Management | 0.54 | 0.54 |

| Groupama Asset Management | 0.53 | 0.53 |

| HBOS Plc | 0.51 | 0.51 |

| Merrill Lynch | 0.50 | 0.50 |

| FIPAR International (CDG Maroc)* | 0.50 | 0.50 |

| RCAR (Régime collectif d’allocation de retraite) – CDG Maroc | 0.50 | 0.50 |

| Société Générale | 0.49 | 0.49 |

| AQR Capital Management | 0.49 | 0.49 |

| Fonds de réserve pour les retraités | 0.47 | 0.47 |

| SRM Advisers (Monaco) S.A.M. | 0.43 | 0.43 |

| HERMES Equity (BT Pension Scheme Trustees Limited | 0.43 | 0.43 |

| TPG-Axon | 0.37 | 0.37 |

| Group savings plan Veolia Environnement | 0.24 | 0.24 |

| Treasury shares | 0.01 | 0.00 |

| Other shareholders | 66.23 | 66.24 |

| Total | 100.00 | 100.00 |

Benefits Offered and Relations with Government

The Moroccan government continued the privatization of Maroc Telecom by conducting an equity offering of 14.9% of Maroc Telecom’s share capital. The success of the equity offering led to the simultaneous listing of Maroc Telecom on the Casablanca and Paris stock exchanges on December 13, 2004. In 2006, the Kingdom of Morocco sold 0.1% of Maroc Telecom’s share capital to the market. On July 2, 2007, the Moroccan State sold 4% of the capital of Maroc Telecom on the Casablanca Stock Exchange. This sale was reserved for Moroccan and international institutional investors. Following completion of the transaction, the Moroccan State decreased its share of the capital and voting rights of Maroc Telecom to 30% and the free float of the share capital rose from 15% to 19%.

The Agence Nationale de Réglementation des Télécommunications (ANRT) prepares research and regulatory acts regarding the telecommunications sector and verifies operators’ compliance with the regulations in force. The ANRT published a policy paper regarding the liberalization of the telecommunications sector for the 2004-2008 period. The various steps in the liberalization process relating to Maroc Telecom were as follows: the Maroc Telecom fixed telephony interconnection catalog for 2008 at a tariff of 35 dirhams and 100 dirhams per month; and on June 1, 2007, number portability became operational in agreement with the ANRT and all operators.

Maroc Telecom fulfils its obligations by providing universal service. Universal service obligations in Morocco comprise telecommunication services including: telephone service of a specified quality at affordable prices, value-added services, the content and performance standards being set forth in the contract specifications of operators of public telephony networks (including services allowing Internet access), the routing of emergency calls and the provision of an information service and a telephone directory in printed or electronic form. Maroc Telecom is required to dedicate 2% of its revenues, exclusive of tax and interconnection fees, to universal service by applying the pay-or-play principle, which offers a choice of paying all or part of one’s contribution to the universal service fund and/or creating programs approved by the universal service management committee.

Product Development

In 2008 Maroc Telecom rolled out mobile 3G+ services in Morocco’s major

cities and launches innovative and attractive new services in addition to its

3G+ mobile high-speed Internet; in compliance with the Universal Service Program Agreement, Maroc Telecom undertook to provide cell phone coverage for 7,338 additional cities until 2011 (representing 80% of the Program Agreement),

corresponding to an estimated investment of 2.8 billion Moroccan dirhams; Maroc

Telecom launched a prepaid Internet 3G+ service providing a greater number of

people total mobility with mobile access to the Internet, without commitment,

subscription or invoicing. Customers gain Internet access including full search

functionality, messaging, navigation and downloading functions; and Maroc

Telecom offered customers who subscribe to its Forfaits Particuliers

(“Private Subscription”) the opportunity to call their landline correspondents in Europe and North America at domestic call rates.

In May 2009 Maroc Telecom secured a US$ 1.3 billion investment programme, mostly financed by the Moroccan government. The programme will see major improvement and modernisation of Morocco's fixed-line and mobile networks, but also a new fiber optic cable to France and through Western Sahara into Mauritania. According to a statement issued by Maroc Telecom, "the investment programme will be devoted to the extension and modernisation of telecommunications infrastructure and will focus on three key thrusts." The first objective would be to "support capacity enhancement with the aim of ensuring optimal traffic management and service quality through the use of Next Generation Network (NGN) while also enabling the deployment, under optimal conditions, of convergence services in the Fixed-line and Mobile services segments in order to roll out unlimited call plans, IPTV and broadband internet" in Morocco proper.

The second objective is to enhance its international transmission capacity via the Atlas Offshore submarine cable between Morocco and Europe. The third objective involves providing coverage across major rural areas and isolated mountain communities in Morocco as part of the Telecommunications Access Programme (PACTE). An additional 7,300 rural areas will be served by the telecommunications network by 2011.