Bnp Paribas

Bnp Paribas

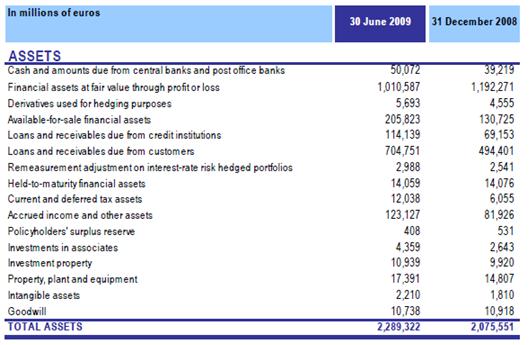

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

BNP Paribas is a European leader in banking and financial services and one of the six strongest banks in the world according to Standard & Poor’s. The Group has one of the largest international banking networks and a presence in over 85 countries. It is the largest French company, 5th in the banking industry worldwide, 1st in the Euro Zone (‘Global 2000 Forbes’ 2008), Global Bank of the Year 2008 (The Banker magazine), 7th most valuable international banking brand (Brand Finance February 2009) and ranks 8th among the world's safest banks (Global Finance - February 2009).

BNP Paribas was created on 23 May 2000 through the merger of Banque Nationale de Paris (BNP) and Paribas. Originally the Compagnie Financière de Paris et des Pays-Bas (Finance Corporation of Paris and the Netherlands) and the Compagnie Financière de Paribas became simply Paribas in 1998 after acquiring the Compagnie Bancaire.

The Banque Nationale pour le Commerce et l'Industrie (BNCI-created in 1932) and Comptoir National d'Escompte de la Ville de Paris (CNEP-created in 1948) were merged in 1966 to form BNP. BNP was privatised in 1993.

In the early 1820s Louis-Raphaël Bischoffsheim founded a private banking establishment in Amsterdam, while his brother Jonathan Raphaël created a branch in Antwerp in 1827 before settling in Brussels in 1836. Having married the daughter of Frankfurt banker Hayum-Salomon Goldschmidt, Louis-Raphaël Bischoffsheim established the Bischoffsheim-Goldschmidt bank in Paris in 1846, then in London in 1860. In 1863 he merged it with the Banque de Crédit et de Dépôt des Pays-Bas, which he had founded in Amsterdam alongside other European financiers. At the same time, in 1869 a group of bankers and investors including Adrien Delahante, Edmond Joubert and Henri Cernuschi founded the Banque de Paris, with its headquarters near the Opera at 3 rue d'Antin.

The Banque de Paris et des Pays-Bas was created in 1872 as part of the consolidation trend in the banking industry which began in the middle of the 19th century. The new financial institution was formed through the merger of Banque de Paris and Banque de Crédit et de Dépôt des Pays-Bas.

In 1982, France passed a legislation that called for the nationalization of five large industrial companies, thirty-nine registered banks, and two financial companies: Suez and Paribas. At the same time the bank adopted the new name of Compagnie Financière de Paribas, Banque Paribas. The bank was owned by the state during the four years that followed. In 1987, Michel François-Poncet, named Chairman and Chief Executive in 1986, was successful in achieving the privatization of the bank through legislation passed on July 2, 1986.

BNP Paribas Mauritania opened its doors in April 2007. BNP Paribas Mauritania is a limited company with capital of 3 398 600 000 Mauritanian Ouguiya.

In Country Location

Ilôt O 91-92 Rue Mamadou Konaté, Tevragh Zeina, BP 415, Nouakchott, Mauritania; Tél : (+ 222) 529 63 74 ; Fax : (+ 222) 529 64 40

Services and Products

BNP Paribas has built up 3 major complementary areas of activity: Retail Banking; Corporate &Investment Banking (CIB); and Asset Management & Services (AMS).

BNP Paribas Retail Banking includes all the Group's retail banks (6 000 branches, including 4 000 outside France) and the core businesses specialised in loans to individual customers and equipment financing for companies. CIB is one of the Group’s growth drivers and operates in advisory and capital markets (Corporate Finance, Equities and Fixed Income) as well as in financing businesses (Specialised and Structured Finance). It focuses on three particular sectors: Derivatives; Equity Capital Markets and Debt Capital Markets and acquisition, export, project, infrastructure and commodity finance.

Investment Solutions comprises 6 complementary businesses (Private banking, Asset management, online savings & trading, Securities services, Real estate services and Insurance). With a presence in nearly 60 countries, Investment Solutions businesses have made international development a cornerstone of future growth and client services.

BNP Paribas Mauritania offers its customers a wide range of services and products ranging from operating funds and capital to more sophisticated financial solutions, including international transactions through its global network of 85 Trade Centers.

Number of Employees

20 employees

Financial Information

In Q2 2009 the company generated a net profit (group share) of 1,604 million euros, up 6,6 percent compared to the second quarter 2008 and up 3 percent compared to the first quarter 2009.

The consolidated Group posted revenues of 9,993 million euros, up 32,9 percent compared to the second quarter 2008. The rise in operating expenses, limited to 19,9 percent, yielded gross operating income of 4,175 million euros, up 56.7 percent compared to the second quarter 2008. Despite the significant rise in the cost of risk, the decline in operating income was limited to 8,6 percent and pre-tax income, which totalled 2,170 million euros, was up 4,6 percent compared to the second quarter 2008.

In the first half of 2009, the Group's revenues were 19,470 million euros (up 30.6 percent compared to the first half of 2008), and the net income group share came to 3,162 million euros (down 9,3 percent compared to the first half of 2008), or a half year net earnings per ordinary share of 2,9 euros. The annualised return on equity was 11,8 percent compared to 15,8 percent in the first half of 2008.

Market Share

Not available

Business Objective

“To be at the leading edge of innovation and to consolidate on the leading position forged by BNP Paribas”

Business Model

BNP Paribas has a diversified customer-driven business model and its main strength lies in its customer franchises. The model is strongly weighted to retail banking. In all its businesses, customer service, risk control, capital and liquidity management and cost discipline remain key priorities.

Retail banking will in 2009 continue to roll out its plan to create an umbrella organisation for all the retail banking businesses in order to speed up their development, adapt its organisation to the new environment, tailor its product offering to new client needs, reduce its exposure to risk and rationalise its operations. Investment Solutions (the new name for AMS) will pursue its integrated strategy with a focus on providing integrated solutions for its clients and seeking productivity gains

The company’s cost management discipline for 2009 is based on the following: adapt the cost base to the 2009 environment; adapt the US platform and operations in emerging countries; reduce the cost base (excluding variable compensation) by 5% on a full year basis; very selective acquisitions; substantial reduction of exposure to volatility and dividends; substantial decrease in corporate bond portfolio and therefore exposure to basis risk; and reducing risk-weighted assets.

Ownership of Business

BNP Paribas owns 60 percent of BNP Paribas Mauritania. The European Development Finance Institutions of Proparco (Agence Française du Développement group) and Deutsche Entwicklungsgesellschaft (DEG) are also involved in this project, each with a 20% stake.

Benefits Offered and Relations with Government

The BNP Paribas Group was granted authorization by the Mauritanian authorities to open a full-service bank in the country in 2006.

The Central Bank remains the banking regulatory agency. It controls interest rates, sets commercial bank reserve requirements, and is charged with financial and credit management. The Deputy Governor is the president of the Banking Commission and is in charge of banking system controls. In 2007, a new banking law was enacted to enhance competition, improve access to credit, and ensure bank liquidity. The law mandates separation of bank management and ownership and limits the percentage of loans that a bank can make to related parties.

Product Development

In 2008 BNP Paribas also announced the launch of Ace Manager, the first banking adventure game based on real-life scenarios in 26 countries including Mauritania. This initiative, aimed at business school and university students, is part of the group's strategy for boosting brand awareness of BNP Paribas as one of the leading employers of students all over the world, and increasing the group's appeal towards the young.