Rio Tinto

Rio Tinto

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Rio Tinto is a leading international business involved in each stage of metal and mineral production. The Group combines Rio Tinto plc, which is listed on the London StockEx change, and Rio Tinto Limited, which is listed on the Australian Securities Exchange.

The British based Rio Tinto Company was formed by investors in 1873 to mine ancient copper workings at Rio Tinto near Huelva in southern Spain. The Consolidated Zinc Corporation was incorporated in 1905 to treat zinc bearing mine waste at Broken Hill, New South Wales, Australia. The RTZ Corporation (formerly The Rio Tinto-Zinc Corporation) was formed in 1962 by the merger of The Rio Tinto Company and The Consolidated Zinc Corporation. CRA Limited (formerly Conzinc Riotinto of Australia Limited) was formed at the same time by a merger of the Australian interests of The Consolidated Zinc Corporation and The Rio Tinto Company.

RTZ and CRA were unified in December 1995. Directed by a common board of directors, the companies operate as a single entity even though they maintain separate shareholder lists in the UK and Australia. This places the shareholders of both companies in substantially the same position as if they held shares in a single enterprise owning all of the assets of both companies.

In June 1997, The RTZ Corporation became Rio Tinto plc and CRA Limited became Rio Tinto Limited, together known as the Rio Tinto Group. Rio Tinto plc is listed on the London and New York Stock Exchanges. Rio Tinto Limited is listed on the Australian Stock Exchange.

In the late 1980s and early 1990s, Rio Tinto Exploration identified a major mineral sands resource in the Fort-Dauphin region of Madagascar. It is made up of three adjacent deposits known as Mandena, Petriky and Sainte-Luce. First ilmenite production from this operation began in late 2008 and the initial capacity will be 750,000 tonnes per year.

QMM is part of Rio Tinto Minerals, Rio Tinto's marketing division specialising in industrial minerals borates, titanium dioxide, talc and salt. QIT (QIT-Fer et Titane) is a wholly owned subsidiary of Rio Tinto, based in Quebec, Canada. QIT’s metallurgical complex in Sorel-Tracy, Quebec is being upgraded as part of the Madagascar mineral sands project. QMM's ore is shipped to Quebec, and processed into high quality titanium dioxide.

Madagascar ilmenite contains 60 per cent titanium dioxide making it higher quality than most other global sources. It will be upgraded in Canada to produce a new 90 per cent titanium dioxide chloride slag suitable for global titanium feedstock markets where it is used in the manufacture of pigments for the paint and plastics industries.

The current mine site is at Mandena, to the north of Fort Dauphin, and production in phase one will eventually ramp up to 750,000 tonnes per annum. Later phases will be at Ste Luce and Petriky and there is potential to expand production to 2.2 million tonnes a year.

The construction of a new port is a public/private partnership executed by QMM that has benefited from a government grant of $35 million, funded by an IDA (International Development Association) loan from the World Bank. It will be a multi-user port capable of attracting other industry to the area and also providing a destination point for cruise ships. The port, which can handle vessels up to 60,000 tonnes, is expected to promote existing local industries such as sisal growing, lobster fishing and harvesting of medicinal plants and fruits, and attract investors to a 400 hectare industrial zone nearby.

In Country Location

Located near the town of Fort Dauphin, on the east coast of Madagascar

Services and Products

The QMM project consists of the development of a mineral sand mine and separation plant, and port facilities in southern Madagascar as well as an upgrade of QIT’s ilmenite smelting facilities in Canada.

Number of Employees

More than 3,500 Malagasy employees on site during the construction phase; estimated work force when mine is fully operational: 530 employees

Financial Information

The total cost of the investment in Madagascar and Canada is US$1.2 billion.

Market Share

QIT Madagascar Minerals' (QMM) mineral sands mining project, is the largest ever investment and infrastructure project in the island's history.

Business Objective

“The Group’s objective is to maximise its value and the long term return delivered to shareholders by finding, mining and processing natural resources across the globe”

Business Model

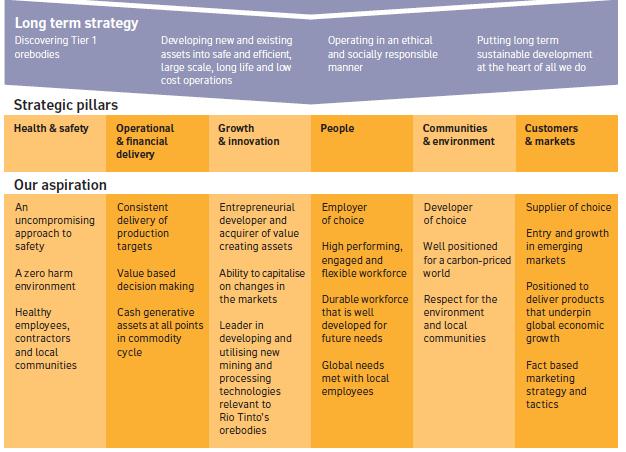

Rio Tinto’s core objective is to maximize the long term return to shareholders by finding, mining and processing metal and mineral resources across the globe. To deliver this objective the Group follows a long term strategy that concentrates on: the discovery of Tier 1, (large, low cost) orebodies that will safeguard our future cash flow; the development of Group assets into safe and efficient large scale, long life and low cost operations to ensure the Group can operate profitably at every stage of the commodity cycle; operating in an ethical and socially responsible manner that maintains Rio Tinto’s reputation and ensures ongoing access to people, capital and mineral resources; and putting long term sustainable development at the heart of everything the Group does.

To support and deliver its long term strategy, Rio Tinto structures its medium term activities around the six core strategic pillars:

Regarding the iron ore sector, Rio’s strategy of remaining the world’s best positioned supplier of iron ore is a key component of the Group’s strategy of maintaining a strong position in products that underpin global economic growth. Rio seeks to expand its business by operating its assets with an emphasis on maximizing efficiency and therefore margins.

While capital expenditure has been reduced in response to the economic downturn, RIO believes the project in Guinea can be activated in response to changes in market conditions and as the Group’s capital expenditure budget permits.

Ownership of Business

Rio Tinto owns 80 per cent of QMM (QIT Madagascar Minerals). The Madagascar Government owns the other 20 per cent represented by l'Office des Mines Nationales et des Industries Stratégiques (OMNIS).

Benefits Offered and Relations with Government

A legal and fiscal framework agreement between QMM and the Government of Madagascar was concluded in 1998 after several years of negotiations. This was ratified by the Malagasy National Assembly and promulgated into law by the president of Madagascar. QMM conducted a Social and Environmental Impact Assessment (SEIA) between 1998 and 2001. The government issued an environmental permit in 2001.

In 2005, the Malagasy Government agreed to contribute US$35 million to the establishment of the port. This contribution is part of its Growth Poles project, funded by the World Bank. Rio Tinto is funding 100 per cent of the project's construction until 2008. At this point, OMNIS will find its share of project costs or dilute its interest.

QIT Madagascar Minerals will manage the port operations. At the end of the life of the mine, the port will fall under the responsibility and control of the Malagasy Government. The mine's life is projected at 40 years from first production in 2008.

Rio Tinto's Government & Corporate Relations team is involved with the Malagasy Government in two key areas: maintaining regular dialogue with the government about legislation and policy concerning mining in Madagascar; and promoting the Extractive Industry's Transparency Initiative (EITI) in Madagascar.

Following a change in government in early 2009 when Andry Rajoelina the mayor of Antananarivo, overthrew the government of President Marc Ravalomanana, the new government indicated that it was considering a more thorough examination of Rio Tinto contract for its $1-billion mineral sands mine. Prime Minister Monja Roindefo said in August 2009 it found some technical irregularities with Rio’s operations.

In October 2009 Rio indicated that it would “soon" give the government the finalized cost for its titanium sands project, forcing a deadline upon the government to decide if it will pay for its 20% option in the project, or have its stake diluted. The government may ask to delay its decision for two months, Rio Tinto said. The deadline only requires the government to confirm if it will pay for the stake, not make the payment itself.

Under the terms of a legal agreement the government signed with Rio, the government has to pay for its 20% stake or have its share diluted.

Product Development

Rio's titanium sand mine began exporting in April 2009 to the company's metallurgical facilities in Canada and is being processed in Canada with effect from June 2009.