Rio Tinto

Rio Tinto

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Rio Tinto is a leading international business involved in each stage of metal and mineral production. The Group combines Rio Tinto plc, which is listed on the London StockEx change, and Rio Tinto Limited, which is listed on the Australian Securities Exchange.

The British based Rio Tinto Company was formed by investors in 1873 to mine ancient copper workings at Rio Tinto near Huelva in southern Spain. The Consolidated Zinc Corporation was incorporated in 1905 to treat zinc bearing mine waste at Broken Hill, New South Wales, Australia. The RTZ Corporation (formerly The Rio Tinto-Zinc Corporation) was formed in 1962 by the merger of The Rio Tinto Company and The Consolidated Zinc Corporation. CRA Limited (formerly Conzinc Riotinto of Australia Limited) was formed at the same time by a merger of the Australian interests of The Consolidated Zinc Corporation and The Rio Tinto Company.

RTZ and CRA were unified in December 1995. Directed by a common board of directors, the companies operate as a single entity even though they maintain separate shareholder lists in the UK and Australia. This places the shareholders of both companies in substantially the same position as if they held shares in a single enterprise owning all of the assets of both companies.

In June 1997, The RTZ Corporation became Rio Tinto plc and CRA Limited became Rio Tinto Limited, together known as the Rio Tinto Group. Rio Tinto plc is listed on the London and New York Stock Exchanges. Rio Tinto Limited is listed on the Australian Stock Exchange.

The 2000 acquisition of North Ltd and Ashton Mining added major aluminium, iron ore, diamonds and coal assets to Rio Tinto's resource base. In a US$38 billion agreed bid Rio Tinto acquired the Canadian aluminium producer Alcan Inc. to become the global leader in aluminium in 2007.

The Exploration group has delivered the world’s largest known undeveloped high grade iron ore resource, at Simandou in Guinea. Simandou is a world-class iron ore exploration and mining project located in south eastern Guinea. The project has completed initial feasibility studies and is pursuing essential mine planning exploration and study work. Simandou has inferred resources of 2.25 billion tonnes @ 66 per cent iron.

Rio Tinto has already spent over US$500 million on exploration and evaluation work necessary to develop a world class mine at Simandou. Of this over US$ 40 million has been in Sustainable Development related projects and studies. Studies completed to date estimate that an up-front capital investment greater than $6 billion will be required to start the construction of a world class mine, rail and port infrastructures at Simandou.

During 2008 Rio conducted advanced studies into establishing an iron ore mine of 70 Mt/a capacity, and potentially of up to 170 Mt/a capacity. A number of options are being reviewed to establish the most efficient and economic means of transporting the mined ore from the project.

Rio Tinto’s presence in Guinea began in 1997, when the Minister of Mines invited the company to conduct initial exploration work at Simandou. After 3 years of exploration work that identified areas of potential mineralization within the initial 1488km2 research area Rio Tinto gave up 50% of its land area in 2000 when it renewed its exploration licenses. This was done in accordance with Guinean law that requires that remaining permit area contain at best possible all of the mineralization sites identified by the company during exploration work. Following that retrocession, the Guinean Government designated Rio Tinto's exploration and mining perimeter land area at 738km2 through the 2002 Convention and 2006 Concession. The Mining Convention was ratified by the National Assembly and signed into law by President Lansana Conté in 2003. In 2006 Rio Tinto’s Mining Concession was granted by Presidential decree in accordance with the Mining Convention and the laws of Guinea.

Also in 2006 the then Minister of Mines, Dr Ahmed Tidjane Souaré, agrees to a revised project timetable (feasibility report at the end of 2008 and commencement of production at the end of 2013) to reflect the delays in granting the Mining Concession and agreeing on the transport route.

In Country Location

The Simandou concession area is located along 110 kms of the Simandou mountain range in south eastern Guinea. The Simandou range is located in the prefectures of Kérouané, Beyla and Macenta. Two Forêts Classées (i.e. protected forest), Pic de Fon and Pic de Tibé, cover approximately 12% of the concession area. The southern part of the Simandou mountain range is within Conservation International’s (“CI”) designated “Guinean Forest Hotspot.

Services and Products

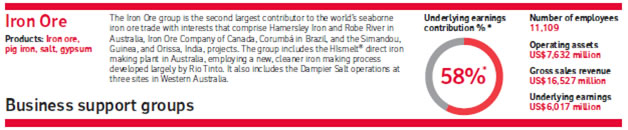

Rio produces aluminium, copper, diamonds, coal, iron ore, uranium, gold and industrial minerals (borates, titanium dioxide, salt, talc).

Number of Employees

1,000 employees in Guinea

Financial Information

|

Llkely mining method |

Measured resources at end 2008 |

lndicated resources at end 2008 |

lnferred resources at end 2008 |

Total resources 2008 compared with 2007 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (a) | T(※1) | G(※2) | T | G | T | G | T | G | |||

| 2008 | 2007 | 2008 | 2007 | ||||||||

| IRON ORE | MT(※3) | %Fe | MT | %Fe | MT | %Fe | MT | MT | %Fe | %Fe | |

| Simandou(Guinea) (mm) | O/P | 1,300 | 66.0 | 995 | 65.9 | 2,254 | - | 66.0 | - | ||

T(※1):Tonnage G(※2):Grade MT(※3):millions of tonndes

Market Share

Between 2006 and 2009 Rio Tinto’s Concession area represented only 18 percent of all mining holdings in the Simandou range: 738 km2 are held by Rio Tinto and 3,333 km2 are held by one other company. During the same time, Rio Tinto’s Concession area represented only a fraction of the over 20,000km2 of iron ore exploration title that is awarded to other companies in Guinea. In 2007 Rio Tinto accounted for 75% of the total investment in the mining sector.

Business Objective

“The Group’s objective is to maximise its value and the long term return delivered to shareholders by finding, mining and processing natural resources across the globe”

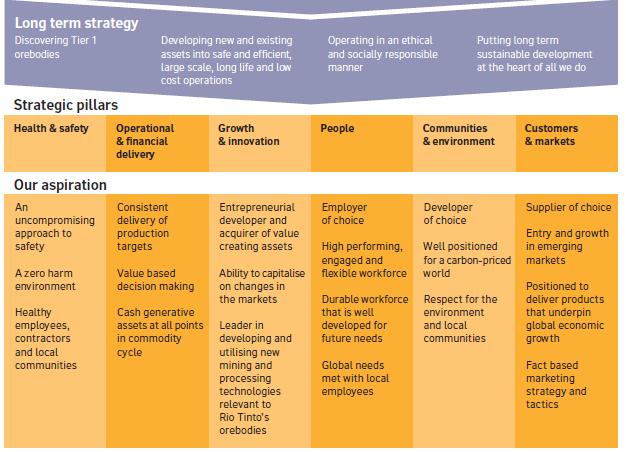

Business Model

Rio Tinto’s core objective is to maximize the long term return to shareholders by finding, mining and processing metal and mineral resources across the globe. To deliver this objective the Group follows a long term strategy that concentrates on: the discovery of Tier 1, (large, low cost) orebodies that will safeguard our future cash flow; the development of Group assets into safe and efficient large scale, long life and low cost operations to ensure the Group can operate profitably at every stage of the commodity cycle; operating in an ethical and socially responsible manner that maintains Rio Tinto’s reputation and ensures ongoing access to people, capital and mineral resources; and putting long term sustainable development at the heart of everything the Group does.

To support and deliver its long term strategy, Rio Tinto structures its medium term activities around the six core strategic pillars:

Regarding the iron ore sector, Rio’s strategy of remaining the world’s best positioned supplier of iron ore is a key component of the Group’s strategy of maintaining a strong position in products that underpin global economic growth. Rio seeks to expand its business by operating its assets with an emphasis on maximizing efficiency and therefore margins.

While capital expenditure has been reduced in response to the economic downturn, RIO believes the project in Guinea can be activated in response to changes in market conditions and as the Group’s capital expenditure budget permits.

Ownership of Business

Rio Tinto has a 95 percent stake in the Simandou project and the International Finance Corporation holds a five percent stake

Benefits Offered and Relations with Government

After the death of long term ruler Lansana Conte in 2008, a military junta under the leadership of Dadis Camara came to power. Both Conte and Camara have regularly threatened to close down mining companies or to significantly change agreements with the companies.

In August 2008, Rio Tinto received correspondence from the Guinean Government purporting to rescind the Concession, the legality of which Rio Tinto questioned. In December 2008, Rio's plans for the project were thrown into disarray when the government stripped it of the northern half of the mining concession, handing it to BSG Resources Guinea, a subsidiary of Israeli businessman Benny Steinmetz's BSG Resources. Rio has engaged in top level discussions with various stakeholders in an effort to clarify the status of the project. Rio Tinto remains of the view that it has complied with all its obligations in relation to the Concession such that it is entitled to hold and retain the entire Concession. It continues working with the Guinean Government to seek to resolve this matter on that basis.

At a proposed production rate of over 70 million tonnes per annum, the Simandou mine would pay millions of dollars each year in taxes and royalties to the Government of Guinea, and millions of dollars to a regional development fund. This would amount to billions of dollars over the life of the mine. The expected annual royalties from the Simandou project alone would represent many times what the Government currently receives from all mining revenues in Guinea. This revenue to the Government would increase in proportion to increased production.

Product Development

In September 2008 dissatisfactions with Camara’s rule resulted in major demonstrations during which security forces shot dead nearly 200 demonstrators.

At the end of September 2009 Rio issued the following statement: “Rio Tinto is closely watching the deteriorating political situation in Guinea but hasn't yet decided to evacuate any of its employees for safety reasons. Rio employs fewer than 100 expatriate staff and "a few hundred" Guinean nationals in the West African state, where the company is conducting work on the Simandou iron ore project, one of the world's largest undeveloped iron ore deposits. The safety of our workforce is our immediate focus. We have arrangements in place. “