Gold Fields Limited

Gold Fields Limited

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Gold Fields Limited is one of the world’s largest unhedged producers of gold from eight operating mines in South Africa, Ghana and Australia. Gold Fields is a public company incorporated in South Africa and currently has 16 gold processing facilities (8 in South Africa, 4 in Ghana, 3 in Australia and 1 in Peru) which treat ore to extract gold and, in the case of Peru, copper. It has attributable production of 3, 64 million oz per annum and total attributable ore reserves of 83 million oz and mineral resources of 251 million oz.

Gold Fields of South Africa was formed in 1887 by Cecil Rhodes and Charles Rudd to hold properties they had acquired on the Transvaal's Witwatersrand gold fields. Reorganized as Consolidated Gold Fields of South Africa (Consgold) in 1892, it was plagued by uncertainties and found itself on a really firm footing only in the 1930s, when it took the lead in opening up the Western Randin conjunction with, among others, the Anglo American Corporation. West Witwatersrand Areas Ltd. was formed in 1932 to work the new field. In 1959, as part of a major restructuring exercise, the name "Gold Fields of South Africa" was revived for a South African rather than a British domiciled company, a wholly owned subsidiary to take over the management of the parent company's southern African assets. In 1971, West Wits took over all of Gold Fields of South Africa's assets as well as its name.

In the 1990’s Gold Fields and Gencor (the product of a 1980 merger between General Mining and Finance Corporation and Union Corporation) merged. The deal created Gold Fields Ltd., the country's second-largest gold concern and one of the largest in the world.

In 1999, it bought the remaining shares of St. Helena Gold Mines Ltd. that it did not already own. In November 2001, St. Ives and Agnew Gold Mines were added to the company's holdings. Abosso Goldfields Ltd. was acquired the following year.

Gold Fields Ghana obtained the mining rights for the Tarkwa property from the government of Ghana in 1993. In August 2000, with the consent of the government Gold Fields Ghana was assigned the mining rights for the northern portion of the Teberebie property. The Tarkwa rights expire in 2027, while the Teberebie rights expire in 2018. A new SAG mill and CIL plant commenced continuous operations at the Tarkwa property in November 2004. The Tarkwa mine has access to the national electricity grid, water, road and railroad infrastructure. Most supplies are trucked in from either the nearest seaport, which is approximately 140 kilometres away by road in Takoradi, or from Tema near Accra, which is approximately 300 kilometres away by road.

Surface mining at Damang commenced in August 1997 and Gold Fields assumed control of operations on January 23, 2002. Historically, the underground mine was in operation from 1878 until 1956 until closure due to an extended strike and lack of cash flow. The Damang mine has access to the national electricity grid and water and road infrastructure. Most supplies are trucked in from either the nearest seaport, which is approximately 200 kilometres away by road in Takoradi, or from Accra, which is approximately 360 kilometres away by road. Abosso holds the right to mine at the Damang property under a mining lease from the government which expires in 2025.

In Country Location

The Tarkwa gold mine is located in south-western Ghana, about 300 km by road west of Accra, the capital, at latitude 5°15’ N and longitude 2°00’ W. It is situated some 4 km west of the town of Tarkwa. Damang is located in south-western Ghana, approximately 300 km by road, west of Accra, the capital, at a latitude 5°11’N and longitude 1°57’W. It is situated some 30 km north of the town of Tarkwa.

Services and Products

Gold Fields is primarily involved in underground and surface gold mining and related activities, including exploration, extraction, processing and smelting. Gold Fields also has an interest in a platinum group metal exploration project.

Number of Employees

As of June 30, 2008, Tarkwa had approximately 4,700 employees, including approximately 2,900 employed by outside contractors. As of June 30, 2008, Damang had approximately 1,600 employees, including approximately 1,350 employed by outside contractors.

Financial Information

In the fiscal year ended June 30, 2008, Tarkwa produced 0.65 million ounces of gold, of which 0.46 million ounces were attributable to Gold Fields, with the remainder attributable to minority shareholders in Gold Fields Ghana. Damang mine produced 0.194 million ounces of gold, of which 0.138 million ounces were attributable to Gold Fields, with the remainder attributable to minority shareholders in Abosso.

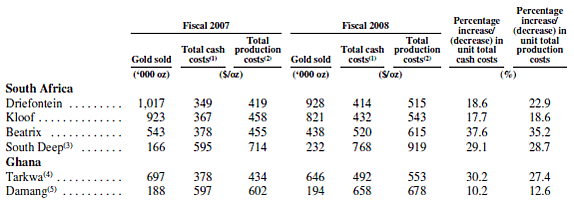

The following table sets out Gold Fields’ total ounces sold and weighted average total cash costs and total production costs per ounce for fiscal 2007 and fiscal 2008.

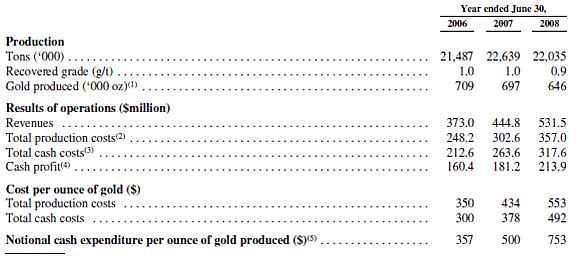

Detailed below are the operating and production results at Tarkwa for the past three fiscal years.

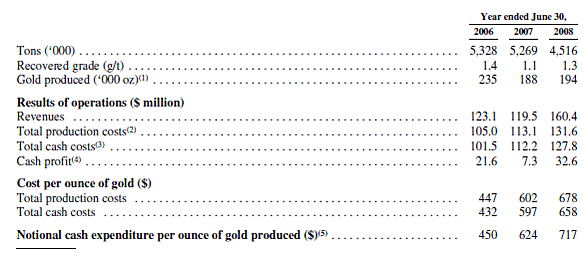

Detailed below are the operating and production results at Damang for the past three fiscal years

Market Share

Ghana's gold output increased by 4 percent in 2008 to 2.6 million ounces. As a result of the rising price for gold, mining revenues increased to $2.3 billion. In the fiscal year ended June 30, 2008, Tarkwa produced 0.65 million ounces of gold, of which 0.46 million ounces were attributable to Gold Fields. Damang produced 0.194 million ounces of gold, of which 0.138 million ounces were attributable to Gold Fields. The market share of Gold Fields was 23% in 2008.

Business Objective

To be the global leader in sustainable gold mining and to produce five million quality gold ounces within five years

Business Model

Gold Fields’ strategy is premised on the following three basic pillars: operational excellence, which is aimed at improving returns through the optimization of existing assets. This is achieved in the first instance through improving productivity. It also implies the reduction of costs through cost management initiatives and growing assets through inward investment; growing Gold Fields by diversifying geographical, technical and product risk through acquiring and developing additional long-life assets; and securing the future of Gold Fields by earning and maintaining what Gold Fields calls its “license to operate” in those countries and regions in which it operates and by upholding strong principles of corporate governance.

Gold Fields views itself as a truly global mining company, but believes that in some circles it is perceived as predominantly a South African company with a few international operations. In order to change this perception and be recognized as a global diversified company, Gold Fields has begun the process of restructuring its operations into four regions that will operate with more autonomy than under Gold Fields’ current structure: South Africa; West Africa; South America; and Australasia. Each of these regions will be led by a strong management team, tasked with running the mines safely and efficiently, as well as driving and being significantly involved in the growth of the business within the region.

Apart from the search for countries and provinces that have the geological potential to host Gold Fields calibre mines, considerable effort is also being expended by the exploration and corporate development groups on assessing which countries are likely to be amenable to large-scale future mining. Against the background of rapidly declining gold reserves, the Group’s approach is one of managing and pricing in risk rather than general risk aversion. In the light of the current market conditions and the need to facilitate entry points into new countries, Gold Fields has continued to seek out value-adding opportunities through strategic partnerships to access regions viewed to be of long-term strategic significance.

Ownership of Business

Gold Fields Ghana, which holds the interest in the Tarkwa mine, is owned 71.1% by Gold Fields, 18.9% by IAMGold and 10.0% by the government of Ghana. Abosso, which owns the interest in the Damang mine, is owned 71.1% by Gold Fields, 18.9% by IAMGold and 10% by the Ghanaian government, mirroring the shareholding structure of Gold Fields Ghana.

Benefits Offered and Relations with Government

The new Minerals and Mining Act came into force on March 31, 2006. Although the Minerals and Mining Act repealed the Minerals and Mining Law, and the amendments to it, the Minerals and Mining Act provides that leases, permits and licenses granted or issued under the repealed laws will continue under those laws unless the Minister responsible for minerals provides otherwise by regulation.

ferred to as the cadastral system, whereby land is demarcated in blocks. Under the new system, a mining lease area may not be less than one block or more than 300 contiguous blocks; mining companies which have invested or intend to invest at least $500 million may benefit from stability and development agreements, relating to both existing and new operations, which will serve to protect holders of current and future mining leases for a period not exceeding 15 years against changes in laws and regulations generally and in particular relating to customs and other duties, levels of payment of taxes, royalties and exchange control provisions, transfer of capital and dividend remittances; provisions requiring the renewal of a mining lease for a further period of up to 30 years once the holder has made an application for renewal pursuant to the terms of the lease if the holder is in material compliance with its obligations under law and under the lease; and provisions restricting royalty rates to not more than 6% or less than 3% of the total revenue of minerals.

Under Ghanaian law, the government is entitled to a 10% interest in any Ghanaian company which holds a mining lease in Ghana, without the payment of compensation. The government of Ghana has already received this 10% interest in each of Gold Fields Ghana and Abosso. Under the Minerals and Mining Law, which continues to apply to Gold Fields Ghana’s operations, and under the Minerals and Mining Act, the government has a further option to acquire a “special share” in a mining company for no consideration or in exchange for such consideration as the government and that company shall agree. Although the government of Ghana has agreed not to exercise this option in respect of Gold Fields Ghana, it has retained this option for Abosso.

Under Ghana’s mining laws, the Bank of Ghana or the Minister for Finance may permit the holder of a mining lease to retain a percentage of its foreign exchange earnings for certain expenses in bank accounts in Ghana. Under a foreign exchange retention account agreement with the government, Gold Fields Ghana is required to repatriate 20% of its revenues derived from the Tarkwa mine to Ghana and use the repatriated revenues in Ghana or maintain them in a Ghanaian bank account. Abosso is currently obligated to repatriate 25% of its revenue to Ghana, although the level of repatriation under the deed of warranty between Abosso and the government of Ghana is subject to renegotiation every two years. Gold Fields currently repatriates approximately 40% of revenues from the Ghana operations to Ghana.

The standard corporate income tax rate is currently 25% having been reduced from 28% with effect from January 1, 2006. Tax depreciation of capital equipment operates under a capital allowance regime. The capital allowances consist of an initial allowance of 80% of the cost of the asset and the balance is added to the balance carried forward and depreciated at a rate of 50% per year on a declining balance basis. Under the project development agreement entered into between the government and Gold Fields Ghana and the deed of warranty entered into between the Ghanaian government and Abosso, the government has agreed that no withholding tax shall be payable on any dividend or capital repayment declared by Gold Fields Ghana or Abosso which is due and payable to any shareholder not normally resident in Ghana.

Gold Fields may exploit all surface and underground gold at all three sites until the rights expire, provided that Gold Fields pays the government of Ghana a quarterly royalty which is calculated on the basis of a formula which ranges from 3% to 12% of revenues derived from mining at the sites. For fiscal 2008, this formula resulted in Gold Fields Ghana paying royalties equivalent to approximately 3% of the revenues from gold produced at the Tarkwa and Teberebie properties, and Abosso paying approximately 3% of the revenues from gold produced at the Damang property.

Product Development

Gold Fields spent approximately $170 million on capital expenditures at the Tarkwa operation in fiscal 2008, primarily on construction of the North Plant heap leach pad, CIL plant expansion, replacement and expansion of mining equipment and capital waste mining. Gold Fields has budgeted approximately $146 million for capital expenditures at Tarkwa for fiscal 2009, principally for the CIL plant expansion, further expansion of the North Plant heap leach pad, additional mining equipment and capital waste mining.

Damang increased gold production year on year due to higher grade ore from the Damang Pit Cutback (DPCB) and improved efficiencies due to construction and early commissioning of a seventh leach tank. The DPCB is scheduled to be completed in F2013 when the final pit limits are mined.

Following Gold Fields’ acquisition of Damang in January 2002, an exploration program was started to seek alternative sources of ore to replace the Damang pit, by testing both hydrothermal and conglomerate styles of mineralization across the Damang lease area. The Rex pit is a new pit located on southern extent of the Damang Mining Lease. The Rex Exploration program was conducted in fiscal 2006 and the pit was originally planned to be mined in fiscal 2010. In light of the occurrence of illegal mining activities in the Rex Project area, management decided to accelerate the mining of the Rex pit to fiscal 2009. Negotiations between the mine and the illegal miners resulted in the removal of the miners over several months without incident. The illegal miners mined some of the ore body but they were removed before the mining plan was significantly affected.

In August 2009 Gold Fields announced the elevation of its operations in Ghana to be the hub for growth in the West African Region. As a consequence, the Vice President and the Managing Director of the Ghana Division, Peter Turner, has been promoted to the position of Executive Vice President and Head of the West Africa Region, effective August 1, 2009.

The Mine Reserve Power (MRP) project was completed in the second quarter of 2008 as a joint venture between the four major mining operators in Ghana to generate supplemented power to the national grid in mitigation of national load shedding that occurred in times of drought. The MRP mitigates approximately 25 per cent of the Gold Fields generator needs