Perenco

Perenco

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Perenco is privately owned and has a geographical spread akin to a mid-sized major. Founded by Hubert Perrodo, and still owned by the Perrodo family, the Perenco Group began operations in the oil and gas industry in 1975 as a marine services company based in Singapore. Within a few years, the Group was providing supply boats, work barges, and tugboats to exploration and production companies in South East Asia and the Persian Gulf. Activities soon diversified into tanker storage and services barges.

In 1980, the Group founded Techfor drilling company and built a fleet of drilling rigs, jack-ups, swamp barges and land rigs. In 1982, the Group acquired French drilling company Cosifor. Perenco then expanded into the upstream business, acquiring several proven onshore oil and gas fields in the United States, applying secondary-recovery techniques to enhance production. After divesting its drilling interests in 1992, Perenco succeeded in building a worldwide portfolio of assets through a series of production acquisitions.

Perenco began operations in Gabon in 1992 with the acquisition of two offshore fields south of Port-Gentil. Major discoveries since then include: Ompoyi Field onshore (2002); Orindi Field offshore (2003); Oba Field onshore (2005); and Loche East Field offshore (2007).Two-thirds of Perenco’s crude oil production in Gabon is sent to the Fernan Vaz and Banio Floating Storage and Offloading (FSO) units, with storage capacities of 2 million and 500,000 barrels, respectively. The company has a production and exploration area of 2,145 km² and exploration acreage of 16,917 km².

In 2007, Perenco completed the acquisition of 600 km² square kilometres of 3D seismic data over the Arouwe license. These data have been processed and led to locations for the 2009 Offshore West Africa drilling campaign.

Since December 18, 2007, Perenco has supplied gas to the power plants of Libreville and Port-Gentil (450,000m3 to Libreville-Owendo and 230,000m3 to Port-Gentil). This agreement makes it possible to replace fuel oil –used until now for electricity production – with gas originating in Ganga and Harelde fields, which are operated by Perenco Gabon. In 2005 Perenco agreed a gas supply contract with the Société d’Energie et d’Eau du Gabon (SEEG) to supply the power plants of Libreville-Owendo and Port-Gentil.

North Gabon is the site of Perenco’s largest surface redevelopment project to date. To streamline operations for further development, Perenco overhauled the infrastructure: development of Olende and M’Polunie fields; construction of two power plants (14MW each) and high-voltage electrical distribution; installation of a distribution network linking Libreville and Port-Gentil to gas reserves; and installation of a dual-product, 2 million-barrel offshore terminal

In Country Location

BP 780, Port Gentil;

Telephone: +241 550 641

Telefax: +241 550 647

Services and Products

Oil and gas exploration and production

Number of Employees

100 employees in Gabon

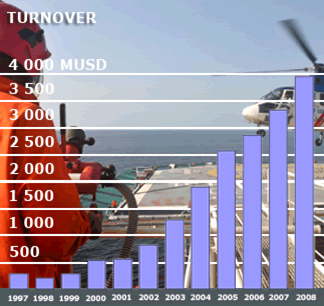

Financial Information

Current production in Gabon is 50,000 bopd through 29 offshore and onshore licences.

Company Statistics

Market Share

Perenco (50,000 bpd p/d) is Gabon's third-largest oil producer behind Total Gabon (76,500 barrels p/d) and Shell Gabon (60,000 bpd p/d). The market share for Perenco in 2008 was 21%.

Business Objective

“To direct our cash-flow toward growing our asset base and strengthening our long-term competitive position”

Business Model

Perenco's main business strategy has been to buy unprofitable oil fields and drilling assets from big multinationals like Shell. The company then operates the new business at a profit with staff and operating costs at a minimum. Since 2001 Perenco has been adjusting its business strategy. After a decade of focusing on mature fields, it started to focus on exploration.

“Perenco's current growth strategy is determined by combining: acquisitions of both producing fields and undeveloped assets; development of existing assets; arresting the production decline curve by rationalisation of operations; and high-value exploration.

‘’To ensure long-term competitiveness, we reinvest a significant portion of cash reserves in our assets-all investments are funded by cash reserves. These investments are a reflection of our strategy. Perenco is confident these measures will position the company for greater cash flow and earnings in the future.”

In addition as part of the risk management strategy it started farming out on all its 100% equity licenses. In terms of this strategy in May 2009 it was announced that Addax Petroleum Corporation will be participating in the recently spudded Azango-1 exploration well in the Ogueyi license area. The Ogueyi license area is an exploration block operated by Perenco.

Addax Petroleum has agreed to fund the Azango exploration well up to a maximum cost of $8 million. Addax Petroleum has the option to make additional staged payments to Perenco based on future exploration results in order to earn a 50 per cent interest in the license area.

Ownership of Business

Ompoyi Field onshore, Orindi Field offshore, Oba Field onshore and Loche East Field offshore is 100 percent owned by Perenco

Benefits Offered and Relations with Government

Gabon’s Oil Ministry is responsible for all regulation in the oil industry. The tax system within Gabon encourages foreign investment and certain aspects of oil exploration are exempt from the value-added tax.

Oil exploration and production licences are acquired by means of Exploration and Production Sharing Contracts (EPSC). Law No 14/82 passed in January 1983 established the EPSC which replaces the Concession Agreement. The terms can be summarised as follows: The exploration phase can comprise either two periods of five years, or three periods comprising an initial five years followed by two 2-year terms. This is based on the location of the block and the work programme; the exploitation phase comprises an initial 10 year period followed by a second and third period of 5 years each; there is a 10% minimum state participation and 5% minimum Royalty payment (as a function of production); in terms of tax and payments, cost oil is limited to 55%. If development costs have not been recovered after five years of production, this could be raised to 75% at the company’s request; and signature bonuses are recoverable after 10 years.

The State offers "technical evaluation permits" (AET) to oil companies interested in prospecting. The holder of an AET gains preferential access to the "exploration and production-sharing contract (CEPP)". The CEPP leads to the issuing of two types of exclusive permit, one for exploration and the other for production, each for a total of 20 years, including renewals. A considerable proportion of national production is covered by the 75-year agreement regime, which has not been available since 1983.

Oil enterprises are required to assign to the State, free of charge, 25 per cent of their capital or of their production under the permits and concessions granted to them. The State entrusts its share of production to a private entity which markets it and hands back the receipts.

Product Development

In October 2009 Perenco announced the strengthening of its position in Gabon with the acquisition of Marathon Oil Corporation's wholly owned subsidiary, Marathon Oil Gabon Limited, which holds a 56.25 percent working interest in three offshore production fields; the effective date of the transaction was 1 January 2009 with completion anticipated during the 4th quarter of 2009.

Perenco's acquisition of Marathon's stakes in the Tchatamba Marin, Tchatamba South and Tchatamba West fields will add approximately 15,000 bopd gross production to Perenco's current production in Gabon. Perenco will now be the operator at these fields, from where production is processed on a single facility at Tchatamba Marin, with processed oil being transported through a pipeline to a non-operated onshore facility.

OBA-9, the last of a four well appraisal campaign in 2008 was put into production in October and is currently producing approximately 1,000 bopd. It is anticipated that the field will produce approximately 12,000 bpd in 2010 from the Cap Lopez and Azile Formations.