Texaf

Texaf

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Societe Financiere et de Gestion Texaf SA (Texaf) is a holding company listed on Euronext with industrial, and financial and property sectors in the DRC. The Company holds stakes in a number of companies engaged in various areas, including Anagest (98.9%), Alta Invest (69.2%), Cotex (100%), Utexafrica (99.6%) and Immotex (50.1%) in the real estate business, and Carrigres (100%) and Mecelco (50.3%) in the industrial sector.

In 1925, the Texaf Company began work in Kinshasa and in 1928 King Albert officially opened the first textile mill in the colony. In 1934 it became known as UtexLeo becoming the UtexAfrica group in 1985. The company also built the first hydro-electrical dam at Sanga, near Kisantu to provide power for the mill.

TEXAF also acquired power plants, oil mills and river vessels and in 1930 TEXAF and Credit Antwerp created the Society Of Hydro-Electric Forces Of Sanga, located on the river Inkisi (80 km from Leopoldville) to provide the textile factory with energy. By 1930 TEXAF owned 32 ginning factories in the Congo and French Equatorial Africa.

In 1934 TEXAF became a holding company in which Credit Antwerp held a 50% share, but in 1939 Crédit Antwerp was declared bankrupt. Joseph Rhodius, TEXAF’s founding father obtained assistance from the United States and succeeded in rescuing the company.

In 1984, UTEXCO bought a 26% stake in “Cotton Kasai” with “Cotton Maniema” (state owned), the majority shareholder. In 1985 UTEXAFRICA was created through he merger of Utexco (spinning, weaving, finishing), Zaïreprint (print) and Otricot-Super Star (Hosiery, clothing). In 1987, the Belgium investment company, Compagnie Benelux Paribas SA (Cobepa) became the majority shareholder in TEXAF with 82% and in 1988 the International Finance Corporation (IFC) extended financial assistance to the company.

With the outbreak of hostilities in 1993 and civil war since 1997, TEXAF’s properties were looted and destroyed several times.

In April 2004 a framework agreement was signed with China's CHA TEXTILES. A new entity was formed, called Congotex. A new real estate company IMMOTEX owned jointly by CHA and UTEXAFRICA was also formed. Congotex was liquidated in 2007 effectively bringing an end to the textile industry in the DRC.

In Country Location

372, Av. Colonel Mondjiba, Kinshasa-Ngaliema, DRC

Services and Products

The Company focuses investments in projects in various areas, such as agro-industrial, energy, construction and tourism. Its main areas of activities are: production of sandstone crushers (Carrigres); construction of mechanical, metal and railroad infrastructures (Mecelco); ownership and leasing of real estate assets: residential and business properties located in Kinshasa (Immotex, Cotex -99.9%-Utexafrica).

Number of Employees

159

Financial Information

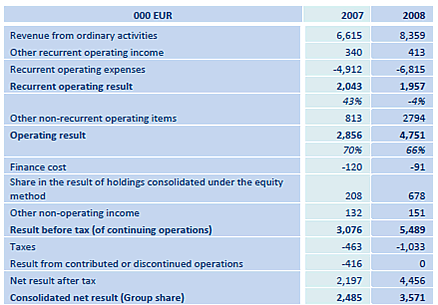

2008 Sales was 8,772,000 Euro.

Consolidated Balance Sheet

Market Share

TEXAF was until 2007 the largest textile company in the DRC. It is currently growing its market share in other sectors.

Business Objective

To once again become a leading investor in the DRC

Business Model

The company is continuing with major rehabilitation of its assets in the DRC. It aims to attract foreign investors to assist in financing further operations. Its strategy is to make use of its good knowledge of the country and its leaders to facilitate the entrance of new investors. In addition the company has already diversified its business and is continuing to do so, using its significant property assets, as a basis.

Texaf is the only investment company with industrial, financial and real estate interests that is quoted on the Euronext exchange. This stock market listing of activities in the Congo is a major asset of the group in promoting growth.

The growth of Carrigrès’s results is due to a better commercial approach and a better quality range of products, thanks to a proactive investment policy. The setting up of a new tertiary crushing unit assist the company to meet more effectively the standards imposed by the large construction companies.

Ownership of Business

| Société Financière Africaine | 73.54% |

|---|---|

| Jean-Philippe Waterschoot | 3.5% |

| Albert Yuma Mulimbi | 2.96% |

Benefits Offered and Relations with Government

Texaf owns 99.9% of Imbakin (textile). In 1997 a court ruled that the government owes Imbakin EUR 64 million following nationalization of land in 1961. Discussions have mainly revolved around the principle of settling this debt of by the transfer of assets in the DRC, but no progress has been made.

Texaf holds a 70% stake in Alta-Invest alongside the State, which owns 84 apartments and 8 studios which are illegally occupied in a much sought after neighbourhood of Kinshasa. Making this acquisition profitable requires an agreement on the vacation of the buildings and significant renovation. No significant progress has been made on this matter.

In 2004, Arthur Z'Ahidi Ngoma, then one of four vice presidents in DRC's national transitional government claimed that a plot of land belonging to Utexafrica legally belonged to him. Texaf accused Ngoma of using his political power to occupy the land illegally. The issue was resolved in tea’s favour.

Product Development

TEXAF and its Congolese subsidiaries Cotex, Utexafrica and Immotex are developing building rental activities in Kinshasa: residential housing, industrial buildings and offices which should generate new revenues in 2010. During 2008, the following new premises have been renovated and rented: 1,863 m² of office space, rented at EUR 322k a year; 240 m² of residential space, rented at EUR 38k a year; part of the old textile factory, half retained by the Group and consisting of 8,487.5 m² of warehouses and offices, is rented for EUR 439k a year.

During the second half of the year Utexafrica began the construction of 3,780 m² containing 15 new apartments to be rented at the end of 2009.

During 2008, MECELCO transferred an unprecedented debt owed to it by Gécamines. This transfer contributed to a consolidated profit of EUR 2,905k.