Anvil Mining Limited

Anvil Mining Limited

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Anvil Mining Limited is an unhedged copper producer whose shares are listed for trading on the Toronto Stock Exchange (as common shares) and the Australian Securities Exchange (as CDIs). Anvil was incorporated pursuant to the Business Corporations Act (Northwest Territories) under the name Dikulushi Resources Limited on January 8, 2004. The Company changed its name to Anvil Mining Limited on March 12, 2004. Its principal assets are in the DRC Zambia and the Philippines. The DRC remains Anvil’s key focus for exploration. Anvil operates three mines in the DRC- Kinsevere, Dikulushi and Mutoshi.

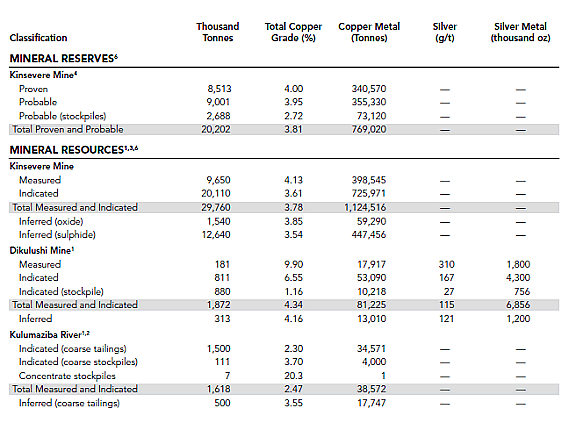

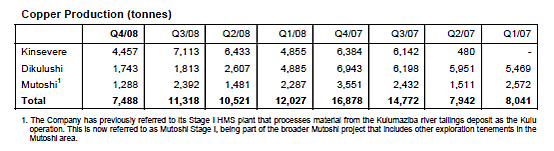

In the DRC, the 2008 exploration program was focused mainly on the Kinsevere copper-cobalt project. Kinsevere is set to become Anvil's biggest investment in the DRC. The project will include a major open cut mining operation, a heavy media separation plant, two (2) electric-arc furnaces and a 60,000 tonnes per year Solvent Extraction and Electrowinning ("SX-EW") copper facility. The Kinsevere plant, which re-started operations in March 2009, is on target to produce 8,900 tonnes of copper by the end of the third quarter. The development was put on hold late last year due to a drop in global copper prices.

Due to the global economic crisis and lower copper prices Dikulushi was placed on care and maintenance in December 2008 and production at Mutoshi HMS plant ceased in November 2008. The Company has significant exploration interests at Mutoshi and during 2008 completed a scope drilling program, to justify development of the Mutoshi Stage II Solvent Extraction-Electrowinning (“SX-EW”) plant. The famous Kolwezi Klippe (part of the Mutoshi concession) is one of the most productive regions of the African Copperbelt. Joint venture holdings of Anvil (80%) and Gécamines (20%) cover 29% of the Klippe which has traditionally produced more than 70% of the DRC copper mineral product.

In Country Location

Anvil Mining Congo SARL, No. 7409, Avenue de la Révolution

Lubumbashi, DRC:

Telephone: +61 (8) 6465 2310

Kinsevere:

30km North West of Lubumbashi, provincial capital of Katanga Province, DRC northwest

Dikulushi:

25 km west of Lake Mweru in Katanga Province, 400km NNE of Lubumbashi, the provincial capital of Katanga.

Mutoshi:

10km east of Kolwezi in Katanga Province, DRC

Services and Products

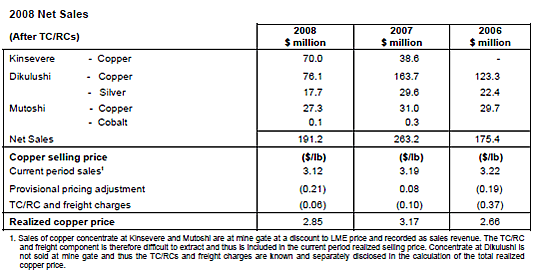

The Company produces a copper and silver concentrate from the high-grade Dikulushi mine and copper concentrates from the Mutoshi copper tailings retreatment operation and the new Kinsevere mine. Also at Kinsevere, the first “black copper” ingots were produced from the Electric Arc Furnace (EAF) in August 2008.

Number of Employees

Cutting operating and administrative costs-workforce reduced from 2,200 employees in November 2008 to the current level of 360 employees

Financial Information

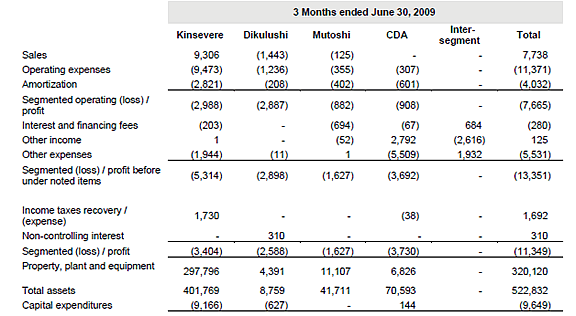

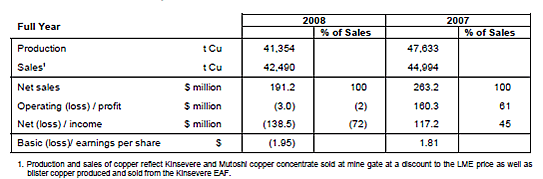

In 2008, the Company produced 41,354 tonnes of copper and over one million ounces of silver from its three mining operations in the DRC. Net sales were $191 million. Group net sales decrease 83% to $13.9 million owing to lower volume of copper sold and also lower copper prices.

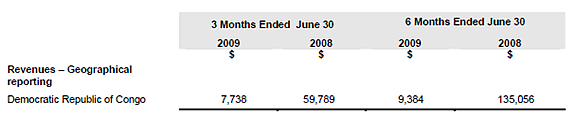

The geographic distribution of the Group’s external revenues

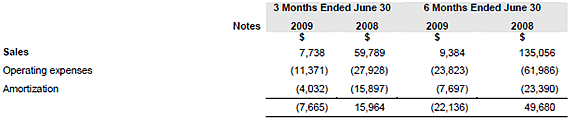

Consolidated Statements of Income and Comprehensive Income

Market Share

Anvil Mining is the leading copper producer in the DRC. In 2007 it produced 47,633 tonnes copper. Total DRC production for 2007 was 148,000. The market share for Anvil Mining was 32.1% in 2007.

Business Objective

“The Company’s medium-term objective is to become a mid-tier copper producer with a considerable proportion of its production in the form of cathode copper. Anvil is committed to improving shareholder returns through the responsible and profitable growth of its core copper business.”

Business Model

For Anvil, the impact of the deterioration in the financial markets and the global economic slowdown was compounded by the underperformance of the Dikulushi and Mutoshi mines and the lengthy process of revisiting the mining agreements that was initiated by the DRC government in 2007. In response to these circumstances, it was one of the first base metal companies to put in place, in the fourth quarter of 2008, a strategy appropriate for the current circumstances to best position itself to be able to continue with the development of its Kinsevere Stage II Solvent Extraction-Electrowinning (“SX-EW”) plant.

Key initiatives central to this strategy included placing the fabrication and construction works associated with the Kinsevere Stage II SX-EW development on hold until the required funding became available (in 2009); cessation of operations at the Dikulushi and Mutoshi mines; significantly reducing operating and administration costs; the curtailment of all but essential capital spending and suspension of all exploration activity.

The Company has continued to focus on cost minimisation and preservation of cash, with the implementation of a number of additional initiatives, including: completion on May 4, 2009 of a public offering that involved the issue of 30,015,000 Common Shares at C$1.15 per share, for gross proceeds of C$34,517,250; in addition to a reduction in the Company's workforce from 2,200 employees to 360 employees that occurred in the fourth quarter of 2008, the Company put in place plans to further reduce the workforce to 150 employees; in March 2009, the Company commenced the process of liquidating its portfolio of available-for-sale investments; and the decision to sell existing stockpiles of copper concentrates at Kinsevere of approximately 16,700 tonnes previously destined for processing.

The success of Anvil’s business in the DRC is built on five key factors: high grade resources: Katanga province has more than 10% of the world’s copper and all of Anvil’s copper projects and operations are based on resources with average grades of more than 3.5% copper; quality exploration tenements: Anvil’s early and sustained commitment to the redevelopment of the DRC mining industry has given the Company first mover status and access to high quality exploration areas; staged development: in each of Anvil’s operations, development and production have begun with comparatively low risk starter projects, subsequently expanded and upgraded with targeted capital investment; competence and capacity: Anvil’s operations were developed under the supervision of experienced and resourceful mining experts from around the world; and sustainability: development of community relationships has become a multi-million dollar sustainability partnership in community development, environmental protection and social responsibility involving local NGOs.

Ownership of Business

The Group holds a beneficial interest of 95% in the Kinsevere operation located in the Katanga province of the DRC; a beneficial interest of 90% in the Dikulushi mine; and a beneficial interest of 80% in the Mutoshi tenements located in the Kolwezi region. Anvil’s tenement portfolio in the Kolwezi District is held by Société Minière de Kolwezi (SMK), a joint venture company between Anvil (80%) and Gécamines (20%).

Benefits Offered and Relations with Government

In January 2009, the Company reached agreement with Gécamines (La Générale des Carrières et des Mines-state-owned copper mining company) and the DRC Government on the terms of its Kinsevere "Contrat d'Amodiation" (Lease Agreement) and the Dikulushi Mining Convention. The Company and Gécamines have signed an amendment agreement for the Kinsevere Lease Agreement and the Company has been formally notified by Gécamines and the DRC Government that the commercial terms and conditions of the Dikulushi Mining Convention remain unchanged.

As part of the Kinsevere amended agreement the Company paid to Gécamines the first tranche of the Pas 3 de Porte of $10 million, less an amount of $2.2 million due to Anvil by Gécamines with respect to past purchases of copper concentrates by Gécamines. The second tranche of the Pas de Porte payment of $5 million is due to be paid in January 2010.

The Kinsevere Project portfolio is comprised of two mining licenses (Permis d'Exploitations), PE528 and 539, which cover a combined area of 29.6km2. Both of these licenses are owned by Gécamines, but having completed a Feasibility Study on the three known deposits on PE528; AMCK (a JV company formed between Anvil and Mining Company Katanga (MCK), signed an Amendment Lease Agreement with Gécamines and the DRC Government in Q1 2009, which sets out a schedule of royalties, payable to Gécamines, based on royalty payments of 2.5% of gross turnover. The Company's 95% interest in the Kinsevere Lease Agreement has not been amended.

Anvil also completed an agreement with Gécamines and the Government on the terms of its Mutoshi Joint Venture (“JV”) agreement. The Company’s interests in Mutoshi are held through a special purpose JV company, Société Minière de Kolwezi SPRL. The key terms are as follows: Anvil’s interest in the Mutoshi project has been reduced from 80% to 70%; Gécamines’ interest has increased from 20% to 30% on a non-dilutable basis; Anvil will pay an additional Pas de Porte (entry premium) of $14.4 million; Anvil will pay royalties to Gécamines of 2.5% of gross turnover; and cash payments, at a rate of $35 per tonne of contained copper on additional copper reserves over and above 753,000 tonnes of copper.

Anvil subsidiaries operating in the DRC are required to comply with the Central Bank of Congo regulations regarding repatriation of sales proceeds. The subsidiaries are required to repatriate no less than 40% of the realized sales receipts, within certain time periods, into US dollar denominated bank accounts located in the DRC. These funds, once repatriated, are available to the Company to meet obligations both within and outside the DRC. At June 30, 2009 no funds were required to be repatriated.

Product Development

On August 10, 2009 Anvil announced that it had reached agreement with Trafigura Beheer B.V. (“Trafigura”-the second largest independent trader in the non-ferrous market, with annual turnover as at September 2008 in excess of $70 billion) for a combined debt and equity financing arrangement for an aggregate amount of $200 million that represents a fully financed solution for the development of Kinsevere Stage II.

Under the terms of the equity financing, Trafigura will subscribe for Anvil equity units by way of private placement, which will result in proceeds to Anvil of $100 million. The equity financing will be undertaken in two tranches, the first of which will bring Trafigura’s aggregate equity interest in Anvil to 19.9% and the second of which, will increase Trafigura’s shareholding to approximately 36% of the issued and outstanding common shares of Anvil, with an opportunity to increase its shareholding to approximately 39% on a fully-diluted basis should it exercise the common share purchase warrants.

Trafigura will also make available to the Company a loan facility with a total commitment of $100 million. The term of the loan facility is five years from the first drawdown and all amounts outstanding under the loan facility will bear interest at a rate per annum equal to LIBOR plus 4%, plus the cost of political risk insurance. The involvement of Trafigura will enable Anvil to commence commissioning of Kinsevere Stage II in late 2010 and achieve commercial production in 2011.