Orascom Telecom Algeria SPA

Orascom Telecom Algeria SPA

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Orascom Telecom Holding S.A.E. ("OTH") is a leading international telecommunications company operating GSM networks in high growth markets in the Middle East, Africa and Asia. OTH operates in Algeria ("OTA"), Pakistan ("Mobilink"), Egypt ("Mobinil"), Tunisia ("Tunisiana"), Bangladesh ("banglalink"), and North Korea ("Koryolink"). OTH has an indirect equity ownership in Globalive Wireless which has been granted a spectrum license in Canada. OTH also owns Medcable and Trans World Associates, both involved in building and operating undersea fibre optic cables, to transmit international voice and data traffic between the group’s Europe and Middle East operations. In 2008 it obtained a licence in what is possibly the world’s largest Greenfield site-North Korea’s first commercial mobile license. The Company had over 80 million subscribers as of March 31st, 2009.

OTH iS.P.Art of the Orascom group of companies, which was established in 1976. The Orascom conglomerate was founded in the 1950’s by the Coptic family'S.P.Atriarch, Onsi Sawiris, as a small construction company. Today, three sons run the enterprise: Naguib, the eldest, is at the helm of Orascom Technologies; Nassef, the youngest, is in charge of Orascom Construction Industries; and Samih, the middle brother, runs Orascom for Hotels and Tourism.

Naguib Sawiris's Orascom Telecom Holding is the highest-profile division, which has grown to become a diversified GSM network operator. In 1994 it acquired an interest in Egypt’s first ISP, InTouch. In 1997, OTH was incorporated to consolidate the telecommunications and technology interests of the Orascom family of companies. In early 1998, GSM operations were commenced by acquiring 51% of ECMS ("Mobinil") with France Telecom and Motorola. In 2000, OTH was floated on the Cairo & Alexandria Stock Exchange and the London Stock Exchange.

The company is the only major Middle-Eastern operator not partially owned by a government or sovereign investment vehicle.

Orascom Telecom Algeria S.P.A (“Djezzy”) was granted a license in 2001 to provide GSM telecommunications services in Algeria. In 2005 and 2006, OTH acquired additional equity stakes in OTA in Algeria to own a 96.81% stake. Djezzy is Orascom Telecom's most profitable subsidiary.

In Country Location

Address: Immeuble Djezzy, rue Mouloud Feraoun,lot n°8 A, Dar El-Beida, Alger

Telephone: +213 070 850 000

Telefax: +213 070 857 085

Services and Products

OTA provides both basic voice and value-added services to its corporate and retail subscribers. In addition to basic voice services, OTA provides its subscribers with a wide range of value-added services and data services such as: Voicemail, CLIP, CLIR, missed call alert, Voice SMS, Chatting services, Web SMS, Data services, MMS, e-voucher, Credit transfer, Ring Back Tone, EDGE, BlackBerry /BlackBerry connect, Wap Portal, Streaming, Directory Service, Automatic device management, Phonebook backup over GPRS, STK menus, USSD menus and all roaming services (Prepaid roaming, GPRS roaming, etc)

OTA offers prepaid, post-paid and hybrid post-paid-prepaid services under its “Djezzy” and “Allo” brands and has become the market leader and trendsetter with the highest brand recognition and preference.

Number of Employees

Total Employees: 15,000; 4000 employees in Algeria

Financial Information

Revenues at end 2008 was US$ 5,327 million (EGP 29,153 million), growing 13% over December 2007. Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA) reached US$ 2,384 million (EGP 13,123 million), an increase of 15% over December 2007. EBITDA margins of the major subsidiaries are: Djezzy 63.2%, Mobilink 40.7%, Mobinil 48.2%, Tunisiana 57.9%, and banglalink 4.7%.

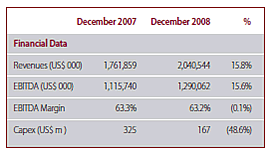

Financial data for Algeria is as follows:

Market Share

As of March 2009, OTA’s network served over 14.1 million subscribers, representing a market share of 63.5% of total mobile subscribers in Algeria and geographical coverage in 48 Wilayas (provinces).

The company’s revenues in Algeria by the end of 2008 represented 39% of itS.P.Arent’s total revenues.

Business Objective

Its mission, according to chairman and chief executive officer Naguib Sawiris, is to become the primary GSM operator in the Middle East and beyond, with a 100 million subscriber base by 2010.

The company also focuses on its core strategic goals of creating shareholder value through the continued growth of its existing subsidiaries and through selective geographical expansion, focusing on emerging markets and the most populous countries in the world while availing affordable quality.

Business Model

Initially Orascom Telecom built up its telecom business rapidly by taking on debt to expand into a few new markets. The company built out networks fast, taking on high start-up costs to cover vast areas and win over customers early. In early 2008 OTH however announced that it was going ahead with a plan to divest smaller non-core assets and focus on its core operations to build value. After operating 22 licenses in Africa and the Middle East, OTH decided to divest networks in Jordan, Yemen and sub-Saharan Africa.

In 2009 the company will also implement a US$1 billion Free Cash Flow optimization program. In addition it initiated a cost reduction program aiming at reducing operating expenses by 10% across the group which would further solidify the Free Cash Flow optimization program and strengthen margins. The company is already decreasing its capital expenditures on operations in Pakistan and Bangladesh, where falling currencies and social instability have hit profitability hard.

The main areas of savings are expected in network, marketing, administration expenses and human resources. It will further focus its investments into new networks in Africa, Canada and North Korea, according to Aldo Mareuse, its chief financial officer. Competition with bullish government-backed operators from the Gulf had pushed Orascom, Egypt’s largest public company, to be more alert and disciplined, he said.

Naguib Sawiris added that Orascom will only get involved in markets with large population and high growth potential where there is a strong chance of becoming the dominant operator and in operations where Orascom can have total management control.

In Algeria OTA has established a clear leadership position in the fast-growing Algerian mobile market by leveraging OTH’s expertise in network deployment, sales and marketing, as well as the ability to react quickly to competitive developments.

Ownership of Business

Weather Investments S.P.A. directly and indirectly owns approximately 52.1% of the shares of OTH, and 47.9% is public free float.

Following the completion of an agreement to purchase an additional 1.21% stake in Oratel in November 2006, OTH directly and indirectly owns 96.81% of OTA.

Benefits Offered and Relations with Government

When Abdelaziz Bouteflika was elected president of Algeria in April 1999, some of the Middle East's more intrepid entrepreneurs saw scope for some major new business opportunities. One of the first to get off the mark was Naguib Sawiris. Recognising that Bouteflika, who had spent a decade in exile building up business connections in Europe and the Gulf, was serious about bringing outside investment into Algeria, Sawiris lost no time in making himself known to the new leader. In the event, Sawiris' original idea of Orascom Telecom directly negotiating a GSM licence waS.P.Assed over in favour of an international tender, but the company still prevailed, through submitting the highest bid. SawiriS.P.Aid a hefty US$737 million for the Algeria license, a sum that was then considered by many excessive, especially considering that it was US$300 million above the bid from the next highest bidder, France Telecom.

Djezzy’s license allows the company to operate its own backbone and to share or lease network infrastructure with other operators in order to provide a range of telecommunications services nationwide. The license is a 15-year dual band license with automatic renewal for two subsequent five year terms. Renewal is at no additional cost.

Income tax expense in 2007 was benefited by a tax exemption for OTA which expired in August 2007.

Relations soured when Lacom (the Algerian Telecommunications Consortium, which was formed by Egyptian firms Telecom Egypt and Orascom Telecom) rolled out its own fixed-line telephone and internet network in 2006 to create competition for state-run Algerie Telecom. Lacom submitted a successful US$65 million bid for the first private-sector fixed telephony licence in Algeria. By 2008 Lacom has collapsed.

Lacom never attracted more than 20,000 customers, and even they began to complain of poor call quality and service. The company could also not meet the commitments regarding national coverage contained in its operating framework, which prompted intervention by the regulatory body for postal and telecommunications services in Algeria, the Agence de régulation des postes et des télécommunications (ARPT). Lacom management blamed the worsENIng situation on the failure of the ARPT and other institutions to remain neutral after the market was opened up to competition. This favouritism, they alleged, gave state-run Algerie Telecom an unfair advantage.

Naguib Sawiris said the Algerian authorities' disregard for the rules of fair competition "killed us off". "As soon as we started operations," he stated. "Algerie Telecom reduced its prices to below cost. We complained, but in vain." According to one ARPT manager Lacom's shareholders expected numerous concessions from authorities without taking any financial risk.

Product Development

As of June, 2005, OTA had launched the first loyalty program in the Algerian telecommunication market; IMTIYAZ is a token of appreciation to subscriber’s loyalty. In March 2006, OTA launched OTAxiphone which is a specific offer targeted to multi-service kiosks operating like phone booths. OTAxiphone allows callers, who are not equipped or cannot afford access to a mobile phone, to call at very competitive prices subscribers on the OTA network as well subscribers on other networks.

In May 2009 Djezzy introduced two discount offers for its Djezzy Carte prepaid subscribers. Liberty 1 day, priced at DZD 99, enables subscribers to make free calls between 00:00 and 18:00 to all Djezzy and Allo OTA numbers and at a charge of DZD 3.49/30 seconds to other fixed and mobile networks. The same conditions are applicable to the Liberty 7 day offer, which costs DZD 599.

In 2009 Nokia Siemens Networks started to provide OTA’s Home Location Register (HLR) solution. The Subscriber Data Management Solution from Nokia Siemens enabled OTA to develop a single database for subscriber information, unifying fragmented data. Nokia Siemens also modernized the installed base of 17 million subscribers and provided additional capacity of 3 million.