Standard Bank Namibia

Standard Bank Namibia

All data are collected in the Fiscal Year of 2008-2009.

Company Profile and History

Established in 1915, Standard Bank’s Namibian operations today have more than 40 branches across the country. Standard Bank Group is South Africa's largest bank with operations in 17 African countries.

In April 1860, a prospectus for The Standard Bank of British South Africa was published in London. Two years after the appearance of its prospectus, The Standard Bank of British South Africa was established. Operations commenced immediately in London and by January 1863 the bank’s agents in Port Elizabeth and Alexander Croll & Company were discounting bills. Over the next 50 years a branch network was established throughout Southern Africa.

In Country Location

Standard Bank Namibia Limited, 5th floor, Standard Bank Centre, Cnr. Post Street Mall &Werner List Street, Windhoek, Namibia

Services and Products

The three main pillars of business are Personal and Business Banking, Corporate and Investment Banking, and Wealth. Other services include corporate advisory services and transactional services such as cash management, trade-related and custodial services, complemented by electronic banking solutions. It provide finance such as term lending, structured debt and asset finance and structured trade and commodity finance, and offer trading and risk management solutions for foreign exchange, money markets and interest rates.

The Global Transactional Products & Services team provides a range of transactional services, primarily across Africa. The Corporate and Investment Banking division maintains a specific focus on industry sectors that are most relevant to emerging markets, including targeted financial solutions for infrastructure and services including energy, power, mining, construction and telecommunications in high-growth markets.

Number of Employees

1,200

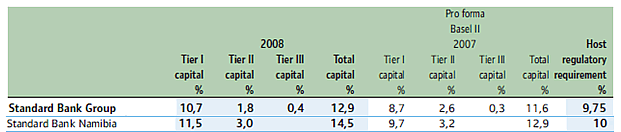

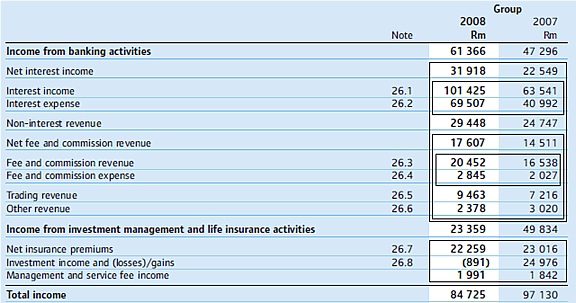

Financial Information

Market capitalisation as at 30 June 2009 was R138 billion (approximately $18 billion); total assets of over R1,333 billion (approximately $172 billion) at 30 June 2009.

Market Share

Standard Bank has 673 branches in South Africa and 337 in the rest of Africa. Standard Bank Namibia is the country's largest commercial bank. Commercial banks in Namibia represent 38 % of total financial assets in the country. The largest bank in terms of size, measured by average total assets is Standard Bank Namibia (approximately 32%).

In Namibia First National and Standard, account for close to 62 percent of the total assets and close to 60 percent of total deposits and loans in the system.

Business Objective

“We aspire to be a leading emerging markets financial services organisation. We do everything in our power to ensure that we provide our customers with the products, services and solutions to suit their needs, provided that everything we do for them is based on sound business principles. We understand that we earn the right to exist by providing appropriate long-term returns to our shareholders. We try extremely hard to meet our various targets and deliver on our commitments.”

Business Model

The Group has played a central role in the development of the Southern African economy for more than 140 years. It has done this by constantly aligning its presence in the market place with the evolving needs of the region's economies, and delivering relevant banking and financial services.

The group continued to invest in technology and infrastructure mainly in its

African operations as part of a strategy of confining its efforts to building

robust operations in selected emerging markets. This investment has contributed

to substantial cost growth. A strong capital position and healthy liquidity

profile has positioned the group to take advantage of business opportunities in

its chosen growth markets. The emerging markets focus insulated the group

from the initial effects of the financial crisis, which originated in developed

economies.

The strategic partnership of the two largest banks in Africa and China, Standard Bank and the Industrial and Commercial Bank of China (ICBC taking a 20% stake in Standard Bank), will generate significant cooperation benefits and new capacity for growth.

The Namibian team, with their in-depth understanding of local market conditions and drivers, leverages Standard Bank’s experience in Africa and emerging markets globally to develop client-focused, cross-border solutions customised to each client’s unique requirements.

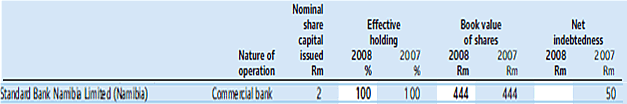

Ownership of Business

Benefits Offered and Relations with Government

The Bank of Namibia regulates Namibia’s four commercial banks: Bank Windhoek, First National Bank of Namibia Standard Bank Namibia and Nedbank Namibia. In June 2009 Bank of Namibia (BoN) Governor Tom Alweendo gave commercial banks until year-end to reduce the interest rate spread, or the difference between the central bank's repo rate and banks' prime lending rates, to 375 basis points.

Currently the BoN's repo, or the rate at which the commercial banks borrow from it, stands at seven percent. The prime lending rate of Standard Bank Namibia is 11.25 percent and that of Bank Windhoek, Nedbank Namibia and FNB Namibia 11.5 percent.

Details of what the BoN intends to do should the banks not meet the deadline, aren't clear.

However, the BoN could drastically increase the cash and liquid assets requirements for banks, among other measures.

Tension between the BoN and the commercial banks built a month earlier when Alweendo said the then rate spread of 475 basis points in Namibia cannot be justified when compared to similar economies. When he announced a repo rate cut on May 22, Alweendo said: "In the past, the Executive Committee (EC) has expressed its concern about the magnitude of the spread between the repo rate and the prime lending rates of commercial banks. The BoN, therefore, expects that the commercial banks will use this opportunity to reduce the spread." This sparked prime lending and home loan rate competition between local commercial banks for the first time.

Meanwhile Namibian authorities' moved to licence two banking institutions to operate in the country, signalling an opening up of the financial sector. This seemingly as a result that calls by the BoN and government for the South African headquartered banks to localise their operations have fallen on deaf ears, with the commercial banks arguing that the move is too costly.

BoN said that another operator, PlatinumHabib Bank Namibia (Bank PHB Namibia), had been granted a provisional license which is valid for six months. Bank PHB Namibia is a wholly-owned operation of Bank PHB Plc, one of Nigeria's fastest growing financial institutions. "Bank PHB Namibia will operate as a full fledged retail bank and is owned by various shareholders, including PlatinumHabib Bank Plc Nigeria and Namibian shareholders. They envisage establishing multiple distribution channels across Namibia," BoN said.

"The BoN is now trying to open the market to limit the power and market dominance that these four banks currently enjoy," said a local economist who declined to be named. The analyst noted that local banks operate like a 'cartel', judging by their pricing mechanisms and product availability. The analyst added that there is no competition among local commercial banks, which have largely been using a uniform interest rates. The move which might have necessitated the central bank to open up the market to more players could include haggling over localisation of operations and the interest rate spread.

"Looking at ultimate product pricing and availability, it has long been observed commercial banks are colluding, everything is the same. They are not actively competing and they (banks) are not helping in availing products to consumers," the analyst said. He added that Bank PHB Namibia might be seeking to close the gap which is being left by the traditional banks, but warned that it was not going to be rollercoaster ride.

Product Development

Standard Bank Africa is in the process of introducing an agricultural banking offering. It will target the agriculture value chain from pre-production through to processing, and will include a funding solution to make finance and direct inputs, such as seed and fertiliser, more accessible to small-scale farmers.

In Namibia, the government has renewed its focus on developing the emerging farming sector.

One such initiative is the Millennium Challenge Account, a collaboration between the Namibian and American governments aimed at strengthening national agriculture and tourism. In addition, Namibia’s Transformation, Economic and Social Empowerment Framework (TESEF) will facilitate national transformation, including the agricultural sector. Some of the agriculture-related aspects covered by TESEF are the redistribution of land, giving previously disadvantaged communities access to land, as well as active social and economic development in the sector. These initiatives have prompted an increase in competitive agricultural financing from other major banks. To increase its share of this market, Standard Bank Namibia has appointed an agricultural adviser, provided agricultural credit training for agricultural business managers and credit evaluation managers, and introduced a specific product offering for the agricultural sector.